Teva Punished By Mylan, Generic Copaxone

Mylan (MYL) finally received approval for a generic version Teva's (TEVA) Copaxone. The news broke Tuesday after-hours. Wednesday TEVA fell 14% and MYL was up 16%:

Mylan NV’s long-awaited U.S. approval for its generic version of rival Teva’s blockbuster multiple sclerosis treatment ("MS") Copaxone drove the drugmaker’s shares up more than 19 percent on Wednesday morning and hurt Teva shares.

The approval late on Tuesday by the U.S. Food and Drug Administration came earlier than both companies had expected. It was issued a day after the health regulator said it would introduce a slew of measures to speed to market generic versions of complex drugs like Copaxone in an effort to address the rising cost of pharmaceuticals.

How will generic Copaxone impact Teva's earnings and outlook? I explain below.

Is A 70% Loss In Copaxone Sales In The Cards?

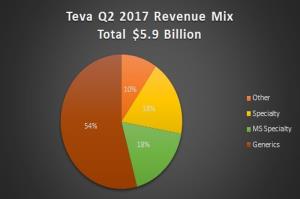

Quantifying the potential impact of the Copaxone fallout starts with projecting the revenue loss. In Q2 Teva's MS Specialty segment (mostly Copaxone sales) generated $1.0 billion in revenue or 18% of the company's total revenue. The entry of generic Copaxone could punish Teva in the form of [i] price reductions for Copaxone and [ii] a decline in volume due to lost market share. According to the IMS Institute For Healthcare Informatics, from 2002 to 2014 the price of medicines was reduced by 51% in the first year generics entered the market:

Generics that entered the market between 2002 and 2014 reduced the price of medicines by 51% in the first year and 57% in the second year following loss of exclusivity. Prices of oral medicines were reduced further, by 66% in the first year and 74% in the second year after generic entry. Within five years, prices of generic oral medicines fell to 80% from their pre- expiry brand prices.

That could imply Copaxone revenue could fall by 51% just on price reductions alone. Wells Fargo analyst David Maris assumes Mylan discounts Teva's pricing by 40% in the 40 mg dosage market, and captures 40% market share. A 51% decline in price and a 40% decline in volume would equate to a revenue decline of approximately 70%.

Teva reported a Q2 EBITDA margin of 31%. Most of its margin erosion came from the generics segment which is experiencing pricing pressure from its largest customers. A 31% margin for MS Specialty would equate to $317 million. A 70% reduction would equate to a $222 million, or a 13% decline in Teva's total EBITDA in year one. That could be optimistic.

Copaxone treats multiple sclerosis; prices for multiple sclerosis drugs have been growing so rapidly that lawmakers started a probe. From 2004 to 2015 the average annual cost for the therapy increased from $16,000 to $60,000. Its increase likely represented pure margin for drug makers. That is a long-winded way of saying [i] Copaxone's EBITDA margin is likely much higher than 31% and [ii] the potential hit to Teva's year one EBITDA could likely exceed 13%.

Teva ex-Copaxone Could Be In A State Of Disarray

Sans Copaxone, Teva could face strong headwinds. Q2 EBITDA margin of 31% was down from the 34% reported in the year earlier period. Sans Copaxone that could deteriorate further. Secondly, the remaining business segments do not appear very exciting.

(Click on image to enlarge)

Currently, Teva's struggling generics segment represents about 54% of total revenue. Q2 revenue from the Specialty Segment was off 8% Y/Y, while other revenue more than doubled. Assuming a loss of 70% of Copaxone sales, generics and the Specialty segment would represent 95% of Teva's total revenue, up from 72% currently. That would imply that nearly all of Teva's remaining operations would face revenue declines or margin erosion.

I believe sorting out Teva with a decline in Copaxone and amid the divestiture of its women's health assets could be a tall order for new CEO Kare Schultz ... then throw in the company's $35 billion debt load now at 5.0x run-rate EBITDA. The loss of Copaxone will likely cause the company's credit metrics to deteriorate even further.