Strongest And Weakest Small Cap Stocks

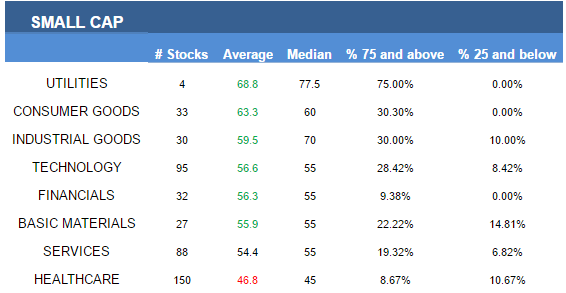

· The strongest small cap sectors are utilities and consumer goods.

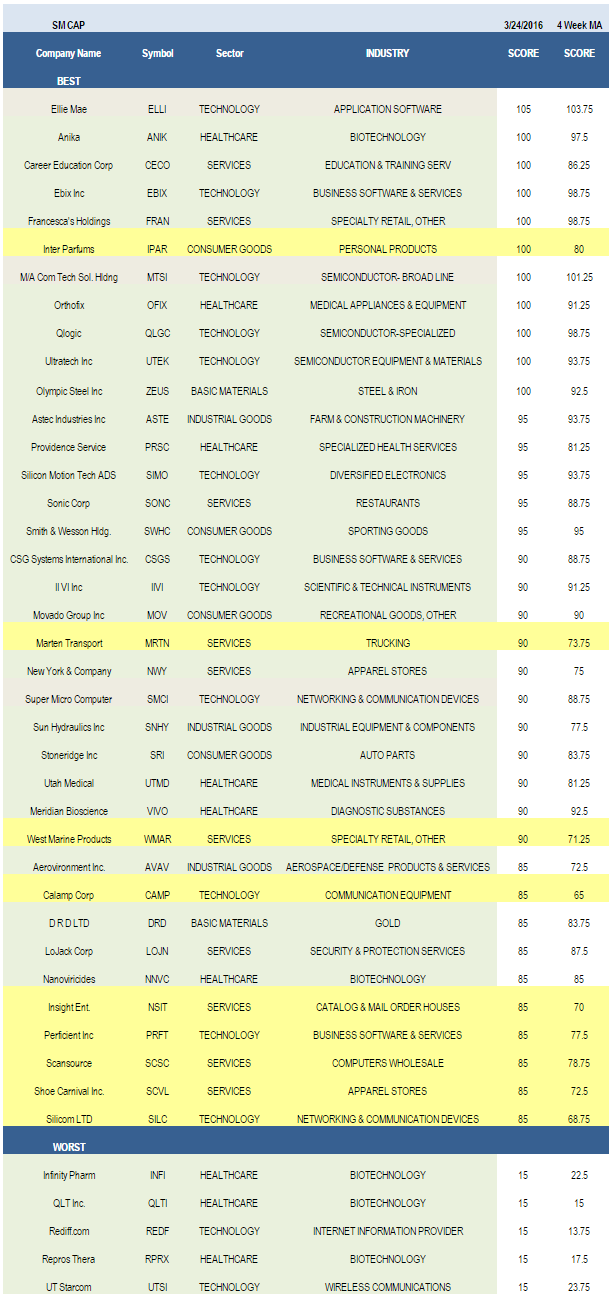

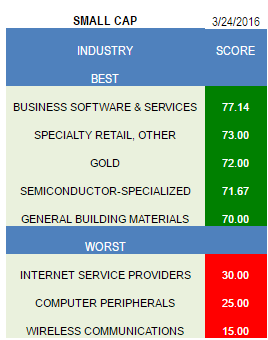

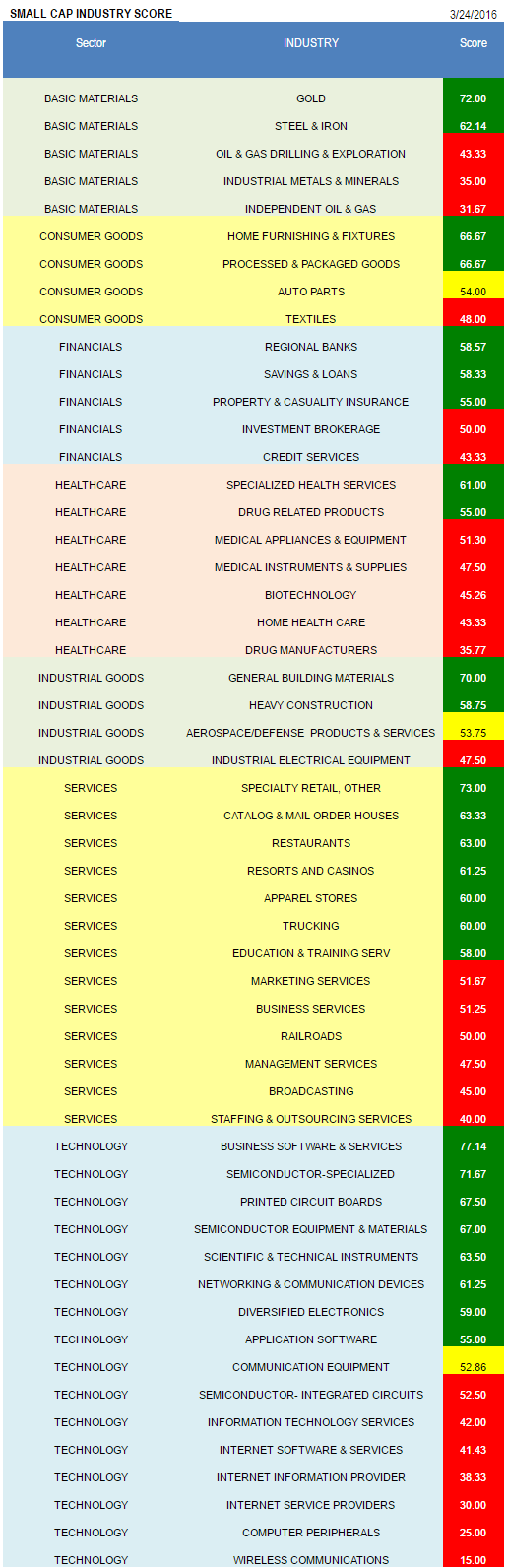

· The best small cap industry is business software.

The average small cap score is 53.67 and that's above the four week moving average score of 52.29. The average small cap stock in our universe is trading -34.98% below its 52 week high, -2.93% below its 200 dma, and has 8.25 days to cover short.

Utilities, consumer goods, industrial goods, technology, financials, and basics all score strongly. Services score in line. Healthcare scores below average.

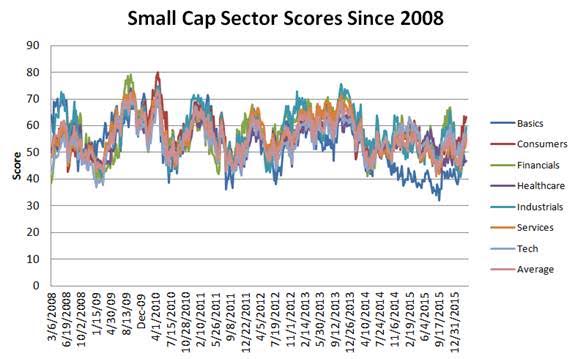

The following chart shows historical small cap sector scores.

Business software (EBIX, CSGS, PRFT, TSYS, MSTR), specialty retail (FRAN, WMAR, HZO), gold (DRD, GSS), specialized semi (QLGC, MPWR), and general building supplies (USLM, NCS, HW) are the top scoring small cap industries.

In small cap basics, focus on gold and steel & iron (ZEUS, ROCK). Home furnishings (ETH) and processed & packaged goods (BDBD) can be bought in consumer goods. Regional banks (MBWM, LKFN), S&Ls (NWBI, OCFC), and P&C insurers (UFCS) are top scoring in financials. No small cap healthcare industries score above average. General building supplies and heavy construction (GVA, AEGN) are best in industrial goods. The top services groups are specialty retail, catalogs (NSIT), and restaurants (SONC). In technology, focus on business software, specialized semi, and printed circuit boards (MFLX, BHE, SANM).

Disclosure: None.