The Priceline Group Stock Downgraded And Still Harvesting High Return On Investment

The Priceline Group, based in Norwalk, Connecticut, is the provider of online travel, restaurant reservations and other related services. They operate throughout the world in over 200 countries, and they have saved customers over $10 billion since they launched. The group’s main brands include Priceline.com, Booking.com, Kayak, agoda.com, rentalcars.com and OpenTable. Falling 17% in January, Priceline was downgraded by analysts. Both Goldman Sachs and Raymond James downgraded the stock, citing that competition from Airbnb would be a major threat to the online booking business. Goldman analyst further believed that online travel agents have already reached a peak in market penetration, and hotels will be less willing to continue to give online service providers better rates.

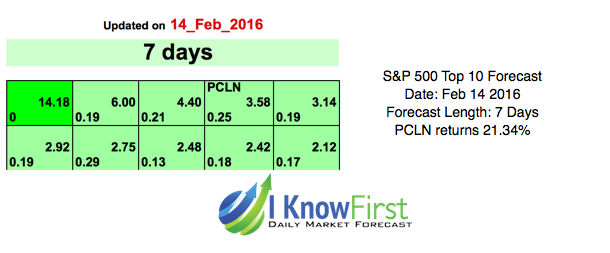

Nevertheless, this past week the company added over $13 billion to its market capitalization as its shares soared from an adjusted closing price of $1,058.01 on Friday, February 12th, to $1,238.28 on Friday, February 9th. This period marked Priceline’s biggest consecutive session price gain since it gained $307.50 over the six sessions ending May 3, 1999. On February 14th, I Know First had a strong signal for Priceline in the S&P 500 top 10 picks forecast.

Priceline’s huge gain in price can be mainly attributed to the earnings report that they released on February 17th, where the company outperformed analyst expectations and strongly outperformed their competitors in the online travel agent space. The company also put forward a very strong forward guidance, causing the stock to gain $124.88, or 11.3% on Wednesday, making it the first member of the S&P 500 to gain $100 in a single session.

For the fourth quarter, The Priceline Group announced gross travel bookings of $12.0 billion dollars, adjusted for currencies this translates to a 13% increase over the last year. Priceline’s gross profit for the fourth quarter was $1.9 billion, adjusted for currencies; this means the group experienced a 12% increase from the prior year. The company reported earnings per share of $12.63, well above the analysts’ average estimate of $11.80.

For the full year, The Priceline Group had gross travel bookings of $55.5 billion, a 10% increase from 2014, on a constant currency basis this about a 25% increase. Gross profit for the year was $8.6 billion, a 13% increase from 2014.

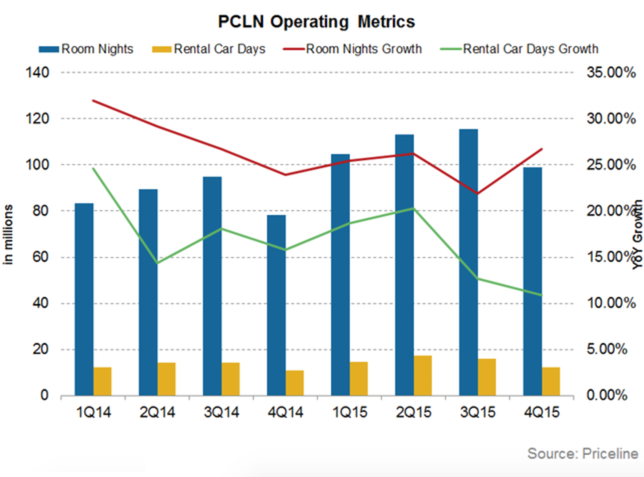

For the year 2015, Priceline booked over 432-million room nights! This is a number that is about twice as many as their next biggest competitor, Expedia. The boost in booking was spurred by a 29% year-over-year growth in international bookings, as the company continues to expand its operations worldwide. The following chart shows the growth in Priceline’s different operating areas.

President and CEO Darren Huston explained that the growth in their booking.com brand has been especially important to the group’s overall growth. “Booking.com continues to expand and innovate and now has over 850,000 hotels and other accommodations in over 220 countries and territories across the globe, up 34% from last year.”

The CEO also had very positive words for the current quarter, and he has no doubt the growth will continue to. Huston explains “The Group’s brands are starting 2016 with strong momentum. We will continue to invest in our brands to organically grow for the long term using our consistent ROI-driven investment philosophy of creating value.”

For the first quarter 2016, the group has plans to increase room nights booked by between 20-27% on a year-over-year basis. They plan to increase the total YoY gross travel booking from between 12%-19%, adjusted for currencies, and they plan to increase YoY gross profit by between 14%-21%.

In order to reach these lofty goals, at the beginning of the month, the company put forward their new strategic initiative to address consumer demand. A spokesperson for the company told PRNewswire “We took a hard look at today’s behavioral trends and they reveal travel’s core truth: travelers take more trips to visit family in places like Rome, Georgia than trips of a lifetime to places like Rome, Italy. A drastically improved product initiative and an expansive increase in available properties, followed by a complete site and app refresh, has put our hotel, rental car and air partners’ content in the spotlight so that no matter what kind of trip you need to take, we’ve put it on the line for you.”

To compete with Airbnb, Priceline announced that they have added over 300,000 properties of all types, including apartments and condos. Furthermore, they have introduced properties that will offer free cancelations and pay-at-arrival services. The company now claims to have among the largest selection of luxury car rentals available. The company has been able to reinvent itself from their older model that involved a bidding system, to a new predominantly published price model, that provides even larger discounts via their “Express Deals” and they believe that they can attract more customers through their “Name Your Own Price” feature.

The company has also launched a new advertising campaign, as they are beginning to divert away from the iconic Priceline Negotiator, featuring William Shatner. The new campaign will appeal to potential travelers by highlighting the pros and cons of travel decisions “while reassuring consumers they should – and can afford to – take the trip.”

Priceline’s Chief Operating Officer explains the new marketing campaign by saying “When we were building our new advertising campaign with BBDO, we wanted to communicate that every trip mattered and that priceline.com had the deals – because, for every trip, there’s something on the line: love, money, career, family, or sports. We also insisted the campaign be as funny as Shatner… and they nailed it.”

Finally, the company announced a streamlined, cross-platform user experience that is based on personalization and speed. After realizing that more than half of their customers use the mobile platform to book their travel. Priceline plans to make the mobile booking process even simpler with their updated platform, as well as introducing features such as “Deals Near Me” and “Tonight-Only Deals” which will appeal to last-minute travelers. Priceline plans to roll out all of these new features including the streamlined user experience, a new homepage, interactive maps, and additional discounts for customers, by the end of the next quarter.

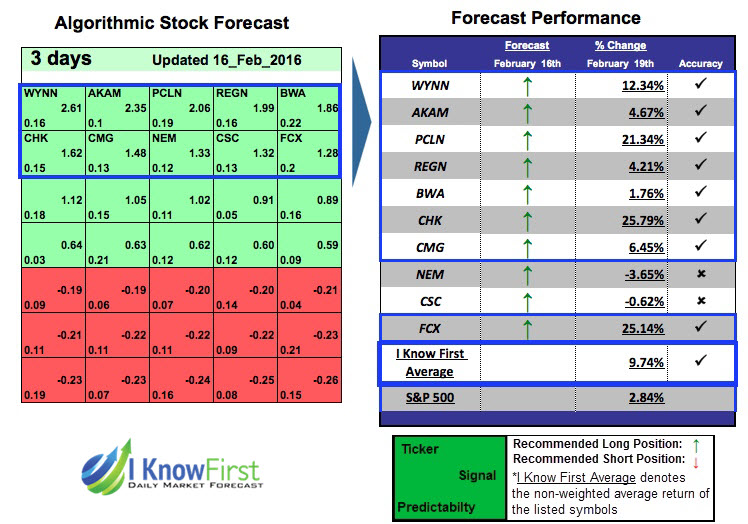

I Know First has previously predicted the bullish stock movement for PCLN on this forecastfor the S&P500 Companies stocks from February 16th, 2016. With a signal of 2.06 and predictability of 0.19, we can see that in just three days PCLN managed to bring returns of 21.34%. For more PCLN forecasts click HERE.

Disclosure: This article originally appeared on more