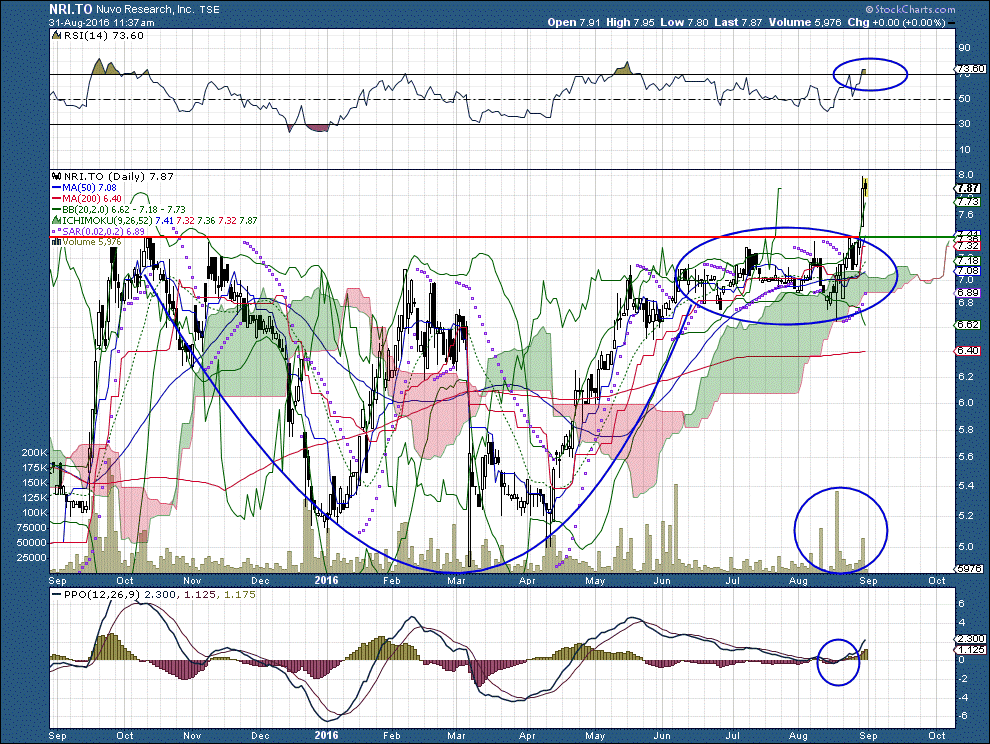

Tech Talk: Novus Research

If you have been following this column for a while, you’ll know why I love the good old cup and handle formation. The problem is that sometimes it’s time to buy this pattern, and sometimes not. The pattern above – Nuvo Research (NRIFF), on the TSE – looks to me like the pattern you may want to buy. Of particular interest is the red and green line across the top, which shows support/resistance. The good news here is that the stock has blasted through resistance, which was about C$7.43.

That kind of activity typically precedes a greening of the Ichimoku Cloud, and that tends to be good.

That said, a note of caution. The relative strength index (RSI) in the top box suggests the stock is a bit overbought. Look back along that indicator, and you will notice that whenever the stock has gone through the 70% mark in that indicator – last October and last May, for example – the stock has responded by moderating. An oversold stock has moved to far, too fast, and at some point will need time to adjust.

On the main chart, you will notice that the shares have been trading relatively high volumes this month. It’s nice to see a stock going up on relatively high volume, but it’s also worth noting that small volumes trade each day. Small volume stocks are susceptible to the risk of high volatility if bad news comes along.

The bottom indicator is the PPO (Percentage Price Oscillator), which is similar to the better-known MACD (Moving Average Convergence/Divergence.) I have circled a positive PPO buy signal, which is only a week old

The MACD indicator works off price. It measures the difference between two values. As time goes by, the $INDU chart has gone from 1000 to 16000. The MACD would make the moves in the early days seem insignificant relative to the moves today.

But at the moment, the news seems good. Some months ago, Nuvo announced its intention to split into two distinct companies, both listed on Toronto. Investors who own Nuvo Research stock upon the split (expected early next year) will get shares in both new companies.

One company will house Nuvo’s profitable specialty pharmaceuticals business, which includes an ointment for arthritis, and sales of that product are growing strongly. The other company will focus on developing new products. For the company’s explanation of how the split will work, please click here.

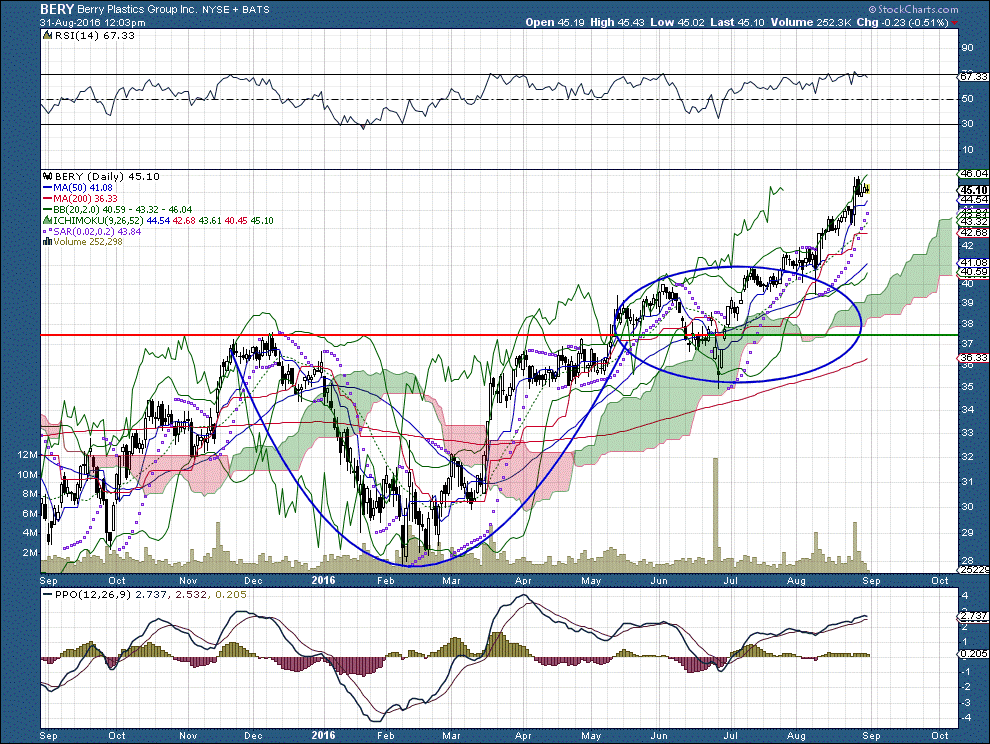

Of course, sometimes you spot ’em, and sometimes you don’t. I own some Nuvo Research, but I don’t own Berry Plastics, a picture of which you will find below. Too bad I didn’t notice that pattern sooner. I’m too cautious to go chasing after breakouts.

Of course, nothing in these comments should be construed as buy or sell recommendations. I don’t do that.

Disclosure: None.