Snap Stock Crashing To New All-Time Lows On Bad Earnings

The theme with SNAP stock is that the company shouldn’t have gone public because it doesn’t have a business model that allows it to be profitable. The company decided to go public because user growth was slowing. That allowed it to raise more money this year than if it went public next year.

In the next few years, Snap could turn into Twitter (TWTR) where it has almost no user growth and still loses money. When you have a social media company like Twitter or Snap that isn’t making any money, there is unrelenting pressure on user growth. If user growth was faster at Twitter and Snap, their stocks would be higher, but the problem remains that costs are out of control. Snap’s valuation rose exponentially when it was a private company allowing it to pay employees whatever they wanted. The hype surrounding the company ended up hurting it in the end as costs have lowered the chances of profitability ever happening.

Some Snap shareholders would complain about it being compared to Twitter, but I’d argue the business is much worse. Twitter is a tool to get information quickly to the world. It is important to journalists, public figures, and people who discuss investments. Twitter has done a poor job at monetization. Snap has that issue combined with the lack of importance as many of its features have been copied by Instagram and Facebook Messenger. I’m a believer in the ability for Snap to compete for those users in the short term, but in the long term a public company cannot exist without profits.

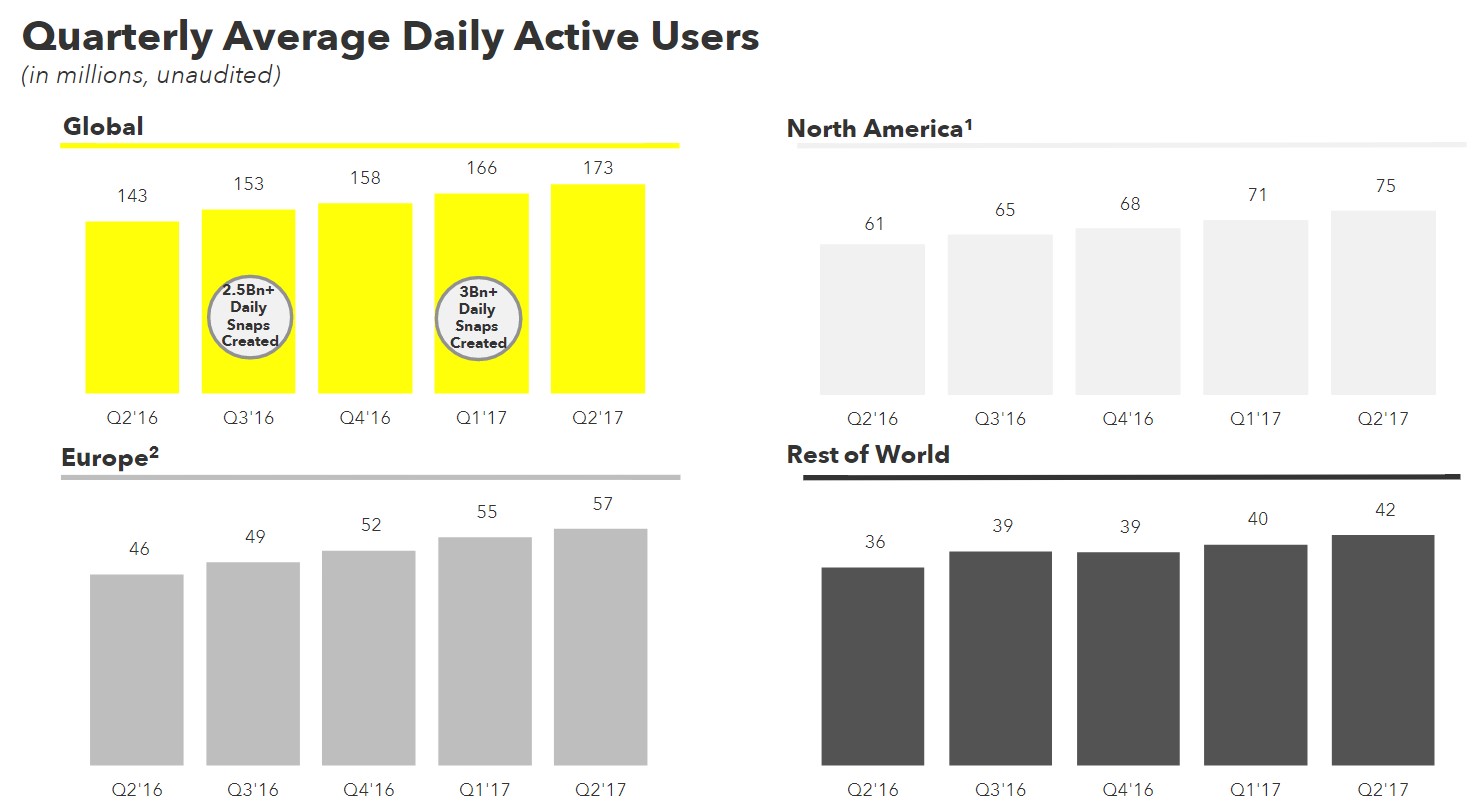

Snap’s quarter was terrible because it missed estimates on every metric. Snap lost 16 cents in adjusted EPS which was worse than expectations for a loss of 14 cents. Revenue was $182.7 million which missed estimates for $186.2 million. Daily active users were up 7.3 million to 173 million. That was below expectations for 175.2 million. Average revenue per user was $1.05 which was below estimates for $1.07. Hosting costs were $0.61 per user which was up one cent from last quarter. This shows that the real cost problem is acquiring human capital and not maintenance of the app. Finally, EBITDA was a loss of $194 million which was below expectations for a $185.4 million loss.

Obviously, growing users is nice, but the real problem with the business is that operating expenses grew way faster than revenues. Revenue growth was 153%, user growth was 21%, and average revenue per user was up 109% year over year. As you can see from the chart below, operating expenses were up 179%. That’s an unsustainable growth rate. Sales and marketing expenses were up 187.5%. It would have been better if the company didn’t bother marketing the product so much because the cost was outrageous. There isn’t an area which grew slower than revenues.

Across the board expenses are too high. The biggest worry is that Snap is going to have to maintain these expenses to compete with Facebook (FB). Snap might have to spend more to develop new products only to have them copied by Facebook. Snap needs to convince advertisers to come on board because most probably already use Facebook. Being the newcomer is difficult. Facebook’s weak point of having previously false engagement metrics and not driving sales isn’t Snap’s strong point. To be clear, when P&G (PG) decided to pull Facebook ad spending, they weren’t doing it to put the money towards advertising on Snap.

I applaud Snap for breaking down its user growth by the number of daily active users. For some reason Twitter says that metric is important, but it doesn’t make it public. I think these growth results are great because North American growth accelerated. The penetration rate ceiling in North America is the rate I’d expect other countries to eventually get to. North America is the most important userbase because it has the highest revenue per user. North America has a $1.97 ARPU while Europe has a $0.39 ARPU and the rest of the world has a $0.29 ARPU. The key demographic that Snap is trying to appeal to is Americans in their 30s and 40s. Teens need to get their parents on Snapchat like they did with other social media apps. Snap needs to develop products which appeal to older users. These older users are Facebook’s bread and butter.

In comparing Snap to Netflix (NFLX), I think investors believe Netflix’s subscription model is stickier than Snap’s advertising based model. Snap has tried charging for added features, but failed. This is an example of how Twitter is more important than Snapchat in terms of the value it has to people’s work. I think Twitter could be successfully selling a premium service as it is a part of journalists’ work flows. Twitter has lower engagement than Snap and Instagram, but it drives the news flow especially since President Trump uses it to get his message out. I’m not saying Twitter is a buy, but it has inherent value in the sense that if it disappeared tomorrow, the world be greatly affected while if Snapchat disappeared, it wouldn’t matter. Investors not getting the appeal of Snap is why the stock was never given a chance in the public market. The second reason is that the IPO wasn’t valued appropriately.

Conclusion

Snap is un-investable even after falling over 50% from the IPO. There is no plan for profitability. That being said, the short case is less compelling now that it has fallen so much. When it gets close to a $10 billion market cap, there will be buyout rumors. If you are short the stock at an $11 handle, I think you are being greedy. It could pop double digits in a day if a rumor that Alphabet might buy it gets traction. That probably won’t happen, but rumors can still cause a short squeeze with it at such a low price and having such a high short interest.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more