Time To Buy Facebook

Facebook (Nasdaq:FB) stock is under heavy selling pressure lately. Shares of the leading social network are down by nearly 20% from their highs of the year after the company provided guidance for decelerating revenue growth and shrinking profit margins in the most recent earnings report.

Interestingly, the current entry price looks fairly attractive, even when incorporating expectations for slower growth in the coming quarters. Besides, the company's long-term growth prospects are still pretty exciting.

The Fundamentals Are Still Solid

Facebook management said in the most recent earnings report that it's expecting revenue growth to decelerate "by high-single digit percentages" from prior quarters sequentially in both the third quarter and the fourth quarters of 2018.

Revenue growth is clearly decelerating, but the growth rates have been considerably above 40% year over year in recent quarters. Chances are that the company will continue growing at well above 20% in the coming quarters, which is still quite a vigorous growth rate for such a massively big corporation.

FB Revenue (Quarterly YoY Growth) data by YCharts

Operating margin is also expected to retrace from nearly 45% currently to around 35% in the next couple of years. A compression in profit margins is hardly good news for investors, but the fact is that Facebook will remain a remarkably profitable business by all standards.

This reduced guidance from management is due to a combination of factors:

- User growth is slowing down, especially in regions such as the U.S and Canada, which generate comparatively high revenue per user.

- The company is trying to make users interact more with each other as opposed to consuming video and news on the News Feed.

- Advertising is transitioning from the News Feed to stories, and this is having a negative impact on revenue in the short term.

- When it comes to costs, Facebook is accelerating spending in data security, and the company is investing lots of money in areas such as Artificial Intelligence and new product development.

In a nutshell, Facebook is making some important changes that are improving the user experience and strengthening the company's value proposition for users and advertisers. These changes make sense from a long-term perspective, but they are taking a toll on financial performance in the short term.

In Mark Zuckerberg's words:

Now, in light of increased investment in security, we could choose to decrease our investment in new product areas, but we're not going to, because that wouldn't be the right way to serve our community and because we run this company for the long term not for the next quarter

It's important to put the numbers in perspective. Even under the new guidance from management, Facebook is expected to deliver revenue growth well above 20% year over year and operating profit margins around 35%. The new guidance represents a downward adjustment in expectations, but the business will clearly remain fundamentally solid, and most companies in the world can only envy such kind of financial performance.

One of the most important risk factors weighting on the stock is regulatory uncertainty. Increased regulation in different countries could force the company to implement more privacy protection measures. Even more worrisome, it could also impose more limitations on Facebook's ability to monetize its data and launch new products.

On the other hand, regulation usually reduces competitive pressure in an industry, and it favors a market leader such as Facebook. The company has enough money and human resources to comply with all kinds of heavy regulations, but those regulations would be far more problematic for a small startup trying to gain some ground in social media. Too much regulation could be a heavy burden on potential Facebook competitors, and that would hurt those companies in their ability to get funding from venture capitalists.

More industry regulation could certainly be a negative for Facebook in terms of financial performance, but it could also consolidate the company's already dominant market position even more. Regulation is not a risk factor to disregard, but it's important to note that it could have both negative implications for Facebook in the short term and positive implications in the long term.

The Big Picture: Price And Value

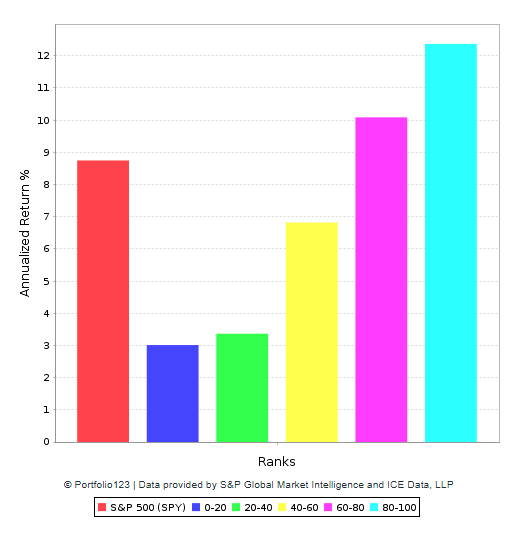

The chart below shows the performance statistics of a quantitative ranking system exclusively available to members in my research service, The Data Driven Investor. This system basically ranks companies in a particular investable universe according to two main factors: financial quality and valuation.

The quality factor is a combination of metrics that includes long-term growth expectations, gross profit margin, free cash flow margin, return on investment and return on equity. The value component of the ranking system includes ratios such as price-to-earnings, price-to-earnings growth, price-to-free cash flow and enterprise value to EBITDA.

Leaving the mathematical details aside, it’s important to understand the simple rationality behind this quantitative system. In the words of Warren Buffett: “Price is what you pay and value is what you get.” The system uses different metrics to select companies based on quality and valuation together. In other words, we are trying to get as much value as possible for a comparatively low price.

The performance results are remarkably consistent, showing that companies in the highest buckets in terms of quality and value tend to materially outperform the indexes over time. Not only that, but there is a clear and direct relationship between the quality and value ranking and market returns.

Data from S&P Global via Portfolio123

Based on data from the quantitative system, Facebook is among the best 20% of stocks in indexes such as S&P 500 and Russell 3000 based on a combination of financial quality and valuation indicators. If the statistical evidence is any valid guide, this bodes well for investors Facebook stock in terms of potential returns going forward.

More specifically, Facebook is priced at fairly attractive prices for such a dynamic growth company, even after considering the recent downward adjustment in earnings estimates.

Wall Street analysts have substantially reduced their earnings estimates for Facebook in 2019. The average earnings estimate is down from $9.26 to $8.39 per share in the past seven days.

Based on those trimmed-down assumptions, the stock is currently trading at a forward price to earnings ratio of 21. That's hardly excessive for a company that can easily sustain revenue growth rates of more than 20% and an operating margin level above 35% of sales in the middle term.

Long-Term Growth Prospects

Over a longer time frame, Facebook still has a lot of room for sustained growth over the long haul.

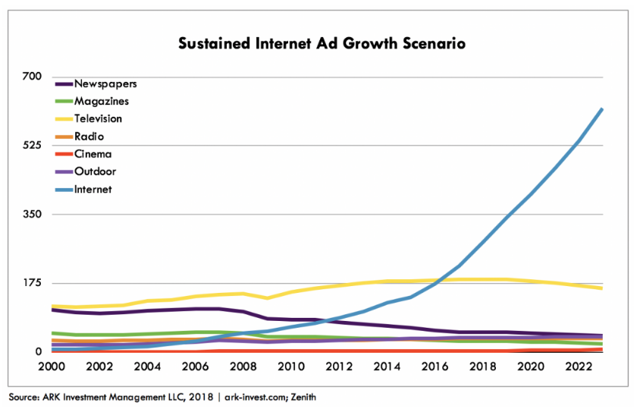

James Wang, from Ark Investment Management, published a really insightful article explaining that the online advertising market has substantially outperformed most growth forecasts in the past several years, and that there is a considerable chance that the industry will continue growing at a faster-than-expected rate in the years ahead. In essence, Wang believes that you need to have a more dynamic set of assumptions to really comprehend the long-term growth prospects in the online advertising industry.

Source: ARK Investment Management

From the article:

Analysts and investors have historically underestimated the size of the internet advertising market and continue to do so based on a static set of assumptions. Yet, more than any other medium, internet advertising has evolved and re-invented itself constantly. The drivers of growth today - mobile, video, and programmatic - barely existed ten years ago. There’s no telling what the next ten years might bring.

On balance, we believe sustained growth is more likely than maturation. Five years from now the ad market as a whole could top $900 billion, two thirds accruing to the internet, not because of a fundamental change in attitudes, just more eyeballs and better ads... which is the goal of every internet company every day.

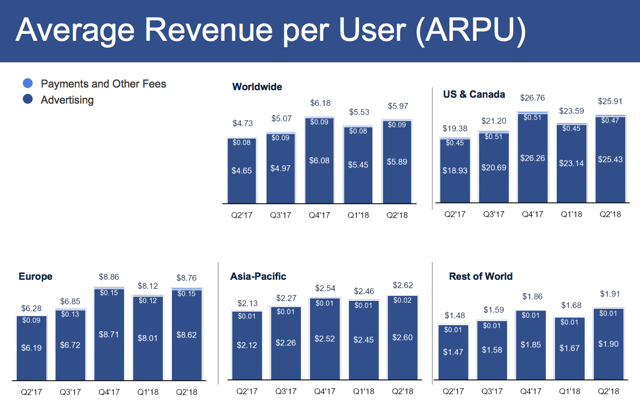

The main Facebook platform currently has 2.23 billion monthly users, and the company doesn't have a lot of room for user growth from its current size. However, revenue per user is a very different story.

Even in its most mature market - the U.S. and Canada - Facebook increased revenue per user by 33.6% year over year last quarter. Monetization levels in other regions are only a small fraction of the average revenue per user that it is generating in its more profitable markets, so the company has plenty of potential for revenue growth if it can bring the average revenue per user in other regions to levels more in line with those of the U.S. and Canada.

Source: Facebook

Importantly, Facebook is barely getting started in terms of monetizing Instagram and Messenger. WhatsApp looks like a huge opportunity in the years ahead, the company is successfully testing WhatsApp payments in India, and it is also expanding its ecosystem of WhatsApp business solutions. Even in the main Facebook platform, the company is venturing into dating services, and this could open the door to promising growth opportunities and rising engagement levels in the years ahead.

In terms of measuring the company's ability to capitalize on its growth opportunities, competitive strength is a major factor to consider. Social media is a very dynamic industry, and many consumers, especially the much valuable young consumers, are always looking for the new hot trends. Being such a big and dominant player, Facebook is hardly the novelty in the sector. According to media reports, it is losing engagement among teenagers and young consumers, since those demographic groups don't like to hang out in the same online platforms as their family members or teachers.

Fortunately for investors in Facebook, Instagram and WhatsApp are still benefitting from rising user growth and engagement among all kinds of consumers. However, there is no way to know for certain what the next big thing in social media will be, and whether or not Facebook can sustain its market leadership in the industry over the long term remains to be seen.

The network effect is a key source of competitive advantage for the company. This is the process by which the value of a service increases as it gains more users over time. Users attract each other to platforms such as Facebook, Messenger, Instagram and WhatsApp. This creates a virtuous cycle of sustained growth and increased competitive strength for Facebook.

Chances are that Facebook, across its multiple platforms, will remain a leading player in social media over the years ahead. Nevertheless, it's important for investors to keep a close eye on the competitive landscape when investing in such a dynamic industry which is particularly prone to technological disruption.

The Bottom Line

Factors such as slowing user growth, the transition from newsfeed to stories in advertising, and rising expenses due to investments in data security and new product development are uncertainty drivers for investors in Facebook stock in the short term.

However, those uncertainties are already reflected in current valuation levels. Even when expecting a deceleration in revenue growth and a compression in profit margins, the stock is attractively priced. Besides, the company is still offering plenty of potential for growth over the long term.

All things considered, it looks like the recent pullback in Facebook stock could be presenting a buying opportunity for long-term investors.

Disclosure: I am/we are long FB.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more