The 7 Best Discount Retailers: Finding Value & Dividends Among Bargain Stocks

Discount retail stocks, much like the goods that fill their stores, are on sale.

In case you haven’t heard, e-commerce retailers led by Amazon.com (AMZN) are taking over the world. But in case that doesn’t come to fruition, many dividend-paying discount retail stocks could be attractive.

Internet retail is indeed gaining market share from brick-and-mortar retailers, but plenty of retailers with a physical presence will survive the e-commerce onslaught.

Plus, income and value investors may be reluctant to invest in Amazon, which is certainly understandable.

Amazon is inconsistently profitable, the stock trades for a price-to-earnings ratio of nearly 200, and there is little-to-no hope of receiving a dividend from Amazon any time soon.

As a result, dividend investors may want to consider the following seven discount retail stocks. They are ranked in order of their appeal, based on their business models, valuations, and dividend yields.

#1 Discount Retail Dividend Stock: Target (TGT)

Dividend Yield: 4.8%

Target takes the top spot on this list, because it is a compelling opportunity on valuation and income potential.

Not only does the stock trade for a price-to-earnings ratio of 10, but it also offers a nearly 5% dividend yield.

And, Target recently raised its dividend by 3.3%, marking the 46th consecutive annual dividend hike.

Target is a Dividend Aristocrat, a group of just 51 stocks in the S&P 500 that have raised dividends for 25+ consecutive years. (You can see the entire list of 51 Dividend Aristocrats here.)

Of course, the reason why the stock is so cheap, is because investors are in full-blown panic mode. Target shocked investors when it revised 2017 guidance earlier this year.

The company announced it would invest as much as $2 billion in strategic initiatives, including store redevelopments, investments in digital capabilities, and investments in lowering prices.

This will be an anchor on financial performance this year—Target expects full-year adjusted earnings-per-share will decline 20% at the midpoint of guidance—but the invesmtnets lay the groundwork for better performance over the long term.

That, along with the intensifying pressure from Amazon, have caused Target shares to plunge nearly 30% just since the beginning of 2017.

However, these fears may be unfounded.

Target is investing to renovate existing stores, and add new stores in an emerging segment—small stores.

First, Target is making a major investment in redeveloping stores, to improve their appearances and functionality to better perform in a multi-channel retail landscape.

The company expects to renovate over 100 existing stores this year. Next year, the number of reimagined stores will exceed 350, and will exceed 600 by 2019.

So far, the company projects a 2%-4% sales lift per reimagined store.

Under the CityTarget and TargetExpress banners, these small stores are perfectly suited for urban areas and college campuses, where Target did not have a heavy presence previously.

Target plans to triple its small-store count over the next few years.

Source: Q4 Earnings Presentation, page 77

The small-store expansion is progressing rapidly: Target had 32 small stores in operation last quarter. By the end of this year, Target plans to have more than 60 such stores in operation.

By 2019, there will be more than 100 small stores in operation.

Target has a huge store footprint, consisting of 1,800 stores across the U.S.

This enables faster rollout of its own e-commerce business. For example, 80% of e-commerce orders received on Christmas Eve last year were processed through a store.

Target’s massive store count provides for improved online order fulfillment, which will allow shoppers to pick-up items in a store, as fast or faster than at-home delivery.

Last quarter, approximately 95% of in-store pick up orders were ready in an hour or less. Target’s digital sales increased 22% for the quarter.

With a nearly 5% dividend yield and growth in e-commerce and new store concepts, Target is a very attractive stock for value and income.

#2 Discount Retail Dividend Stock: Wal-Mart (WMT)

Dividend Yield: 2.7%

While Amazon dominates the news headlines, Wal-Mart remains the biggest retailer in the world, with nearly $500 billion in annual sales.

There is arguably no company better positioned than Wal-Mart to take on e-commerce. That’s because of Wal-Mart’s unparalleled store count and distribution network.

Wal-Mart is simply a cash cow—free cash flow increased 34% in fiscal 2017, to $21 billion. Free cash flow rose at a double-digit annualized rate over the past few fiscal years.

Source: Raymond James Institutional Investors Conference, page 5

According to the company, Wal-Mart stores are located within 10 miles of approximately 90% of the U.S. population.

Wal-Mart can exercise a great deal of influence over its suppliers, to lower prices in order to compete with Amazon.

Plus, its massive footprint allows the company to easily pursue e-commerce, either by investing in its own distribution centers, or by making significant acquisitions.

For example, Wal-Mart acquired e-commerce giant Jet.com for $3.3 billion, and acquired a 10% investment in China-based e-commerce site JD.com.

More recently, Wal-Mart acquired men’s online retailer Bonobos for $310 million.

E-commerce will gradually play a more important role for Wal-Mart over time.

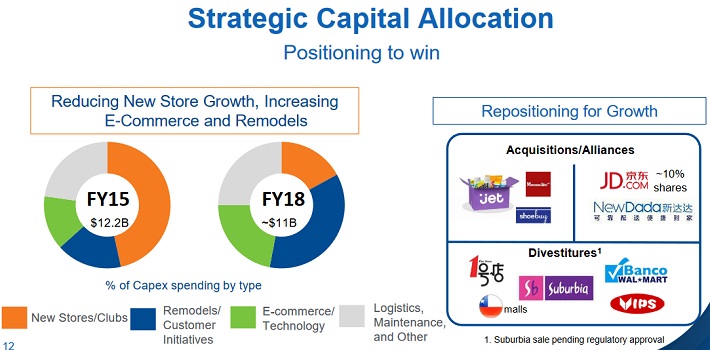

Source: Raymond James Institutional Investors Conference, page 12

These investments are gaining momentum. Wal-Mart’s e-commerce sales rose 22% in fiscal 2017, to $15 billion. U.S. sales increased 3.2%.

The new fiscal year is off to a bang.

Last fiscal quarter, e-commerce sales rose over 60% from the same quarter last year. This drove a 1.4% increase in U.S. comparable sales for the quarter.

Rising domestic comparable sales, which measures sales at stores open at least one year, is a good sign for Wal-Mart that the brand is regaining strength.

Wal-Mart’s diversification has also helped so far this fiscal year.

In addition to its core U.S. business, Wal-Mart also has a sizable international presence, as well as a warehouse club operation under the Sam’s Club banner.

These complementary businesses boosted Wal-Mart last quarter. Excluding currency impacts, international sales rose 0.8% last quarter.

Comparable sales increased 1.6% at Sam’s Club not including fuel, which was a massive increase in sales growth from previous quarters.

Wal-Mart certainly has the financial strength to compete with Amazon on price and e-commerce. And, its massive cash flow allows it to raise dividends each year.

Like Target, Wal-Mart is a Dividend Aristocrat. It has raised its dividend for 44 years in a row.

Discount Retail Dividend Stock #3: Costco (COST)

Dividend Yield: 1.2%

Costco has a low dividend yield, but it makes up for this with very high dividend growth rates.

On April 25th, Costco raised its regular cash dividend by 11%.

Costco is a Dividend Achiever, a group of 265 stocks with 10+ years of consecutive dividend increases.

You can see the entire list of all 264 Dividend Achievers by clicking here.

Even better, Costco pays a special dividend on occasion. Costco also declared a special dividend of $7 per share for 2017.

Special dividends are not guaranteed from year to year, but Costco has paid three special dividends in the past five years.

It can raise its regular dividend and also pay a special dividend from time to time, because of its highly successful business model.

Costco’s sales and membership have grown consistently over the past several years.

Source: 2016 Annual Report, page 3

Overall, Costco’s net sales increased by 2% in fiscal 2016, due to a 4% increase in comparable sales.

Results are strong so far in fiscal 2017. Last quarter, comparable sales increased 5%. Earnings-per-share increased 28%, year-over-year.

Costco owes its growth to several factors. First, it has developed a strong brand connection with consumers.

Membership increased 7% in 2016, and renewal stands at 90% in the U.S. and Canada.

In addition, Costco is highly profitable. As a warehouse club operator, Costco utilizes scale to keep prices low.

It can offer low prices, but also generate strong earnings growth, thanks to its membership fees. Costco’s membership program added $3 billion of revenue in 2016.

Membership revenue should continue to grow at a healthy rate, due to new member signups, and price increases. Costco enjoys significant pricing power, and raises membership fees regularly.

One challenge to Costco’s growth potential is Amazon, which presents a significant threat.

Conceivably, if Amazon Prime costs less than a Costco membership, with lower product pricing and faster shipping, Costco could see its cardholder numbers decline.

However, Costco should be able to retain its membership base, because it has a popular line of signature brands.

The Kirkland Signature product line helps keep customers coming through the doors. Last year, Costco expanded the Kirkland line into athletic apparel, which is a growth category.

And, while Amazon is making big waves with the $14 billion acquisition of Whole Foods (WFM), Costco has its own line of organics which are growing increasingly popular. In 2016, Costco added organic products like quinoa and hummus to the Kirkland Signature line.

Plus, Costco has a growing e-commerce business of its own. E-commerce sales increased 15% in 2016.

The company is also working on grocery delivery, having formed a partnership with third-party delivery service Shipt. Costco plans to expand the service to 50 markets by the end of 2017.

As a result, Costco has all the tools necessary to fend off the Amazon threat.

Discount Retail Dividend Stock #4: Dollar General (DG)

Dividend Yield: 1.5%

Dollar General was formed in 1955. It was held by a private-equity firm until 2009, when it went public.

Dollar General is a ‘dollar store’, meaning most of its goods can be found for $1 or less. It operates on the deep discount side of the discount retail industry.

As of May 5th, 2017, Dollar General operated 13,601 stores in 44 U.S. states.

It is among the largest dollar store chains, and has acquired significant scale through its massive store count and 14 distribution centers.

This allows it to be a low-cost operator, which helps keep prices low.

Source: 2020 Vision Presentation, page 28

Dollar General has an amazingly recession-resistant business model.

The company has increased comparable-store sales for 27 years in a row. This includes the Great Recession.

In fact, the years of the Great Recession were Dollar General’s best years of growth. For example, the company grew comparable sales by 9% in 2008 and 9.5% in 2009.

Consider how well the company performed during the Great Recession:

- 2008 earnings-per-share of $0.34

- 2009 earnings-per-share of $1.04

- 2010 earnings-per-share of $1.82

- 2011 earnings-per-share of $2.22

Thanks to its rapid comparable sales growth, the company not only survived the Great Recession, it actually benefited from the recession.

This actually makes sense—dollar stores benefit when the economy enters recession, because consumers scale down their spending.

Consumers that would normally shop at higher-end discount retailers or department stores, shift spending down the ladder when the economy goes south.

The company also performs well when the economy is growing. In 2016, net sales increased 7.9%, to $22 billion.

Operating cash flow increased 15%, to $1.6 billion. Diluted earnings-per-share rose 12%, to $4.43.

2017 is off to a good start as well: Dollar General’s net sales increased 6.5% in the first quarter, as comparable-store sales rose 0.7%.

For the full year, Dollar General expects comparable sales growth of up to 2%, and 5%-7% net sales growth.

With its high profitability and strong cash flows, Dollar General returns significant cash to shareholders through dividends and share repurchases.

Dollar General is a relatively new dividend-payer. It began paying dividends in 2015. But, it has raised its dividend twice since then, including a 4% increase for the 2017 first-quarter payment.

Like Wal-Mart and Target, Dollar General is moving into groceries, as well as small stores. By doing so, Dollar General hopes to match the diversified product offerings as its larger discount retail competitors.

Source: 2020 Vision Presentation, page 11

In the company’s estimation, there is a huge addressable market opportunity for groceries—thus, the push into food.

The company accelerated this investment when it acquired 41 former Walmart Express stores last year. These small-format stores are designed to enter densely-populated large cities that cannot offer the square footage necessary for a full Dollar General store.

And, these locations will feature an expanded product assortment, which will include fresh meat, produce, and in many cases, fuel.

Dollar General pays an annual dividend of $1.04 per share, good for a 1.5% dividend yield based on its current share price.

Discount Retail Dividend Stock #5: PriceSmart (PSMT)

Dividend Yield: 0.8%

With the lowest dividend yield of the seven stocks on this list, PriceSmart may not appeal to investors who desire high yields.

However, it does have appeal to dividend growth investors–while PriceSmart is a low-yielder, it raises its dividend at high rates. The company last raised its dividend in 2014, by 17%.

PriceSmart is essentially the Costco of Central America and the Caribbean. At the end of 2016, PriceSmart operated 39 stores in 13 countries, with $2.8 billion in annual sales.

Source: December 2016 Investor Presentation, page 6

The company has a strong brand. It has 1.5 million membership accounts, with a renewal rate of 86%. It has attained this by offering low prices, and a diversified product offering.

Not only does PriceSmart provide branded products, but it also has a popular signature line. Sales are nearly evenly split between U.S. and internationally-produced goods, and locally-sourced products.

PriceSmart stores are typically smaller than Costco or Sam’s Club warehouses, with an average store size of 50,000-75,000 square feet. This allows PriceSmart to keep costs low.

These strategies have helped PriceSmart differentiate itself from the competition.

In fiscal 2016, PriceSmart’s net warehouse club sales and total revenue increased 3.7%. The company is off to a good start to fiscal 2017 as well—net sales increased 3% through the first nine months of the fiscal year.

Earnings-per-share have not been reported yet for the fiscal third quarter, but were up 5.5% in the first two fiscal quarters.

PriceSmart’s future growth catalysts will be new store openings, and membership growth. The company opened 3 new stores in Colombia in 2015, which drove a 25% membership increase that year.

More recently, membership increased 3.4% last quarter.

As a mostly international operator, PriceSmart’s results are subject to currency risk, and geopolitical risk.

PriceSmart’s growth would look much more impressive, were it not for the deterioration of the Colombia peso versus the U.S. dollar.

Source: December 2016 Investor Presentation, page 13

Last quarter, PriceSmart’s comparable sales growth would have been 10.4%, on a local-currency basis.

For example, one of PriceSmart’s largest Caribbean markets—Trinidad—posted a 9.6% decline last quarter.

Still, PriceSmart is a highly profitable company, with the opportunity for growth in under-developed nations. These economies can be prone to higher volatility, but over the long-term, the growth potential is attractive.

Discount Retail Dividend Stock #6: Big Lots (BIG)

Dividend Yield: 2.1%

Big Lots is a discount retailer with over 1,400 stores in 47 U.S. states. Big Lots ended 2016 with 12 consecutive quarters of flat or positive comparable sales growth.

The streak was broken in the first quarter, when comparable sales unexpectedly declined 0.9%. This was only a temporary slowdown, however, as comparable sales bounced back to low-to-mid single digit growth in March and April.

And, Big Lots is rapidly improving its profitability.

Earnings-per-share hit a record in 2016, up 21% for the year. Earnings-per-share rose another 40% in the first quarter.

For 2017, Big Lots expects earnings-per-share in a range of $4.05-$4.20. This would represent 11%-15% growth for the full year.

Earnings growth will consist of 1%-2% expected growth in comparable store sales, as well as cost reductions.

Big Lots attributes its success to its focus on its target customer, which management refers to as ‘Jennifer’.

In the company’s estimation, Jennifer wants a combination of value and quality. Big Lots believes it can be a destination for Jennifer, because of its strength in a few key categories, such as furniture, seasonal products, and consumables.

These are the areas in which Big Lots believes it has an opportunity, and the company’s growth proves it is on to something.

With its rapid earnings growth, Big Lots rewards shareholders with an increasing dividend.

Big Lots does not have an extensive dividend history. It has only paid a dividend since June 2014. But, it has increased its dividend three times since then, including a 19% raise on March 3rd, 2017.

And, the stock is reasonably valued. With a price-to-earnings ratio of 12, Big Lots could be undervalued. This makes the stock attractive for a mix of yield, dividend growth, and value.

Discount Retail Dividend Stock #7: Fred’s (FRED)

Dividend Yield: 2.3%

Last but not least is Fred’s, the smallest company on this list, with a market capitalization of $377 million.

Fred’s earns a spot on the list because it has a unique business model, which could allow it to keep Amazon at bay.

Fred’s specializes in discount retail, in the pharmacy industry. The company operates over 600 pharmacy and general merchandise stores, along with three specialty pharmacy-only locations.

Its product offerings include branded items, as well as proprietary Fred’s Pharmacy label products.

Fred’s has been challenged lately, by the extremely difficult environment for retailers.

In 2016, the company reported a net loss of $1.80 per share, much bigger than the loss of $0.20 per share in 2015.

The loss was due to many non-recurring expenses, such as inventory write-downs, asset impairments, and restructuring expenses.

The good news is, the company expects to be profitable by the end of 2017.

It is off to a good start—first-quarter comparable-pharmacy sales increased 3.3%, led by a record quarter in specialty pharmaceutical sales.

Source: First Quarter 2017 Presentation, page 9

And, it could see meaningful growth going forward, due to its aggressive acquisition strategy.

Fred’s has reached an agreement to acquire 865 stores from Rite Aid (RAD) for $950 million in cash, provided the acquisition of Rite Aid by Walgreens Boots Alliance (WBA), and subsequent divestment, work out as anticipated.

Fred’s has indicated it is willing to purchase up to 1,200 Rite Aid stores, if necessary to help the acquisition close.

Fred’s is a turnaround stock. It did not have a good year in 2016, but things are starting to improve so far this year. Whether the company’s turnaround is ultimately successful, hinges on the fate of the WAB-RAD merger.

The purchase of these Rite Aid stores would make Fred’s the third-largest drugstore chain in the U.S., and would provide Fred’s with the national scale to significantly boost its profitability.

This should allow it to maintain and possibly grow its dividend, which yields 2.3%.

Final Thoughts

Despite the intense pressure being put on discount retailers by e-commerce competitors like Amazon, many brick-and-mortar retailers remain profitable, with steady growth.

And, they are investing heavily to compete with Amazon, by building out their own digital platforms, and lowering prices.

Of the seven stocks on the list, Target, Wal-Mart, and Costco are the most attractive.

Target and Wal-Mart are the top two discount retail stocks, based on their cheap valuations and high dividend yields.

Costco is slightly less attractive because of its high valuation, but it will remain a force to be reckoned with in discount retail.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more