The Under-Performance Of Facebook

The shellacking of Facebook (FB) for over a week of scandal-ridden headlines has created that rare beast in the jungle of tech stocks: a “value” play. Facebook has a trailing P/E of 29.6 and a forward P/E of 17.9. Quarterly earnings growth is running at 19.6% year-over-year. According to briefing.com year-over-year revenue growth has run from 44% to 49% for each of the last 4 quarters. This looks like a deal…except of course FB has become “cheap(er)” for a reason.

When I stubbornly targeted Facebook for accumulation into the panic as the headlines broke about the abuse of user data by Cambridge Analytics, I positioned myself for a rally starting by the early part of the last week of March (the coming week). Instead, FB now looks poised for more imminent losses as a broken stock.

Facebook (FB) became a broken stock by confirming a breakdown below its uptrending 200DMA Source: FreeStockCharts.com

The above chart shows how FB was on the edge of conquering resistance at its 50MDA when the scandal from Cambridge Analytics broke and gapped the stock back below its 50DMA. The uptrending 200DMA also survived two previous tests. Even after the first day of post-scandal selling, buyers managed to take FB back to its 200DMA support. For the next 4 trading days buyers tried to defend FB’s stock; each attempt took a slightly different form. Each day, the end result was the same: closes at or below the lower-Bollinger Band (BB). Friday’s 3.3% loss took FB to an 8-month low and closed the stock further below its lower-BB than its has closed in a very long time.

I tried to remain optimistic that my rebound scenario would play out. Wednesday’s gain in particular fooled me as FB briefly peered over its 200DMA. It never occurred to me at that time to start buying puts as a hedge for my position.

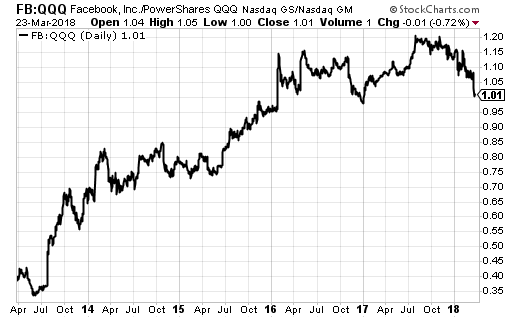

Yet, perhaps the biggest thing I missed was Facebook’s long streak of under-performance relative to its other large cap tech peers in the PowerShares QQQ ETF (QQQ). Facebook’s relative performance peaked in July, 2017 and has declined ever since. Facebook’s relative performance has returned to its early 2017 level.

Facebook was on a multi-year streak of out-performing the PowerShares QQQ ETF (QQQ). Now, the stock is on a persistent losing streak that started last July. Source: StockCharts.com

If I had checked out this chart, I would have gotten a LOT more wary about anticipating a rapid recovery for FB. Investors were already increasingly (relatively) lukewarm on Facebook, and the Cambridge Analytics scandal was like the final excuse to lock in profits. In order to become a buy again, FB needs a washout technical event and/or a display of strength like closing above its 200DMA. (I duly note that in December, 2016, I pointed to the technicals to demonstrate that FB was breaking down at the time. Even with this week’s selling, FB is up 65% since then!).

I think Monday’s sharp and dramatic reaction to FB’s troubles set the unforgiving mood for the rest of the week. The week concluded with an equally deflating vote of no confidence when Elon Musk proudly tweeted he would join the #DeleteFacebook movement: poof went his Facebook pages for SpaceX and Tesla (TSLA). The anchors wrapped around Facebook’s ankles are extremely tight and heavy!

For now, I think FB is facing a public relations nightmare more than a destruction of its business model. I recall how Google, now Alphabet, overcame the uproar over advertisements placed next to objectionable content on YouTube. Alphabet even conducted a second round of protections for advertisers on YouTube in January of this year. Unfortunately for Facebook, the latest scandal started on the user side of the business which strikes at the core of the business model of selling access to highly targetable users. Moreover, the scandal stumbles all over political landmines. Together, the two are proving to be a deadly combination hard to contain

Full disclosure: Long FB calls.

For a level-headed review of the implications of the scandal on Facebook’s business take a listen to this broadcast from eMarketer: “ more