Start Booking Gains Now With These 3 Growth Stocks

After the pretty dismal months of August and September, the fourth quarter has started out much better for investors. The recent rally has been led by the out of favor value stocks, such as those from the beaten down commodity and energy sectors, which are off to very solid starts in October. However, I doubt this shift will last. Headwinds such as continued economic weakness in China and most of the globe will prevent energy prices rising to anywhere near the levels we saw in 2014. In addition, given how deep the losses have been in these sectors a huge amount of “tax loss selling” should hit the sector through year end.

Meanwhile, after posting almost four percent GDP growth in the second quarter of 2015, forecasts for third quarter GDP growth keep getting slashed. Some are predicting the just completed quarter will clock in with just one percent growth. Global demand continues to fall and the domestic economy continues to muddle along within the weakest post-war recovery on record.

In addition, third quarter earnings are expected to be down year-over-year for the second quarter in a row after this earnings season is complete. I believe this “profit recession” will again push investors back into growth stocks that can churn out both revenue and earnings growth despite a very challenging global economic backdrop. Here are a few large cap growth plays I own that have reasonable valuations and should come back into vogue by the end of 2015.

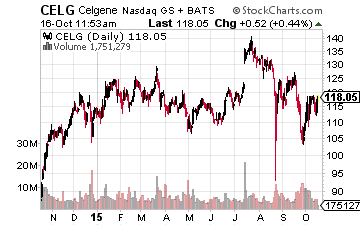

On Thursday, I penned an article on why the bear market in biotech is likely to be over by the end of the month. That makes some of the large cap growth plays in the sector great long term buys after their recent sell-off. I added some Celgene (CELG) over the past month as the shares fell from over $140.00 to under $105.00 a share at one point during this recent pullback in biotech.

They are still a nice bargain at under $120.00 a share. The company’s flagship blood cancer drug Revlimid continues to see impressive growth and is now doing over $5 billion in annual sales. Other products in the portfolio like Abraxane are also showing good growth. The company is not resting on its laurels either. It purchased promising biotech play Receptos (RCPT) earlier this year for just over $7 billion. Celgene also recently got into the emerging area of immuno-therapy this summer with a $1 billion collaboration deal with Juno Therapeutics (JUNO).

Revenues are growing better than 20% annually and earnings should go from approximately $3.70 a share in FY2014 to almost $6.00 a share in FY2016. The stock trades at just a slight premium to the overall market multiple despite its far superior growth prospects. Earlier this month JP Morgan upgraded the company to a Buy with a $152.00 a share price target.

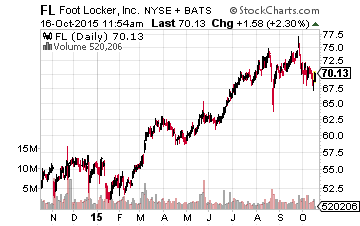

Next up is Foot Locker (FL). Economic forecasters have largely been flummoxed by most consumers choosing to save their gasoline “tax cut” instead of spending it and boosting the economy as most pundits predicted. Two areas that are seeing an uptick in demand as consumers open up their wallets are restaurant sales and footwear.

This is buoying this leading retailer in the footwear space. The company is churning out 10% to 15% annual earnings gains on mid-single digit increases in revenues. This $10 billion company has some $800 million in net cash on its balance sheet and goes for less than 15 times forward earnings. The stock also pays a 1.4% dividend yield. The stock is down some 10% from recent highs.

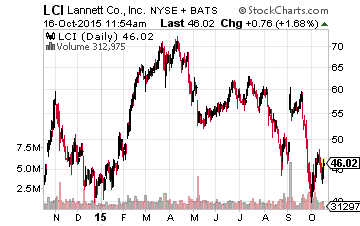

I also picked up shares in generic drug maker Lannett Group (NYSE: LCI) recently after the shares were beaten down during the election-driven attacks on drug price “gouging” that seems to happen like clockwork every four years. The decline in generic drug makers is perplexing as they are a key component to holding down overall spending on drugs.

Lannett is a growth superstar that most investors have never heard of despite the fact the company has been around for over 70 years. The company has grown its top line by an average of 25% annually since 2001. The company has benefited from strategic acquisitions and as branded drugs continue to come off patent.

The drug maker recently made its largest acquisition ever by purchasing Kremers Urban Pharmaceuticals, the U.S. based specialty generic pharmaceuticals subsidiary of UCB S.A., for just over $1.2 billion. The acquisition will be accretive to earnings next year, save the company some $100 million on its tax liability and another $40 million will be saved annually by eliminating redundant operations.

Earnings will be up slightly this year as Lannett integrates Kremers and should be up 20% next year as synergies are unleashed. The stock is cheap after its recent 25% decline at under 10 times next year’s profit projections.

Every cloud has a silver lining and the hiccup several growth sectors have experienced lately is providing some great entry points for long term investors.

Disclosure: Long CELG, FL & LCI

more