Stick To These 4 All-American Dividend Stocks In 2016

It’s no secret that the global economy is on a weak footing. Many multi-nationals are taking hits to their growth and will have tough times booking gains in 2016, but a great strategy to avoid this trap is to start making investments in companies that only do business in the States.

The stock markets started out 2016 with a steep decline driven by the news of a slowing Chinese economy. At midday on Monday, January 4, the Dow Jones Industrial Average was down by 370 points, or 2.1% and the Nasdaq Composite was off by 127 points or 2.5%. Leading the way down were the U.S. companies with multi-national businesses. The global economy continues to soften and investors may be better served over the next few years by in companies that do the majority of their business right here in the States.

In 2015, the best returns came from tech and other stocks that were growing internationally. The best example may be Netflix, Inc. (NASDAQ: NFLX), which gained 138% in 2015. Netflix is counting on international subscriber growth to generate a growing revenue stream. Almost everyone in the U.S. who would subscribe to Netflix already does. Another company counting on international growth is Starbucks Corporation (NASDAQ: SBUX) which gained 52% last year. A slowing global economy will make it tough for Starbucks to get close to repeating last year’s gains. Overall, stocks may have a tough time in 2016 just because the big multi-national companies will not be able to generate much in the way of earnings growth. These companies and their results tend to drive the overall market.

For 2016, I think a focus on dividend-paying shares of companies that do all or most of their business in the U.S. may produce better returns for investors. The U.S. economy is in a slow-growth mode, but it is still growing. Medium to high dividend yields will generate most of the returns, with some revenue growth fueling modest dividend increases. At the end of 2016, earning a 5% to 7% or higher yield with some dividend increases may look a lot better than the share values of former high-flying stocks that need international sales to grow.

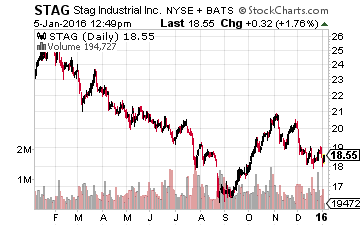

Real estate investment trusts (REITs) fit right into the higher yield and U.S. based investment criteria. An industrial property REIT like Stag Industrial Inc. (NYSE: STAG) is not affected by what happens with the Chinese economy. STAG currently yields 7.7% and should grow dividends by 4% to 6% per year.

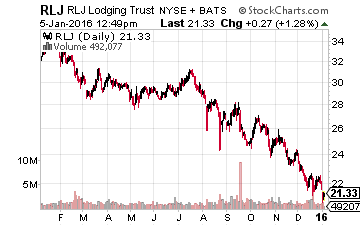

Hotel/lodging REITs have been hammered recently on fears of slowing revenue growth. My analysis indicates that the lodging cycle still has a few years to run and these REITs primarily own hotels in the U.S. Take a look at RLJ Lodging Trust (NYSE: RLJ) which currently yields 6.3% and is currently paying only 52% of adjusted funds from operations (FFO) per share as dividends.

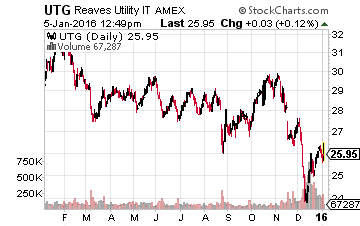

Regulated utilities are another attractive dividend paying sector that have U.S. focused businesses. The stock analysts at Barclays have noted that the current economic cycle indicates that utilities could outperform the market by 18% over the next 12 months. My recommended investment in the utilities sector is the Reaves Utility Income Fund (NYSE: UTG), a closed-end fund that pays monthly dividends.

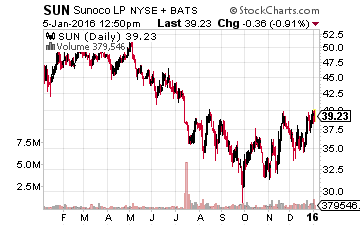

I know the energy sector is currently like Kryptonite to investors, but the U.S. will continue to need fuel for personal and business transportation needs. With lower gas and diesel prices, fuel demand should grow in 2016. Sunoco LP (NYSE: SUN) is a wholesale distributor and retailer of motor fuels in the U.S. SUN yields 7.75%. Wall Street analysts forecast that SUN can increase distributions by a low-teens annual growth rate. This is not an energy company that is affected by crude oil prices, except that lower is probably better for business.

Finding companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and consistent dividend growth in stocks is what has given me the most consistent gains out of any strategy that I have tried.

Disclosure: more