The Case For Shorting Apple

Apple (AAPL) is one of the most recognizable companies on the planet, it has a market cap larger than the GDP of most countries (nearly $800 billion), it brings in revenue of well over $200 billion a year and its cash reserves alone are larger than most Fortune 500 companies (over $250 billion). Investors who bought Apple stock when it went public in December 1980, would have made a 37,878.8% return at Apple’s current price. These facts have made Apple stock a piece of virtually every person’s portfolio, from Warren Buffet’s to the High Schooler who has just opened his first brokerage account. However, many people, including the media and analysts seem to be ignoring several key facts about Apple that could send the stock falling over the next few months.

For the most part Apple has been a great investment over the years as the stock remains in an upward long-term trend, but there have been periods where the stock has gone through significant corrections of 30-40%. I believe the stock may be nearing one of those corrections now.

Apple stock from 2011 to September 26th, 2017

By looking at the chart above it easy to notice how Apple stock is at the top of the trend it has kept since 2012, the last two times the stock was at the top of the trend, in 2012 and 2015, the stock proceeded to crash 40% and 30% respectfully. This on its own means little to most people, the stock could continue to rally on fundamental reasons and break the trend. However, Apple’s most recent rally, which has seen the stock surge nearly 70% in the last year and a half, has been powered by the expectation that Apple’s most recent products will be wildly successful and usher the company into a new age of innovation.

Apple has recently released a new series of products, including 3 new iPhones, a new smart watch, an improved T.V box and a slate of new software features. The most important of these products is the iPhone X, the phone which is meant to mark the 10-year anniversary of the iPhone and represent the innovation that made the company what it is today. The iPhone X is indeed a major upgrade over previous models, with features such as facial recognition (which Apple calls Face I.D) and wireless charging. Unfortunately, Apple’s stock price hangs entirely on the success of this specific model. There have been few fundamental reasons behind Apple’s recent rally meaning markets have mostly priced in the success of the iPhone X so any hiccup whatsoever could have serious consequences.

The question is whether the iPhone X is enough to keep Apple’s stock rally alive. The last two times Apple stock took a serious tumble the main driver was lack of innovation and new products. Apple has increasingly become a one product company, with the iPhone being responsible for two thirds of the company’s revenue. This reliance on one product has made Apple vulnerable in case of a slowdown in smart phone demand, which is happening now. The smart phone market has matured, in markets such as the U.S and Europe smart phone sales have plateaued and in growing regions like China, Apple trails local competitors.

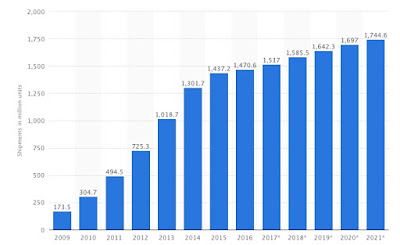

Chart showing forecasted smart phone sales in millions.

Market growth has significantly decreased.

Competition has shrunk the company’s market share forcing Apple to jack up prices for its new phones to maintain growth. The iPhone X will be the most expensive iPhone yet with the cheapest model retailing for nearly $1,000. Analysts say that the price will not hurt sales however early polls show that only 18% of people are willing to pay $1,000 for a new smart phone. There have been concerns that carriers like AT&T and Verizon will be unwilling to finance more expensive smartphones since doing so hurts their already slim margins. Carrier incentives have been one of the key reasons consumers started buying smart phones in the past, which makes sense considering few people have $600-700 to spend on a new phone. Incentives are decreasing while phone prices are increasing that on its own is not a great sign for future sales but there will be no way to truly tell how big of an effect this will be until the phone comes to market on November 3rd.

Chart showing Apple’s market share of the global smartphone market (in percentage)

iPhone’s growth has been stagnating

The importance of the iPhone X becomes even more apparent as reviews come out for Apple’s other devices. The iPhone 8 has received mostly tepid reviews with most people saying that although it is a decent smart phone there is little to distinguish it from the iPhone 7 (which I point out was no one’s favorite iPhone). Demand for the iPhone 8 has also been softer than many expected, the phone managed to capture just .3% of the global IOS market in its 1st week out, which is lower than the iPhone 7 which captured 1% and the iPhone 6 which captured 2%. Although the iPhone 8 plus performed slightly better, the reviews for it were also not extraordinary. The Apple series 3 watch, the 3rd iteration of the company’s first new product in years, also suffered setbacks, with the device having problems with its cellular connectivity feature, which was the devices main selling point. These series of problems led to Apple stock having its worst week since April 2016, with the stock falling over 5%.

Apple bulls have said that these fears are overblown, pointing out that soft demand for the iPhone 8 is due to strong pent up demand for the iPhone X, which is supposed to lead the way to a 13% surge in sales over the next year. What the bulls are forgetting is that a huge bump in sales from the iPhone X has already been priced into the stock. For over a year investors have been looking forward to this product release, expecting Apple to wow them like they used to be by Steve Jobs. Having a smart watch that doesn’t work well, and 2 mediocre iPhones does not strike me as the beginning of a new “super cycle”. Apple is boosting prices for its newest phone to maintain growth, that would be great if the company was marketing itself as a blue chip, but it hasn’t, it claims to be a growth stock. To be a growth stock Apple must show that it can innovate. Competitors like Microsoft, Google and Samsung have expanded into multiple high growth fields such as Artificial Intelligence and self-driving cars. Meanwhile Apple has been resting on its laurels and although it has begun investing into new technologies it remains behind its competitors. This means Apple’s growth is capped. If anything goes wrong with the launch of the iPhone X or even if demand falls slightly below expectations Apple stock could get crushed. So, with all the growth from its new products already priced into the stock it is possible and even likely that Apple stock could see a significant pullback.

Disclaimer: This material has been distributed for informational purposes only and is the opinion of the author, it should not be considered as investment advice.

What other stocks do you recommend we buy and avoid?

With #iPad sales way down, #Apple has begun to bank on it's #iPhone line as buyers tend to buy new phones with far greater frequency than tablets. But as an investor, I recommend that Apple find the "next big thing" to diversify.

The company first got big with it's ipod... who even has a dedicated mp3 player anymore. If they don't continue to innovate with newer and better products, the company will go extinct.

Why are iPad sales down? Don't some people own multiple tablets but only one phone?

I'd say most people own one tablet and one phone. Maybe families with kids have more tablets for their children to play with, but I'd bet they are cheaper tablets like #Amazon Kindle Fires orones geared towards kids like the LeapPad. But tablets don't need to be upgraded as frequently and don't break as often. Phones are always on us and take a lot of abuse, get lost etc. And they tout many more new features with every generation.

By contrast, I can't tell much of a difference between the latest iPads and my older one. Sure they are fractionally faster, thinner and lighter. But barely noticeable. I see no need to upgrade. But regardless of the reason. tablet sales are down.

Innovate is what #Apple does best. They didn't invent the cell phone nor the MP3 player or anything else. They indentify promising products and then make them better. This is what they do and what they will continue to do. Apple isn't going anywhere! Bullish on $AAPL.

While I generally love #Apple and its products, I think the fan boys keep $AAPL stock a bit higher than it deserves - that being said, that rabid loyalty can't be discounted and does add value to the company. It means any serious errors will be quickly forgiven and even mediocre products will sell well.

It takes guts to say anything negative about #Apple. $AAPL