The Good And The Bad On An 18% Yield

When the economy was melting down in 2008, I was doing my part to keep things going. You see, I was one of the “suckers” who were actually paying their mortgages every month. So whoever bought a derivative that included my mortgage – you’re welcome.

Apart from the occasional financial collapse, investing in mortgages can be lucrative and investing in companies that invest in mortgages can be as well.

Shareholders of New Residential Investment Corp. (NYSE: NRZ) are currently enjoying a more than 18% yield as the stock trades for around $10 and pays $1.84 in dividends on an annual basis.

That’s a sky-high yield. But can New Residential Investment Corp. continue to pay investors such high dividends?

There are some things to like here, but other things that concern me.

The Good

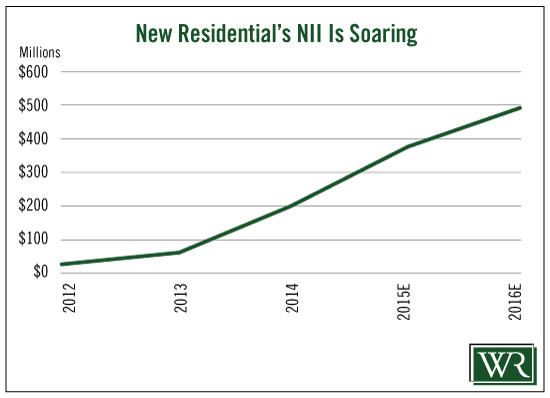

The company’s net interest income (NII) has been steadily growing. NII is how we measure this type of company’s ability to pay the dividend. For 2015, NII is projected to be $377.3 million.

As you can see from the chart, NII has soared from less than $100 million in 2013 to an expected $493 million next year.

That has enabled the company to increase its dividend payouts four times since it began paying a dividend in 2013.

The Bad

My concern is that in 2015, the company will likely have paid out in the neighborhood of $400 million in dividends, while generating slightly less than that in net interest income.

If it keeps its current dividend intact and meets NII expectations for 2016, it will pay out 86% of its NII in the form of dividends, which is a little high for my taste. I like to see payout ratios of 75% or lower.

Now, the company has announced a $200 million stock buyback, which will reduce the number of shares outstanding and, as a result, the total amount of dividends paid. So that could bring the payout ratio a little bit lower. But just because a company announces a buyback doesn’t mean it will use the entire amount that has been authorized.

And of course, if for some reason New Residential’s NII doesn’t meet estimates, the payout ratio could once again equal 100% or more of NII.

I don’t see a dividend cut coming in the next few months, but if NII does not grow as anticipated, the dividend becomes more questionable. The company has a good track record of raising the dividend, but it is too short to be meaningful.

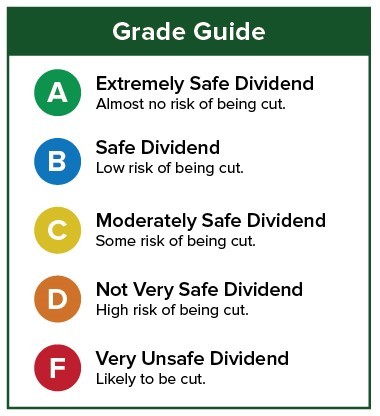

Dividend Safety Rating: C

If you have a stock whose dividend safety you’d like me to analyze, leave the ticker symbol in the comments section below.

Good investing,

Marc

Disclaimer: Nothing published by Wealthy Retirement should be considered ...

more