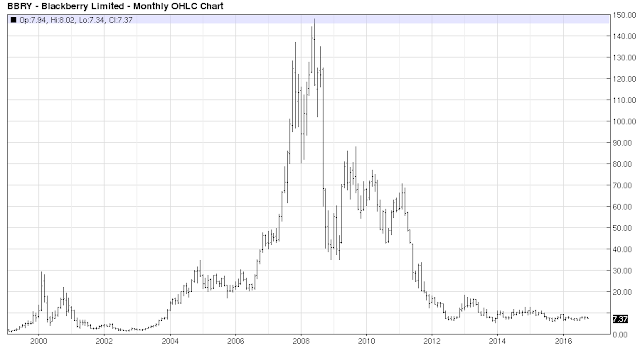

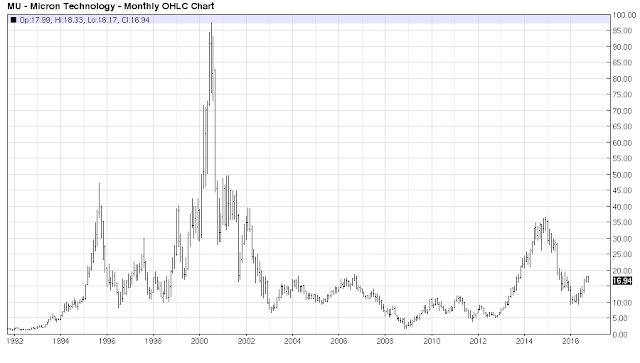

Stocks Are Not Long Term Investment Vehicles

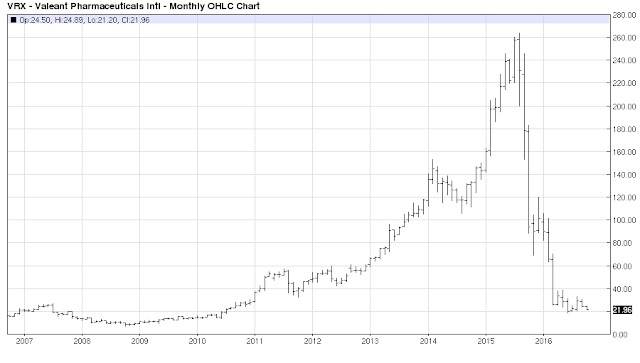

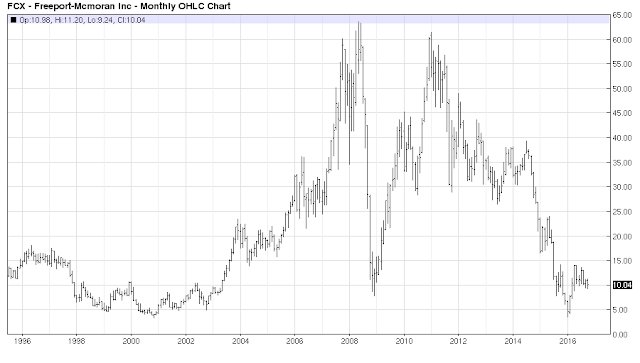

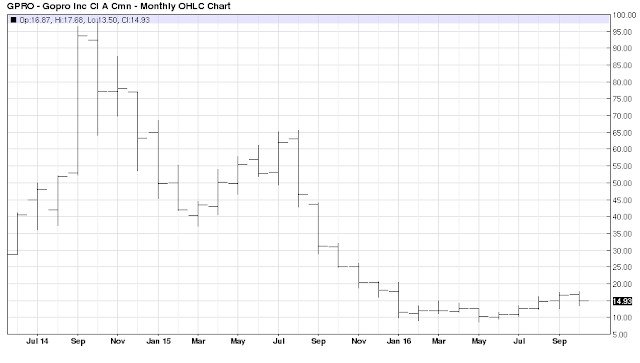

We discuss market theory in this video, and why stocks are not the long term investment vehicles they are purported to be. Pay attention to what phase a stock is in. Everything, i.e., stock prices, are determined by fund flows and market structure far more than fundamental valuation concerns. When market participants quote fundamental metrics they are literally staring at individual blades of grass in the larger context of a huge forest.

Every asset right now in modern financial markets is uninvestable from a long term fundamental time horizon basis due to several factors, but namely bizarre central bank policy. Everything is essentially a commodity and is either being accumulated or distributed based upon your chosen time frame.

Whether you realize it or not everything is a trade in financial markets, when discussing specific time frames we are really just talking semantics here. You better learn how to trade your 401Ks if you want to keep them from being reduced to 201Ks when the fund flow dynamics change in financial markets.

This is why central banks are so reluctant to raise rates, they realize the capital destruction phase they are inevitably going to initiate in financial markets, and they are trying to stall this inevitable repricing for as long as possible.

Disclosure: None

Thanks for sharing