T. Rowe Price Group Could Benefit From Snapchat IPO

In my view, T. Rowe Price Group (TROW) stock should be included in every diversified large cap dividend stocks portfolio. The global investment management company T. Rowe Price disclosed last week that its Institutional Large-Cap Growth Fund holds 1.29 million of Snapchat shares valued at $15.30 a share, as of December 31, 2016. The initial public offering of the popular messaging application Snapchat is scheduled on March 1, and according to market sources, the planned $3.2 billion IPO is oversubscribed. According to Reuters, the high demand indicates that Snapchat stocks could trade at a higher price than the estimated IPO price range of $14 to $16 a share, benefitting T. Rowe Price and also the mutual funds run by Fidelity Investments.

Latest Quarter Results

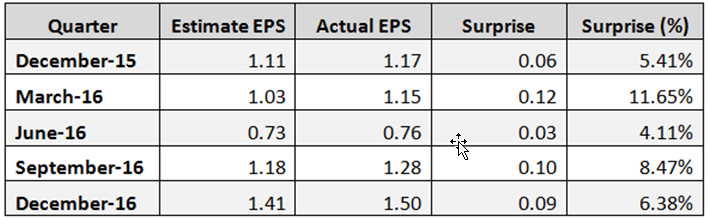

On January 26, T. Rowe Price reported its fourth quarter 2016 financial results, which beat earnings per share expectations by $0.09 (6.4%). TROW's revenues of $1.1 billion for the quarter were in-line with the consensus estimate. The company showed earnings per share surprise in all its five last quarters, as shown in the table below.

TROW Stock Performance

TROW's stock has underperformed the market in the last few years. Since the beginning of the year, TROW's stock is down 4.4% while the S&P 500 Index has increased 5.7%, and the Nasdaq Composite Index has gained 8.6%. Since the beginning of 2012, TROW's stock has gained only 33.4%. In this period, the S&P 500 Index has increased 88.2%, and the Nasdaq Composite Index has risen 124.4%. According to TipRanks, the average target price of the top analysts is at $82, representing an upside of 14% from its February 24 close price of $71.95, which appears reasonable, in my opinion.

Valuation

As I see it, TROW's stock is slightly undervalued. The company has no debt at all, its trailing P/E is at 15.08, and its forward P/E is at 14.16. The price to cash flow ratio is at 12.80, and the Enterprise Value/EBITDA ratio low at 8.40.

On February 16, T. Rowe Price announced an increase of 5.6% in its quarterly cash dividend to $0.57 per share. The forward annual dividend yield is at 3.17%, and the payout ratio is 44.1%. The annual rate of dividend growth over the past three years was high at 13.1%, over the past five years was at 11.5%, and over the last ten years was also high at 13.8%.

Ranking

According to my ranking system, TROW's stock is ranked fourth among all S&P 500 stocks. The 20 top-ranked S&P 500 companies according to the ranking system are shown in the table below:

The "All-Stars: Greenblatt" ranking system is taking into account just two factors; Return on Capital and Earnings Yield (E/P) in equal proportions. Back-testing has proved that this ranking system is one of the best free available ranking method. I recommend investors to read Joel Greenblatt's book "The Little Book That Beats the Market", where he thoroughly explains his system.

Summary

In my view, TROW's stock is an excellent candidate for diversified, large-cap dividend stock portfolio. The company has no debt at all, it has a proper valuation, and it pays a generous dividend, and the annual rate of dividend growth over the past ten years was high at 13.8%. What's more, according to market sources, the planned Snapchat IPO is oversubscribed, which could benefit T. Rowe Price due to its large holding in Snapchat shares. The average target price of the top analysts is at $82, representing an upside of 14% from its February 24 close price of $71.95, which appears reasonable, in my opinion.

Disclosure: I am long TROW stock.