Texas Instruments: A High Dividend Growth Stock

Texas Instruments (TXN) is an under-the-radar type of stock. The company does not get much attention in the financial media. It tends to get ignored, as analysts focus more intently on other stocks in the technology sector.

But lo and behold, Texas Instruments has trounced the market in recent periods. The stock has increased 36% just since the beginning of the year.

And, it is also an excellent stock for dividend growth.

Texas Instruments has increased its dividend for 13 consecutive years. It qualifies as a Dividend Achiever. You can see the entire list of all 273 Dividend Achievers here.

This article will discuss Texas Instruments’ operating advantages that are the reasons for its success.

Business Overview

Texas Instruments operates in two key segments, which are analog and embedded processing. It was not always this way—the company underwent a significant repositioning several years ago.

Management decided to chart a new course for the company by selling out of low-growth businesses, such as its older wireless business. In turn, it focused much more on analog and embedded processing.

Analog and embedded processing semiconductor sales represented 86% of Texas Instruments’ sales last year.

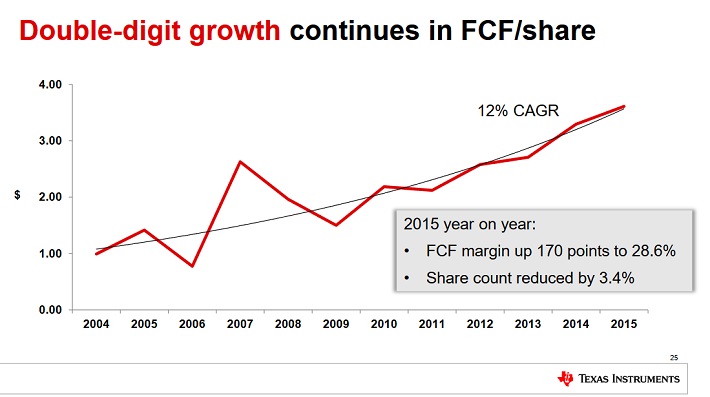

This was clearly the right strategy to take, as Texas Instruments has significantly increased free cash flow for several years.

Source: 2016 Capital Allocation Presentation, page 25

In the past four quarters, free cash flow increased 8% to $3.9 billion. Free cash flow in that period represented 29.5% of sales. That is a very high level and actually increased from 27.5% in the same quarter last year.

Last quarter, revenue from embedded processing and analog increased 10% and 6%, respectively. Plus, operating margins expanded in both businesses.

Thanks to cost cuts and effective capital allocation, operating profit in embedded processing and analog increased 17% and 26%, respectively.

Texas Instruments’ operational strategies should continue to drive growth up ahead.

Growth Prospects

Texas Instruments has generated strong growth over many years. It has done this by focusing first and foremost on efficiency.

This strategy is likely to propel additional growth because the company has taken this approach to other areas of the business.

For example, Texas Instruments is becoming more efficient with its research and development spending. It is steering future investment towards the most attractive industries going forward, which include industrial and automotive.

Source: 2016 Capital Allocation Presentation, page 13

At the same time, Texas Instruments will be reducing R&D spending on its electronics business.

Another key component of Texas Instruments’ future earnings growth will be share repurchases. Stock buybacks help to grow earnings-per-share. Fewer shares outstanding means each existing share is entitled to a greater share of profit.

Texas Instruments has aggressively reduced its share count for more than a decade.

Source: 2016 Capital Allocation Presentation, page 21

Continued buybacks will generate additional earnings-per-share growth.

Texas Instruments has a long runway of growth up ahead, thanks largely to its competitive advantages.

Competitive Advantages

Texas Instruments’ impressive growth would not be possible without sustainable competitive advantages.

The first competitive advantage for Texas Instruments is its manufacturing strategy.

As part of the company’s portfolio repositioning, it has adopted a strict policy of acquiring manufacturing assets as cheaply as possible. It strategically acquires mature assets ahead of demand, when their prices are most attractive.

This means the company does not have to spend lots of money on capital expenditures. This is a major reason for the company’s excellent growth of free cash flow over the past several years.

In addition, Texas Instruments’ superior product portfolio is a competitive advantage. The company continuously innovates to meet changing customer demands.

For example, the next promising product line for the company is 300-millimeter Analog processors. The company is aggressively investing in this technology.

Source: 2016 Capital Allocation Presentation, page 15

Last year, the company manufactured 25% of its Analog semiconductors on 300-millimeter wafers. According to the company, these are the industry’s largest wafers and have a 40% cost advantage per chip versus 200-millimeter wafers.

Eventually, Texas Instruments sees the potential for $8 billion in annual revenue just from 300-millimeter Analog.

With high levels of free cash flow and low debt, Texas Instruments maintains a strong balance sheet. It ended last quarter with $3.8 billion of cash and short-term investments, 80% of which is held in the U.S.

This is an advantage over its competitors because it allows Texas Instruments to use this cash to enrich shareholders with share repurchases and dividend growth.

Many other large technology companies have lots of cash parked overseas. But the difference is that, in order to return that cash to shareholders, those companies would be subject to a significant repatriation tax.

Valuation & Expected Total Return

One drawback to Texas Instruments is that the stock has an elevated valuation.

The stock has a price-to-earnings ratio of 23. This is slightly below the S&P 500 Index, which has an average price-to-earnings ratio of 25.

At the same time, the stock is valued above its normal range. Since 2000, Texas Instruments has had a price-to-earnings ratio of 19.

Therefore, Texas Instruments stock seems to be fairly valued in today’s low-interest rate, high price-to-earnings market. With that said, further multiple expansion may not occur.

If that is the case, future returns will be made up of earnings-per-share growth and dividends. Still, that does not mean the stock should be avoided.

A likely breakdown of future returns is as follows:

- 6%-8% revenue growth

- 1% margin expansion

- 2% share repurchases

- 2.7% dividend

The good news is that even without expansion of the price-to-earnings multiple, investors could still earn 11.7%-13.7% annualized returns going forward.

Dividends will be a meaningful driver of future total returns. Texas Instruments has delivered high rates of dividend growth for many years.

Source: 2016 Capital Allocation Presentation, page 23

It recently hiked its dividend by 32%, to $2 per share annualized.

Final Thoughts

Texas Instruments is a high-quality business with a shareholder friendly. The company is growing and rewards shareholders with an attractive dividend.

Future cash returns, including share repurchases and dividends, should continue to grow, thanks to its strong free cash flow.

Texas Instruments stock has appeal for growth and income investors alike.the company’s double-digit expected total returns provide a compelling reason to consider Texas Instruments for investors looking for exposure to the technology sector.

Disclosure:

more