Tableau Delivers Better Performance, But Acquisition Recommended

An IDC report published earlier this year, the Worldwide Semiannual Big Data and Analytics Spending Guide, forecasts global revenues for Big Data and business analytics to grow 12% this year to $150.8 billion. The 12% growth rate is expected to continue through to 2020, when the industry would have grown to more than $210 billion. The growth will be driven by investments made in the banking, discrete manufacturing, process manufacturing, federal/central government, and professional services sectors. All combined, these five sectors are estimated to spend $72.4 billion on the analytics solutions this year and will grow to $101.5 billion by 2020.

Tableau’s Financials

Data analytics firm Tableau (NYSE: DATA) is counting on this rapid growth. It recently reported its second quarter results that outpaced market expectations, thus helping its stock soar. Q2 revenues grew 7% over the year to $212.9 million, ahead of the Street’s forecast of $210.8 million. Adjusted earnings per share of $0.10 was also significantly better than the market’s projected loss of $0.05 per share for the quarter.

By segment, license revenues fell 11% over the year to $103.3 million. Maintenance and Services revenues grew 33% to $109.6 million. Ratable license bookings were 37% of total license bookings, compared to 16% in the second quarter of 2016.

Tableau’s Subscription Growth

Last quarter, Tableau had announced a new subscription pricing option. The new pricing allowed for reduced initial investment costs, thus allowing customers to deploy Tableau more easily, at scale. The market appears to have adapted well to the model. Annual recurring revenue from its subscription sales increased 175% to $103 million.

Tableau’s Cloud Focus

Besides pricing flexibility, Tableau is also paying attention to its customers’ demand of cloud flexibility. Many customers still prefer a hybrid-version of the cloud, where there is data both on-premise and on the cloud. To help these customers manage their analytics requirements, Tableau has been expanding the Bridge and the Online offering. Both the products now allow the users with the flexibility to deploy Tableau in the cloud while maintaining the data behind a firewall in an on-premise data server. Tableau Bridge handles both scheduled extract refreshes and live queries of published data sources, thus maintaining its customers’ need of wanting to keep data on-premise.

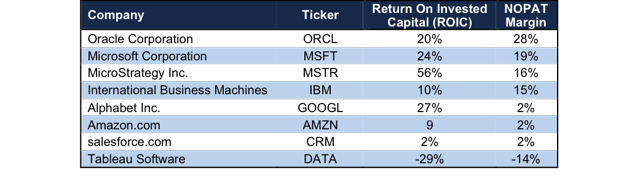

Tableau may be focused on improving product offerings to drive market expansion, but its profitability continues to worry me. It may have outperformed the market expectations on adjusted earnings, but on a GAAP basis, it continues to suffer losses. For the reported quarter, GAAP loss came in at $42.5 million, or $0.54 per share. Here is an interesting analysis by David Trainer, courtesy SeekingAlpha. The table below shows how its competitors are significantly more profitable compared with Tableau, primarily because they are bundling their analytics offering with other tools. Tableau doesn’t have anything else to bundle its offering with, whereas the likes of Amazon and Microsoft offer significantly discounted, or even free, offerings like QuickSight and PowerBI. It makes the case for an acquisition of Tableau by the likes of Microsoft even stronger.

Tableau’s stock is trading at $69.94 with a market capitalization of $5.5 billion. It had fallen to a 52-week low of $41.41 in December last year. It had reached a 52-week high of $71.53 earlier last month.

Sramana Mitra is the founder of One Million by One Million (1M/1M), a global virtual incubator that aims to help one million entrepreneurs ...

more