The Stratification Of Equity Research: Coverage Vs Research

With the closing of multiple investment banks’ equity research departments and headcount reductions throughout the industry, there remains little doubt that the world of equity research is changing rapidly.|

Whether these changes simply represent an industry-wide restructuring or whether we are witnessing a major global disruption remains to be seen. However, what is becoming clear is that there is an ever-increasing stratification in the quality of equity research.

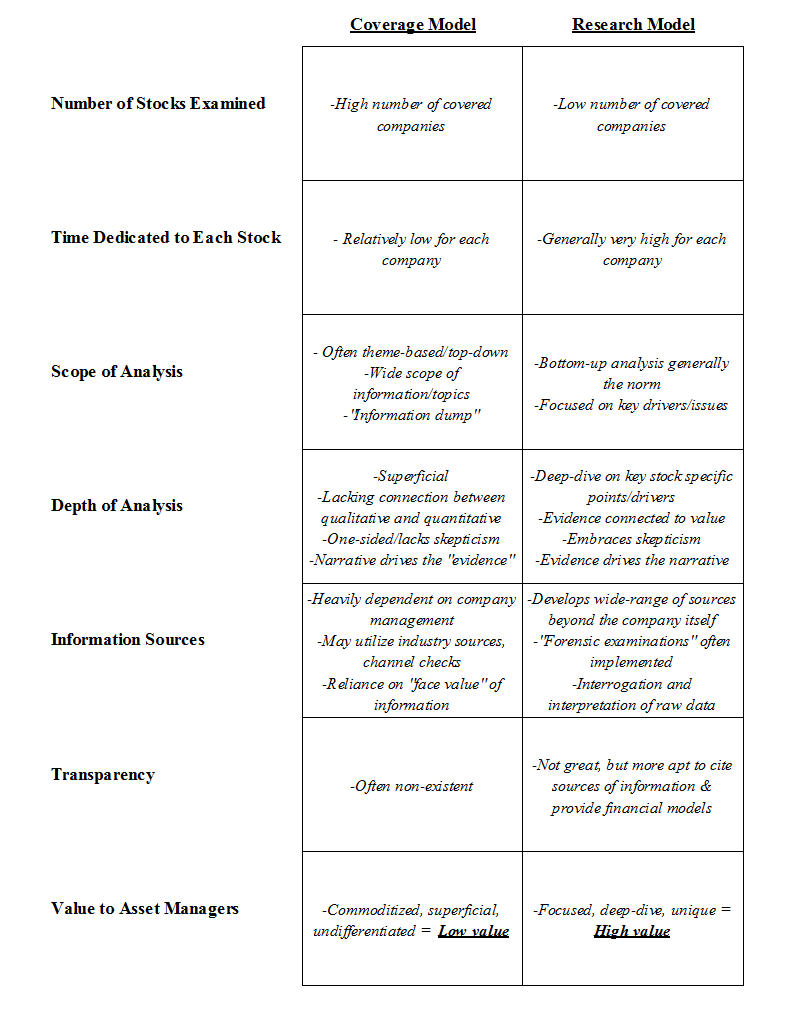

As this stratification continues, we see two primary production models emerging. The first, what we call the “Coverage Model”, is akin to the traditional sell-side approach hallmarked by the coverage of a large number of companies in a relatively superficial manner. The second model, which we call the “Research Model”, takes the form of highly specialized and often independent firms, who focus in on a smaller number of companies, but with significantly deeper levels of analysis. Ultimately, these two models can be distinguished by their thematic base and scope, depth of analysis, information sources, and transparency. While both models certainly have their place in the market, we believe the qualities inherent to the Research Model create significantly more value for asset managers.

Thematic Base and Scope of Analysis

As mentioned, one of the hallmarks of the Coverage Model is the examination a large number of companies. This approach has a number of natural consequences, the most obvious of which is less time available to focus on each individual company. This often leads the analysts operating within this model to create macro or sector-based themes that dominate their analysis with only a small percentage of a report being dedicated to the individual company in question. Along with that approach also comes the tendency to elaborate on a wide range of information to form a comprehensive narrative without drilling down on what is truly important. Any evidence that is presented is usually put in place to support the analyst’s story (as opposed to the evidence driving the story in the first place). Ultimately, this narrative creates the illusion of a thorough, company-specific analysis where none really exists. To maintain the illusion, initiation notes essentially become “information dumps”, while follow-up notes are forced to comment on everything, whether the news or event is important or not. This theme-based, wide-scope + maintenance report approach usually results in little differentiation between the purveyors of such work and rarely results in alpha generation for clients.

In contrast, the Research Model focuses in on a much smaller set of companies, allowing for significantly more time to be spent on each one. While there may still be some analysts that focus on theme driven ideas, they tend to be less broad-based themes involving a smaller subset of companies. The result is greater focus on stock-specific key drivers and issues and far greater differentiation versus the prevailing market or consensus views. The evidence takes center stage and drives the story (as opposed the story driving which “evidence” is articulated). The bonus of this model is that readers are rarely subjected to 50-page reports that “say a lot without saying anything important.”

Depth of Analysis

As another consequence of the wide-scope approach taken in the Coverage Model, the depth of the investigations into individual companies, and resulting information are typically superficial. Key drivers may be discussed (though, often they are not) in qualitative or quantitative terms, but often the connection between the two lacks rigor or is missing entirely. In addition, specific risks are largely ignored. Deep examinations of accounting, corporate governance issues, and legal documents are almost unheard of in the Coverage Model.

In contrast, depth of analysis is where the Research Model really stands out. This model typically focuses on evidence as opposed to selling a story. Often, this is where you will see the deep forensic analytics that expose accounting frauds, or where hidden, valuable assets discovered, or opportunities for shareholder activism. The Research Model may take significantly more time and intellectual commitment, but because of that time and commitment, it is also better suited to discovering specific, alpha-producing ideas.

Information Sources

The scope and depth differences between the Coverage Model and the Research Model go hand-in-hand with how each model sources information. For example, in the Coverage Model, analysts are typically very dependent on a company’s management. While they may also lean on industry contacts and data and minor channel checks (though these are often limited in scope and rigor as well), and other anecdotal information, management’s word is often the final word. This results in the Coverage Model acting as little more than a mouthpiece for the covered company’s managers. In addition, as a consequence of the perception of the necessity of management access, a positive bias is almost inescapable.

On the other hand, the Research Model typically starts with a skeptical view of management. Often analysts in this model are fiercely independent and look to access non-traditional sources of information, including ex-employees, legal and accounting experts, and deeper channel checks/surveys. Anecdotal information serves as a starting point to dig deeper, instead of an ending point on which to draw sweeping conclusions. Many analysts who participate in the Research Model setting take management refusal to answer their questions as a point of pride and motivation to dig deeper. The outcome is usually a highly-differentiated view.

Transparency

In spite of the wide-scope approach of the Coverage Model, transparency is not regarded as necessary or desirable. Often, analysts in this model want to be seen as experts without exposing their expertise (or lack thereof) to extensive questioning. This also contributes to the lack of depth where vagueness will suffice (“better to appear vaguely right, than to appear specifically wrong”). Questioning of an analyst’s “source” by someone of equal status in the Coverage Model is often seen as an affront to the analyst’s credibility and is not to be tolerated. Any financial models that are provided to clients are typically convoluted and overly complex in order to defend against questioning, or to provide an air of expertise. The “Take my word for it” attitude and approach are the norm.

Although many firms that epitomize the Research Model also lack a degree of transparency, they are typically much better than Coverage Model firms. Most Research Model analysts are not afraid to present more depth to clients because they are not afraid of the questions that come with it. And, while it is still fairly atypical for analysts in this model to provide full financial models, the highest quality firms provide models that are readily accessible, connected to the text of the note, and easily flexed by clients.

Implications

Both the Coverage Model and Research Model have utility in the market. However, with the implementation of MiFID 2 rapidly approaching, asset managers are going to face choices on where they spend their research budget. The questions is: will they spend on wide-scope, low-depth, commoditized “coverage”, or focused, deep-dive, differentiated “research”. We think the value proposition is fairly uncomplicated, as the characteristics inherent to the Research Model create more opportunities to generate alpha.

The analysts themselves will also be faced with a choice: do they improve their critical thinking skills, technical abilities, and research methods, or will they continue in the status quo of producing commoditized coverage. Again, we think the choice will be straightforward. However, the truth of the matter is, not everyone is capable of functioning or competing in the Research Model. It takes a special, highly-skilled analyst that is willing to go well beyond traditional thinking just to get in the door.

Disclosure: None.

Have something to say on a recent acquisition or merger? Let us know your views on the StockViews platform!