This Stock Rallied 16% Higher During The Sell-Off

And, the best news is that it has even more room to run higher. The major averages are down, but this stock is showing no signs of stopping its rally.

Retail sales haven’t been great. It was a so-so holiday shopping season, with Amazon.com (NASDAQ: AMZN) being the only real winner.

The industry-wide retail sales in the US were down 0.1% in December (versus November). For all of 2015, retail sales were up 2.1%, which is the slowest growth we’ve seen since 2009.

There’s plenty of pain and blame to go around.

However, one particular sore spot has been the department retailers. Let’s look at some of the performances over the last year: Bon-Ton Stores (Nasdaq: BONT), which made our 2014 bankruptcy watch list, is down 65%, Sears (Nasdaq: SHLD) has fallen 50%, Dillard’s (NYSE: DDS) is down 41% and Kohl’s (NYSE: KSS) has fallen 17%.

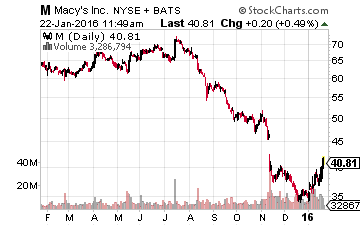

Even the world’s largest employer, Wal-Mart (NYSE: WMT) is off 26% for the last year. In that same vein, there is the largest department store operator, Macy’s (NYSE: M), which has fallen 35% over the last twelve months.

If you’re going to invest in retail you have to have a plan, a dividend, and some downside protection. There’s a few stocks offering a 3% plus dividend in the retail space – but how safe are those dividends is the real question.

But, not many (if any) of those retailers have true catalysts to push the stock higher in the interim. For these names, it is really just a wait-and-see game and should best be avoided.

The Best Retail Play Today

Right now, what if I told you there was a retailer offering a dividend yield of 3.5%, with five straight years of dividend growth, and has a payout ratio of less than 40% of its earnings via dividends.

And, it gets better. This same retail stock is trading at close to 10 times earnings and 6.5 times free cash flow while generating double-digit returns on invested capital.

Even better, it owns most of the real estate its stores sit on. Meaning it has the largest and most valuable real estate portfolio in the department store industry. A fact that the market is overlooking. Now, factoring in this overlooked real estate value, the stock could be worth three times where it trades today.

The name? Macy’s, the owner and operator of some 800 stores across the US. It owns well over half its stores and we’ll do a deeper dive to the real estate value (plus catalysts) in a bit, but first, let’s talk about Macy’s as a retailer.

Tough Times

Macy’s has taken its lumps of late, like most retailers. Shares are trading at $40 a share, after almost hitting $75 just six months ago, a near 45% slide. However, some of Macy’s issues are its own and just interim headwinds that should subside. This includes the unseasonably warm weather that left Macy’s with a lot of cold weather inventory that it’s having to markdown.

Beyond the interim issues, Macy’s impressive scale gives it purchasing power at vendors, and its private label business gives it some differentiation while allowing it to generate higher margin revenues.

However, the true advantages of Macy’s is the years of investments in localizing its merchandise and developing an omnichannel that connects its brick-and-mortar stores with its digital presence. This advantage will not disappear overnight either. The only worry is that it takes another few quarters to work down elevated inventory levels. But let’s not forget the fact that Macy’s owns most of its real estate and does not have to make lease payments which gives it a fair amount of financial flexibility.

The Real Estate Catalyst

Enter activist investor, Starboard Value. The hedge fund started pressuring Macy’s last summer for changes when shares were trading around $70 a share. Starboard has said that Macy’s shares are worth upwards of $125. The kicker being that the market is overlooking the real estate that Macy’s owns. This includes some 400 mall locations and key stores in Chicago and San Francisco. Lest we forget the flagship store in Herald Square NYC which is said to be worth $4 billion.

The fund pushed Macy’s to form a real estate investment trust (REIT) to help monetize that real estate. In November, Macy’s rebuffed the idea of forming a REIT, saying it wouldn’t provide enough operational flexibility. Then the tax laws changed earlier this year making it even harder for a company to form a REIT.

With that, Starboard Value hired a real estate firm and went back to the drawing board. They are back with a new plan to unlock value, which includes forming joint ventures (JV) for its owned real estate.

Here’s how to think about it: There is a precedence for this. Hudson’s Bay, Simon, and RioCan have done similar transactions. Basically, forming JVs allows Macy’s to get cash for their real estate while keeping operational control. A real estate firm would invest in the JV to have an ownership stake and Macy’s could use that cash to pay down debt, buyback shares, or invest in growth.

Unlike a REIT, the risk to Macy’s operations is nil, as the retailer would control the property decisions and have access to almost all the cash that it was generating prior to the JVs.

Under the JV scenario, Starboard sees Macy’s shares hitting $68. Then there are other things, in the future that Macy’s can do to create even more value. This includes taking the JVs public with IPOs or by selling part of its JVs at higher prices. And all this still leaves Macy’s with some $4 billion in other real estate holdings it can monetize later including “C” location malls, distribution centers, and three flagship stores under redevelopment.

Macy’s is certainly coming around to the idea as well. This week Macy’s CEO Terry Lundgren said the company is taking a “more professional view” of its real estate assets than ever. The real estate firm, Tishman Speyer, is already interested in taking stakes in certain locations. Macy’s is also looking to hire an in-house real estate adviser who can help the company think through the opportunities with its owned real estate.

The More Pressure the Better

Time is of the essence here as well, with the real estate market near all-time highs, now is the time to separate Macy’s real estate assets. That’s why having two activist hedge funds involved makes the Macy’s case even more compelling.

Just last week, in an investor letter, David Einhorn’s Greenlight Capital revealed that it had taken a new stake in Macy’s. Einhorn notes that when Starboard first showed up the stock was at $70, it’s now at $40 and the idea of unlocking real estate value is much more appealing.

Greenlight is invested at an average price of just under $46 a share. Greenlight also has floated another scenario, where a private equity firm could partner with a REIT to buy all of Macy’s. The pair would then be able to unlock that real estate value privately.

The hedge fund also notes that the unseasonably warm weather, and negative impact that the strong dollar has had on tourism, are near-term headwinds that will dissipate.

In the end, investing in retail outright (for a turnaround) is tough given the shifting environment. When Starboard started kicking around Macy’s this past summer, the thesis was interesting, but not a real “no brainer.” With the stock price getting cut in half from where Starboard announced its stake, Macy’s is a lot more interesting today. The simple thesis for Macy’s is that you have a best-in-class retailer with a high dividend yield, plus untapped real estate value, and potential catalysts for pushing the stock higher in the near-term.

Disclosure: You could collect an average of $3,268 in extra monthly cash with ...

more