The AHCA: Will It Stall The Bull Market?

The market is pricing in the economy maintaining the current pace which could mean stocks will rally when something gets done and sell off if nothing gets done. I’m expecting it to be a binary event, meaning I don’t see a scenario where stocks sell off after a deal gets done even if the tax cuts are smaller than promised. The reason behind that is because the repatriation tax cut is the biggest booster for the market and it is also the most solidified part of the stimulus measures. The reason I am bringing up the fiscal policy is because there was movement today in the Senate on the heath care plan.

As a reminder, the healthcare plan called the American Healthcare Act needs to be passed before the tax cuts because it will cut spending which will pay for the tax cuts. This is the most difficult part of the process. The Trump administration initially promised everything would get done within months, but that’s not how Washington works. The deadline is the summer of 2018 which is right before the mid-term elections. The GOP wants to pass a tax cut to appeal to voters in that election. The healthcare care bill passed the House of Representatives and is now in the Senate.

The news on Tuesday was that four conservative Senators which are Rand Paul, Ted Cruz, Mike Lee, and Ron Johnson said in a joint statement that they didn’t support the healthcare plan in its current form. Rand Paul is the intellectual leader of the bunch, in my view, because he’s a doctor and has more experience in the healthcare sector. Rand Paul was displeased with the tax credits, the fact that it won’t lower premiums enough, and the stabilization fund. The stabilization fund is a $50 billion fund in the plan which would attempt to stabilize the Obamacare exchanges over the next 4 years.

These four Senators opposing the bill means it can’t pass because the GOP needs 50 votes and there’s only 52 Republican Senators. This looks to me like a rerun of what we saw in the House. At first the House Freedom Caucus hated the plan because it was created in secret. Then the establishment made changes. After the change were made, the moderates from the Tuesday Group didn’t like it, so the two factions met and hashed out their differences, making some last ditch small moves to make it appeal to the moderates. Rand Paul was actually the one who led the initial opposition in the House even though he’s a Senator.

I think the rerun will continue as the establishment will make changes which will move to the right which will make some of the centrists complain. Eventually, they will get together and hash something out. I think it will be easier to solve the disagreement in the Senate than the House because there’s less members. Also, Rand Paul and Mitch McConnell are close because they’re both from Kentucky. Mitch McConnell, the Senate majority leader, knows exactly what Rand Paul wants, so I think he'll negotiate a compromise this summer. The bill should affect healthcare stocks, but we’ll only know which direction it will be in when the details are released. As you can see from the chart below, the biotech ETF is up 28.54% in the past year and has rallied 9.35% in the last 4 trading days. Frankly, I’m surprised the index is off its highs, given the rampant speculation in stocks.

The fact that the legislators are going to move on to the tax cuts is good news for the overall market which should push stocks higher in the late summer. Before the tax cuts are reviewed, the debt ceiling will need to be raised. This ups the stakes for the healthcare plan because if it’s not done by September when the debt ceiling is reached, it will be delayed until afterwards. Also, Congress won’t have the momentum to pass a debt ceiling increase. I’m not that worried about the debt ceiling hurting stocks for more than a few days because Congress thrives on high pressure stakes. Pressure is the only way to motivate members to make tough votes. The best example of a motivated Congress was when TARP passed. Congress can get things done quickly; it just needs a catalyst and a deadline.

Oil Crash

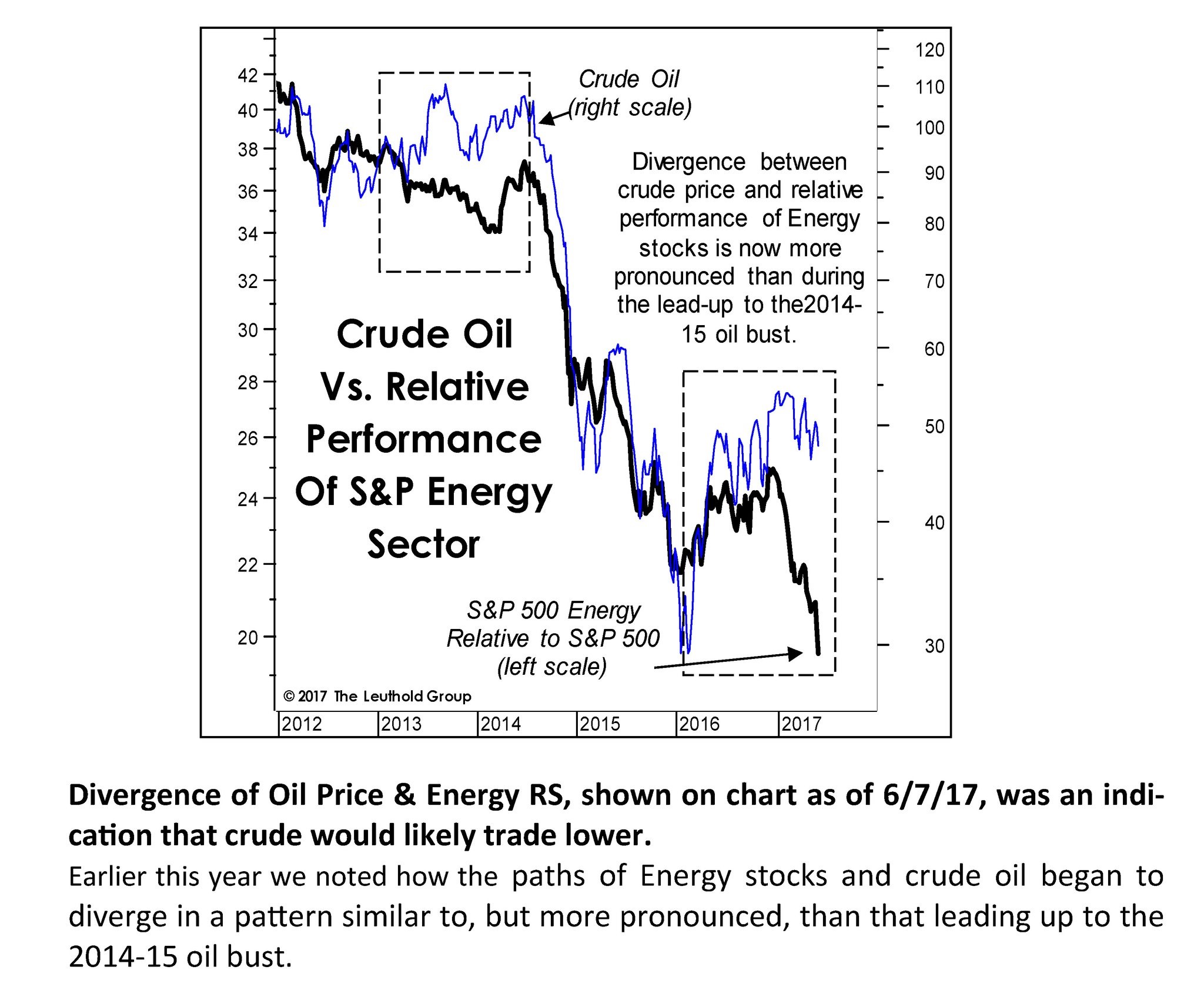

Even though oil rallied slightly on Thursday, its selloff remains the top story of the week as the stock market hasn’t moved much. The VIX remains at a 10 handle. As you can see from the chart below, the S&P energy sector forecast this move lower in oil just like it did in 2014. It’s worrisome that the divergence is larger now because that would signal an even sharper crash in oil than in 2014 if the relationship holds. My hypothesis for why energy stocks have fallen so much is because oil prices have less room to fall before breakeven costs make it unprofitable to produce oil.

When oil was in the $100s, oil needed to fall over $40 to get below the breakeven cost. When oil was in the $50s, it only needed to fall $10 to get below breakeven costs. Both the 2014 and 2017 oil markets were/are in a glut. It was easier for investors to see oil falling $10 when it was in the $50s this year, than it was for investors to see oil falling to the $60s back in 2014. That’s my explanation for why oil won’t fall over 60% again. Mathematically, it’s also unlikely since oil would have to break the prior lows in the $20s to have the same sized correction. While I don’t think oil will fall to the $20s, at the current price energy firms will see losses if they aren’t hedged. Energy stocks have already priced this in, so that means energy stocks might not fall anymore which is bullish for the near-term prospects of the S&P 500. In theory, since this selloff is priced in, energy stocks will fall less than the price of crude oil and rally more than it.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more