The Top 5 Aerospace & Defense Stocks Today: Will Jaw-Dropping Performance Continue?

The Aerospace and Defense industry has been very hot in recent years.The Aerospace & Defense ETF (ITA) has returned 141% over the past five years.In comparison, the S&P 500 index has gained 73% during that same time frame.

Why has this sector practically doubled the market index over the last five years?

The answer to that question is largely due to hot spots around the globe (the Middle East, the Korean Peninsula) combined with governments spending more on defense.The U.S. government, the largest buyer of defense products, spent $589 billion on defense in fiscal 2017.This was an increase of $9 billion from the previous year.For fiscal 2018, the government’s defense spending jumped to $700 billion and is expected to increase higher in the coming years. In February, members of the two major political parties agreed to a deal that would see defense spending add an additional $165 billion in defense spending over the next two years.

This increase in defense spending is going to benefit many of the major companies in this sector.As you can imagine, the share prices of many stocks in this sector have increased in the past few years due to these factors, but that doesn’t mean these stocks aren’t attractively priced.

This article will discuss the five best aerospace and defense companies. All five stocks pay dividends to shareholders.

We will examine each company’s business, recent earnings results, dividend history and our expected total return, which you can see in the Sure Analysis Research Database. In the Sure Analysis Research Database, we determinetotal annual return based on the stock’s current yield, expected change in valuation and forecasted earnings per share growth through 2023.

Without further ado, here are the top five Aerospace and Defense companies in the Sure Analysis Research Database, ranked from low to high in terms of our total expected return.

Top Aerospace and Defense Stock #5: Raytheon Company (RTN)

Raytheon Company, the fifth largest military contractor in the world, was founded in 1922.The company’s first product was the S gas rectifier tube.This revelatory product eliminated the need for expensive batteries found in home radios.Today, Raytheon provides missiles and electronic, radar and communication systems to the U.S. and its allies.The company is divided into four divisions: Integrated Defense Systems, Intelligence Information & Services, Missile Systems and Space & Airborne Systems.Raytheon has a market cap of almost $56 billion and generated $25 billion in sales last year.The company employs ~64,000 people.

Raytheon reported 1st quarter earnings on April 26th.

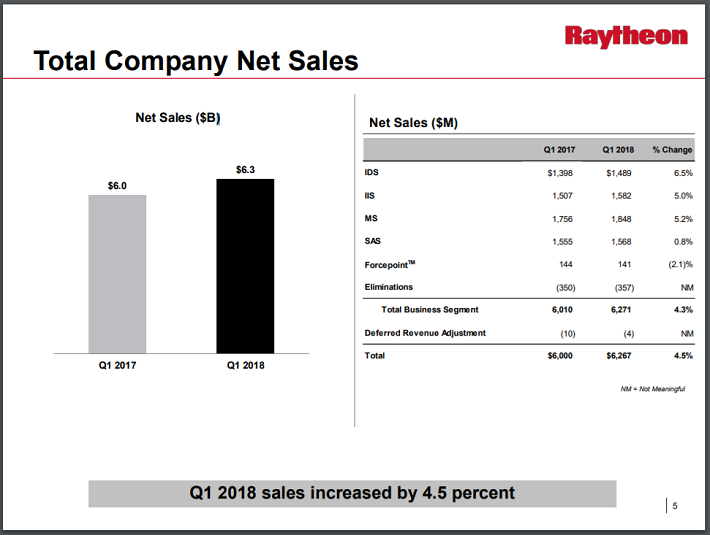

Source: Earnings Presentation, page 5.

The company earned $2.20 per share, topping analysts’ estimates by $0.09.This was a 27% increase in earnings-per-share from Q1 2017.Raytheon’s revenue grew 4.5% year over year to $6.3 billion.Each segment of the company saw sales improve, led by Integrated Defense Systems 6.5%.Higher sales of Raytheon’s Patriot defense program was a main driver of sales growth in the quarter.The company’s backlog now stands at $38.1 billion, a 5.8% increase year over year.Raytheon spent $400 million to repurchase 1.9 million of its own shares during Q1.The average repurchase price was $211, an 8.1% premium to the current share price.

The company also updated its guidance for 2018.

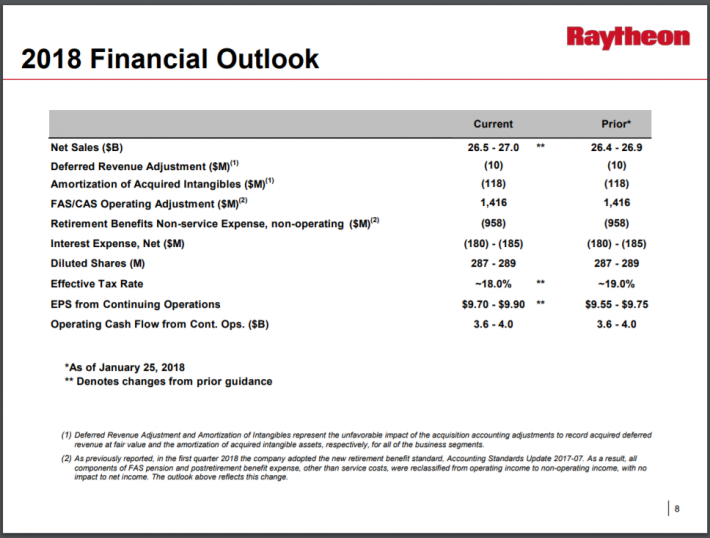

Source: Earnings Presentation, page 8.

Due to a slightly lower than anticipated tax rate for the year, Raytheon sees earnings per share coming in above its original guidance.The company increased the midpoint of its earnings-per-share forecast to $9.80 from $9.65.Sales guidance was also raised slightly.

Over the last decade, Raytheon has increased earnings by an average of 6% per year.During the last recession, the company actually saw earnings-per-share increase.While the company has seen earnings declines on a year over year basis several times in the last ten years (2010, 2015, 2017), the general trend in earnings-per-share has been higher.

Using the midpoint of the company’s updated guidance, shares are trading at a multiple of 19.7.This is well above the stock’s 10-year average price to earnings ratio of 14.If shares were to revert to this target multiple by 2023, Raytheon’s valuation would contract 6.6% per year.

Raytheon has increased its dividend for the past fourteen years.Over the last ten years, the average growth rate has been 12%.The company increased its dividend by 8.8% on March 21st.At a price of $193, shares currently yield 1.8%.

Based on the company’s earnings growth rate, dividend yield and multiple reversion, we expect shares of Raytheon to offer an annual return of just 1.2% per year over the next five years.Raytheon is up just 2.74% in 2018, but has returned more than 35% since the beginning of 2017. We suggest interested investors wait for a pullback before adding this company to their portfolio.

Top Aerospace and Defense Stock #4: Lockheed Martin (LMT)

Created when Lockheed Corporation and Martin Marietta merged in 1995, Lockheed Martin is the world’s largest defense contractor by sales.The company had $51 billion in sales in 2017, with the U.S. Department of Defense contributing 60% of this total.Other U.S. government agencies and international clients make up about 20% each of remaining sales.

Lockheed Martin consists of four divisions: Aeronautics – which produces fighter aircraft like the F-35, Rotary and Mission Systems – which houses combat ships and naval electronics, Missiles and Fire Control – which create missile defense systems, and Space Systems – which produces satellites.In 2015, the company purchased Sikorsky Aircraft, which produces Black Hawk helicopters, from United Technologies’ (UTX) for $9 billion.

Lockheed Martin released 1st quarter earnings on April 24th.

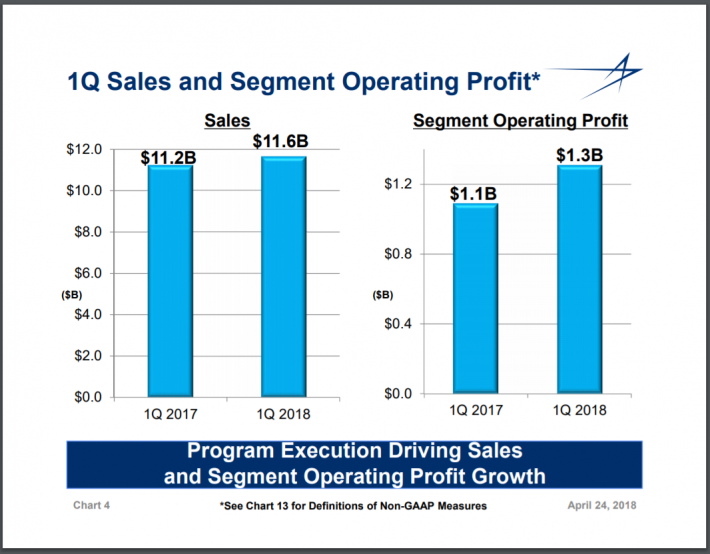

Source: Earnings Presentation, page 4.

Lockheed Martin’s first quarter earnings per share improved 54% from the previous year to $4.02.The company beat estimates for earnings by a massive $0.60.The company’s sales total was $11.64 billion, $360 million above estimates and a 3.8% increase from the previous year.All divisions of the company posted revenue gains, except for Space Systems, which had a slight decline from Q1 2017.Missiles and Fire Control showed 8% growth while Aeronautics added 7%.

Lockheed Martin has a back log in excess of $100 billion.This backlog should power earnings growth going forward.The company bought back 0.9 million of its own shares of its own stock in the quarter at an average price of $333, a 30% premium to the recent trading price.

Due to a strong Q1, Lockheed Martin also issued updated guidance for this year.

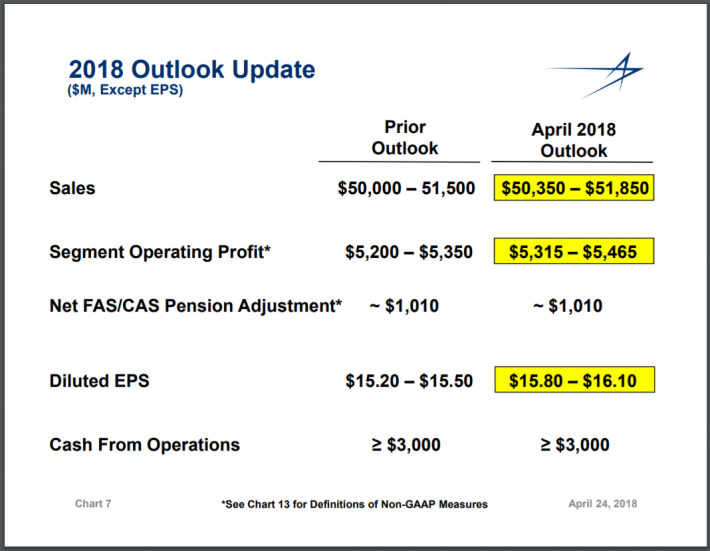

Source: Earnings Presentation, page, page 7

The company now sees earnings per share midpoint of $15.95, well above its previous guidance of $15.35.Lockheed Martin raised its sales forecast as well thanks to the high demand for products going forward.

Lockheed Martin saw a slight decline in earnings per share in the years following the last recession, but has seen earnings-per-share growth every year since 2011.The company has a 10-year earnings-per-share growth rate of 5.4% per year.

Based off of the current price of $299, Lockheed Martin’s stock is trading at a forward multiple of 14.4.This is lower than the current multiple but above the 10-year average P/E of 13.9.Shares today have a price to earnings multiple of 18.7.Given the company’s top spot in its industry, current business fundamentals and backlog, we feel that Lockheed Martin deserves a P/E multiple that is at a premium to its historical valuation.We have a five-year target P/E of 15.If shares were to revert to this average, shares would experience a reversion of 4.3% per year by 2023.

Lockheed Martin has rewarded shareholders with a dividend raise for the past fifteen years.The average raise is more than 17% per year over the past five years.At the end of September, the company increased its dividend 10%.Shares currently offer a 2.7% yield, near the high end of its average yield of the past few years.This is also the highest yielding stock on our list.

Taking into account earnings growth rate, P/E contraction and dividend yield, we see shares of Lockheed Martin offering a yearly return of 3.8% over the next five years.Shares of the defense contractor are down almost 7% year to date after rising 28.5% in 2017.As the largest player in the defense sector, we like Lockheed Martin’s opportunity to capitalize on increased spending in this sector.That being said, we would prefer to purchase shares at a slightly lower price.We encourage investors to consider Lockheed Martin on a pullback.

Top Aerospace and Defense Stock #3: General Dynamics (GD)

General Dynamics is a Dividend Aristocrat, a group of 53 stocks in the S&P 500 Index, with 25+ consecutive years of dividend growth. There are currently 53 Dividend Aristocrats.You can download an Excel spreadsheet of all 53 (with metrics that matter) by clicking the link below:

Click here to download your Dividend Aristocrats Excel Spreadsheet List now.

General Dynamics operates four business divisions: Aerospace – which produces the high end Gulf Stream jet, Combat Systems – maker of combat vehicles like the Abrams battle tank, Information Systems & Technology – provides fire-control systems for ships as well as programs for cyber security and Marine Systems – manufacture of ships and submarines for the Navy.

The company agreed to purchase IT services provider CSRA for $9.6 billion on February 12th, 2018.Management expects this deal to be accretive to earnings as soon as Q3 of this year.General Dynamics employs more than 98,000 people worldwide, has a current market cap of $56 billion and produced $31 billion in sales in 2017.

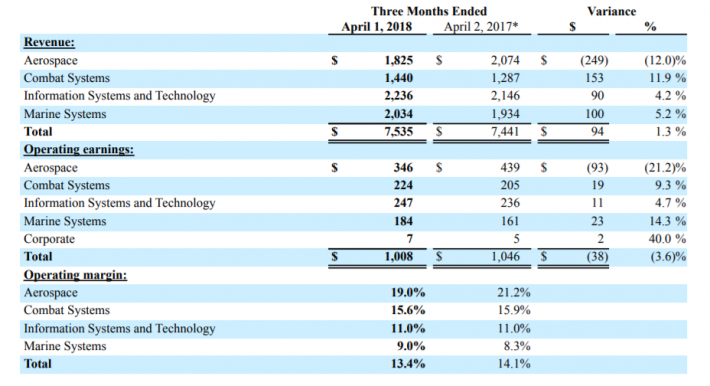

General Dynamics’ 1st quarter earnings were released on April 25th.

(Click on image to enlarge)

Source: Earnings Results, page 4.

General Dynamics earnings grew almost 7% to $2.65 per share.This came in $0.17 ahead of estimates.Revenue grew 1.3% to $7.54 billion, though this was $20 million below what analysts had expected.Three out of four segments posted positive growth, with Combat Systems seeing a sales increase of 12% from Q1 2017.Aerospace was the one segment that saw sales decline year over year, but this was mostly due to the timing of aircraft deliveries.Management said on the conference call that they expect that Aerospace revenues for the year will reach their initial expectations for 2018.General Dynamics ended the first quarter with a backlog of $62 billion.The company repurchased 1.2 million shares in the first quarter.

Unlike many companies in the market, General Dynamics managed to increase earnings during the last recession.In fact, only once in the last ten years (2012) has the company not shown an increase in earnings per share.While the average earnings growth rate is just 5% over the last decade, earnings-per-share has really ramped up in the last five years climbing more than 9% per year since 2013.We forecast that earnings can grow 7.7% per year through 2023, a premium to the ten-year growth rate, but a discount to the five-year growth rate.

Based upon the midpoint of General Dynamics’ 2018 earnings-per-share guidance of $10.90 and the current stock price of $189, shares are trading with a multiple of 17.3.This is above the stock’s decade long average of 14.If shares were to trade with this valuation by 2023, then shareholders would see a multiple contraction of 4.1% per year.

General Dynamics has had twenty-one consecutive years of dividend growth.General Dynamics is one of the more consistent dividend growers available.The company’s average growth rate over the last three, five and ten-year time frames is 10.7%, 10.4% and 11.5%, respectively.The most recent raise occurred on March 7th, resulting in a dividend increase of 10.7%.General Dynamics offers a current yield of 1.5%.

Taking into account our anticipated growth rate, current yield and multiple contraction, we see shares of General Dynamics returning 5.1% annually through 2023.This is a decent total return.Investors looking to add the stock to their portfolio could consider building an initial position at this price.Those investors already with a sizeable holding may want to wait for a better price before adding more shares.Shares of the defense company are down 7% since the first trading day of the year, but up almost 11% since the start of 2017.

Top Aerospace and Defense Stock #2: Northrop Grumman (NOC)

Northrop Grumman began its corporate life as Northrop Aircraft in 1939.The company’s first aircraft was a patrol bomber for the Norwegian Air Force.Northrop Aircraft’s B-2 stealth bomber took its first flight in 1989.In 1994, Northrop purchased Grumman Corporation, which provided the Lunar Module that landed on the moon in 1969.Today, Northrop Grumman has a market cap of $56 billion and had $26 billion in sales in 2017.The company has three divisions: Aerospace – which includes manned aircraft such as the F-35 and B-2 as well as unmanned aircraft such as the Global Hawk, Missions Systems – which produces of radars, sensors and surveillance and targeting systems and Technology – which provides customers with IT solutions and cybersecurity programs.

Northrop Grumman reported 1st quarter earnings on April 25th.The company earned $4.21 per share, topping estimates by $0.57.This was an improvement of 14% from the same quarter a year ago.Revenue grew 5.1% to $6.74 billion.This came in $130 million ahead of the average analyst estimate.Revenues for the company’s Aerospace division improved 10% due to strong demand for F-35 programs.Unmanned aircraft and space systems also showed growth year over year.

The company is a finalist to update the U.S.’s land-based nuclear missiles.If selected, this would be a catalyst for growth.Mission Systems grew sales 3% as sensors and processing programs saw increased volumes.Technology declined 4% from Q1 2017 largely due to completion of several programs in 2017.Northrop Grumman has been very aggressive repurchasing its own shares, reducing the share count at a rate of 6.3% since 2008.

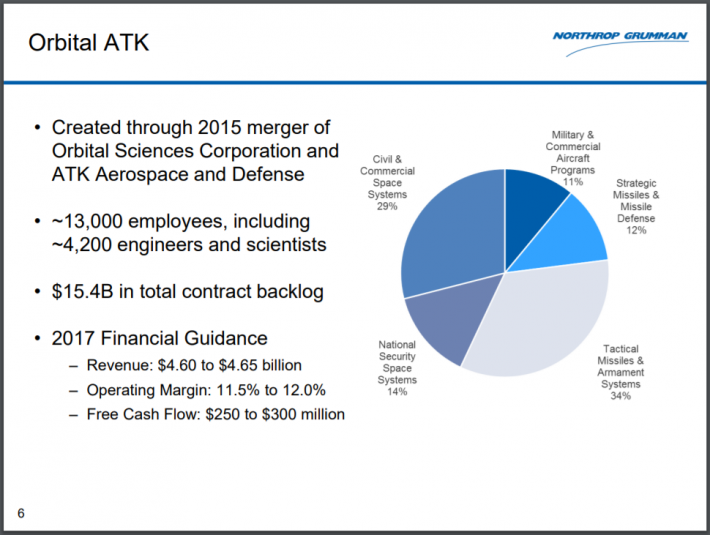

Due in part to a strong first quarter and a lower tax rate, Northrop Grumman raised the midpoint of its guidance for the year to $15.53 from $15.13.Besides a strong quarter and improved guidance, it is Northrop Grumman’s recent purchase of Orbital ATK that should have investors excited for the future of this company.

Source: Acquisition of Orbital ATK, page 6.

On September 18th of last year, Northrop Grumman agreed to purchase Orbital ATK for $9.2 billion.Orbital ATK is the largest supplier of ammunition to the U.S. government and has contracts with NASA to provides the rockets used to travel to the International Space Station.While this acquisition will add to the Northrop Grumman’s debt level, long term Orbital ATK will be an earnings boon to the company. The combined companies would have had sales of almost $30 billion in 2017 and a backlog that totals more than $60 billion.On June 6th, Northrop Grumman updated its guidance a second time for 2018, this time to reflect Orbital ATK.The company now sees earnings per share reaching a midpoint of $16.33 and generating sales of $30 billion.Both figures are well above analysts’ expectations.

In the last decade, Northrop Grumman has only had two years (2009, 2017) where earnings per share didn’t increase.Over this time, the company has had EPS growth of 8% per year.With Orbital ATK in the fold, we project earnings could grow 10% per year through 2023, slightly above the company’s 10-year average of 8% earnings-per-share growth.

Based off of update guidance and a share price of $312, Northrop Grumman has a forward multiple of 19.1.While the stock’s average multiple over the last ten years is just 12.9, we feel that the purchase of Orbital ATK combined with share repurchases and a sound business environment means that Northrop Grumman should trade at a slight premium to its historical valuation.We have a 2023 target P/E of 15.Reaching this level would mean that shares had a multiple reversion of 5.7% per year.

Northrop Grumman has increased its dividend for the past fifteen years.The average raise has been 12.6% annually.The company raised its dividend 9.1% on May 15th.Shares currently yield 1.5%

We see Northrop Grumman returning 5.8% per year over the next five years based on earnings growth, dividend yield and multiple contraction.Northrop Grumman shares have been on fire over the last eighteen months, up almost 34% since the beginning of 2017.Shares are up just 1.7% this year, but that is the second best performer on our list.We feel that the Orbital ATK purchase should be a catalyst for growth in future years and recommend investors looking for exposure to the Aerospace and Defense sector consider purchasing Northrop Grumman.

Top Aerospace and Defense Stock #1: The Boeing Company (BA)

Boeing is the world’s largest commercial jet manufacture and second largest military weapons producer. The company has been in business since 1916. In the last 100+ years, the aerospace and defense company has gone from making canvas and wood airplanes to producing today’s advanced planes. Boeing has a market cap of almost $200 billion and had more than $93 billion in sales in 2017. The company is composed of three divisions: Commercial Airplanes, Defense, Space & Security and Global Services.

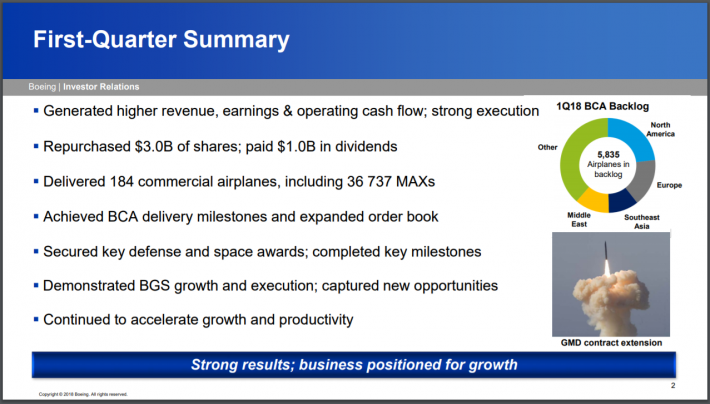

Boeing reported 1st quarter earnings on April 25th.

Source: Earnings Presentation, page 2.

The company earned $3.64 per share during Q1, beating estimates by a massive $1.05.Revenue climbed 6.6% to $23.4 billion.This was $1.18 billion above estimates.Boeing delivered 184 commercial airplanes in the quarter, 9% more than the previous year.The company is planning to increase its delivers in future years as well.The company’s 737, which was the first commercial jet to reach a production mark of 10,000, is expected to see production increase from 47 aircraft in 2017 to 52 aircraft in 2018.That number is expected to reach 57 by 2019.Boeing has a backlog of almost 5,800 airplanes for a total value of $486 billion.

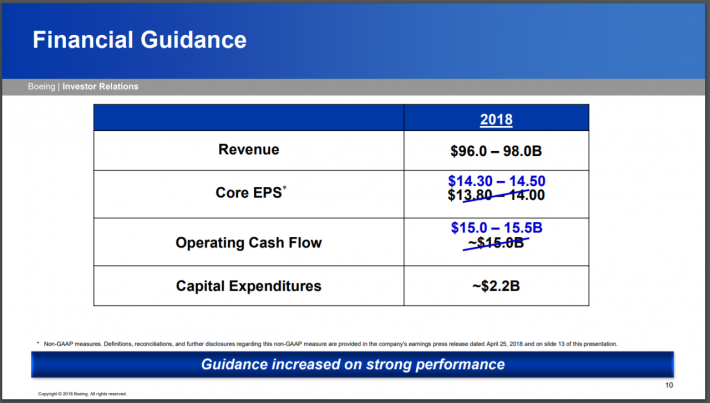

Based on Q1’s performance, Boeing has issued updated guidance for this year.

Source: Earnings Presentation, page 10.

While revenue remains at the same level as the initial guidance, Boeing’s management now sees an earnings-per-share midpoint of $14.40.Aside from a drastic 51.5% reduction in earnings per share in 2009, Boeing has seen earnings-per-share grow every year for the last ten years.Since 2008, the company has increased earnings at a rate of more than 12% annually.

Shares currently trade at $339, meaning that Boeing’s stock has a forward multiple of 23.5.This is above the stock’s ten-year average multiple of 17.If shares were to revert to this P/E by 2023, then shares would experience a multiple contraction of 6.3%.

Though the company paused its dividend growth from 2009 to 2011, Boeing has raised its dividend every year since.The company has increased its dividend by at least 20% every year since 2013.The most recent raise was announced on December 11th of last year and resulted in a 20.4% increase. Boeing’s stock offers a yield of 2.0%, the second highest on our list.

Add up earnings growth, multiple contraction and dividend yield and we anticipate shares of Boeing offering a total return of 7.7%.Boeing has been one of the best performing stocks in the entire market over the recent term.Even with a recent pullback, shares are still up 15% year to date and a staggering 104% since the beginning of last year.

This type of return might make investors sheepish, but Boeing forecasts that the airline industry will need more than 40,000 new aircraft over the next 20 years.That equates to almost $3 trillion in new aircraft.As the leader in commercial aircraft, Boeing has an extraordinary position to capitalize on this growth, which makes the stock our top pick in the Aerospace and Defense sector.With that said, the stock is overpriced so now may not be the best time to initiate a new position.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more