Strong Buy Goldman Sachs Eyes Bitcoin Trading Op

The Goldman Sachs Group, Inc. (GS ) is an investment banking, securities and investment management company that provides a range of financial services to corporations, financial institutions, governments, and individuals. The Company operates in four business segments: Investment Banking, Institutional Client Services, Investing & Lending, and Investment Management. The Investment Banking segment consists of financial advisory and underwriting. The Institutional Client Services segment makes markets and facilitates client transactions in fixed income, equity, currency and commodity products. The investing and lending activities, which are typically longer-term, include its investing and relationship lending activities across various asset classes, primarily debt securities and loans, public and private equity securities, infrastructure and real estate. The Investment Management segment provides investment and wealth advisory services. As of December 2016, it had offices in over 30 countries.

Financial media is awash in reports today that Wall Street giant Goldman Sachs is exploring options related to trading cyber currencies like Bitcoin. Although no firm plans are yet in place, the Wall Street Journal, Bloomberg, and other outlets are reporting that the bank is in talks with "cryptocurrency experts" about setting up exchanges where clients could trade Bitcoin and other similar vehicles.

This will be tricky for the bank, as the cyber currencies are popular vehicles for a variety of nefarious activities including tax evasion, drug dealing, arms sales, etc. US and other law enforcement agencies are engaged in an ongoing battle with so-called "dark web" bazaars that sell everything from credit card numbers to MDMA to weapons. Cybercriminals who infect computers with ransomware also prefer to be paid their ransoms in cyber currencies such as Bitcoin.

In launching this initiative, Goldman has embarked on a different path from competitors such as JPMorgan Chase. Just last month, the CEO of JPMorgan pronounced Bitcoin a "fraud" and promised to fire any bank employee who traded it for being "stupid."

Goldman may see an opportunity here, but one wonders how they can possibly meet various regulatory requirements when dealing with an investment whose reason d'être is providing users with anonymity and easy portability. For now, we'll just have to wait and see what the bank comes up with as more details leak out about its plans.

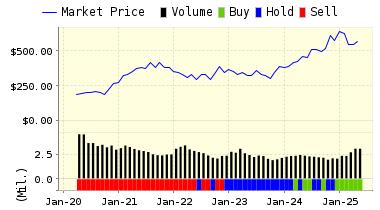

We continue our STRONG BUY recommendation on Goldman Sachs for 2017-09-29. Based on the information we have gathered and our resulting research, we feel that Goldman Sachs the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and Momentum.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

239.66 | 1.04% |

|

3-Month |

237.95 | 0.32% |

|

6-Month |

242.72 | 2.33% |

|

1-Year |

266.78 | 12.48% |

|

2-Year |

259.44 | 9.38% |

|

3-Year |

263.85 | 11.24% |

|

Valuation & Rankings |

|||

|

Valuation |

11.11% overvalued |

Valuation Rank |

|

|

1-M Forecast Return |

1.04% |

1-M Forecast Return Rank |

|

|

12-M Return |

49.22% |

Momentum Rank |

|

|

Sharpe Ratio |

0.66 |

Sharpe Ratio Rank |

|

|

5-Y Avg Annual Return |

14.99% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

22.59% |

Volatility Rank |

|

|

Expected EPS Growth |

5.24% |

EPS Growth Rank |

|

|

Market Cap (billions) |

103.31 |

Size Rank |

|

|

Trailing P/E Ratio |

12.72 |

Trailing P/E Rank |

|

|

Forward P/E Ratio |

12.09 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

2.43 |

PEG Ratio Rank |

|

|

Price/Sales |

3.20 |

Price/Sales Rank |

|

|

Market/Book |

1.19 |

Market/Book Rank |

|

|

Beta |

1.42 |

Beta Rank |

|

|

Alpha |

0.09 |

Alpha Rank |

|

Disclosure: None.