The New Tesla Motors Gigafactory Will Give It An Advantage Over Other Electric Car Producers

Although the costs of electric vehicle batteries have declined significantly in the last few years, they still represent the single most costly part of electric cars. The cost of Lithium-ion battery that Tesla Motors (TSLA) uses is estimated to be about $190 per kilowatt-hour (kWh), and considering that Model 3 will be offered with a 60 kWh battery, the cost of the battery pack for this car will be about $11, 400.

To decrease battery cost and get enough battery supply for its projected car production of 500,000 by 2018. Tesla built its Gigafactory outside Reno, Nevada which has started mass production of lithium-ion battery cells on January 3. According to Tesla, The cells will be used in its energy-storage products, and later in the Model 3 all-electric sedan which the company plans to begin delivering by the end of 2017. In my view, the Tesla's Gigafactory project is very impressive, according to the company it will produce annually 35 GWh of lithium-ion battery cells, which is nearly as much as the current global battery production combined.

As I see it, by producing its battery cells, Tesla could significantly reduce the cost of its car production, which would give it an advantage over its competitors in the electric vehicles market. What's more, since the current global production of lithium-ion batteries coming mainly from China, Japan, and South Korea would not be enough for Tesla's projected car production for the next few years, the new Gigafactory would solve this problem. All in all, I believe that with the new Gigafactory Tesla's financial performance could improve significantly, which would drive its stock higher.

Lithium

By reaching the Gigafactory full production capacity, the global consumption of lithium could double, as the quantity of lithium in an electric vehicle is almost 5,000 times the amount of lithium in a smartphone. As such, a very tight supply of lithium can be expected, which would benefit lithium producers. There are four major producers of lithium; FMC Corporation (FMC), Chemical & Mining Co. of Chile Inc. (SQM), Albemarle Corporation (ALB), and the Chinese company Tianqi Lithium Industries.

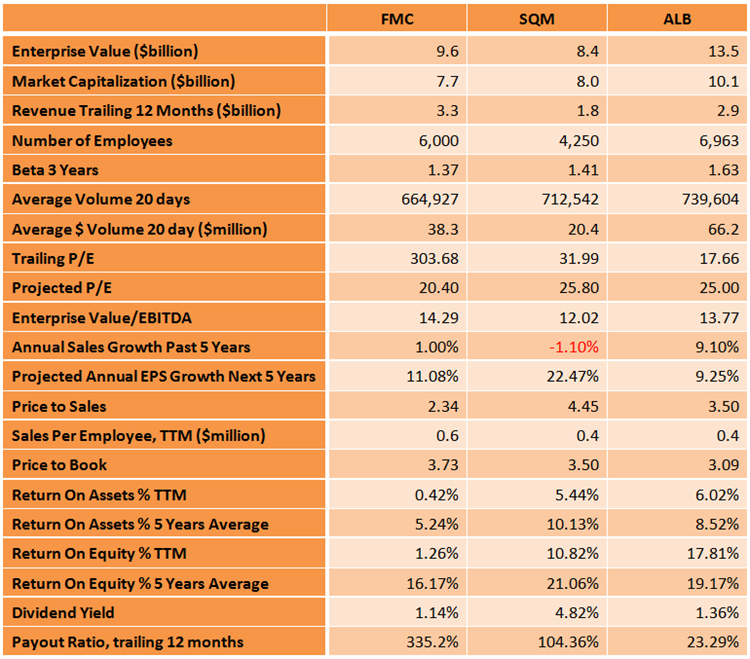

The table below shows important valuation and growth parameters for the three companies which are traded on the New York Stock Exchange.

Source: Portfolio123

The table clearly shows that all the three companies have strong growth prospects. What's more, while all the three companies pay dividends, SQM's annual dividend yield is much higher at 4.82%.

Conclusion

As I see it, by producing its battery cells, Tesla could significantly reduce the cost of its car production, which would give it an advantage over its competitors in the electric vehicles market. As such, with the new Gigafactory Tesla's financial performance could improve considerably, which would drive its stock higher. By reaching the Gigafactory full production capacity, the global consumption of lithium could double. Therefore, a very tight supply of lithium can be expected, which would benefit lithium producers like FMC, SQM, and ALB.