Small Cap Buys And Sells - August 25, 2016

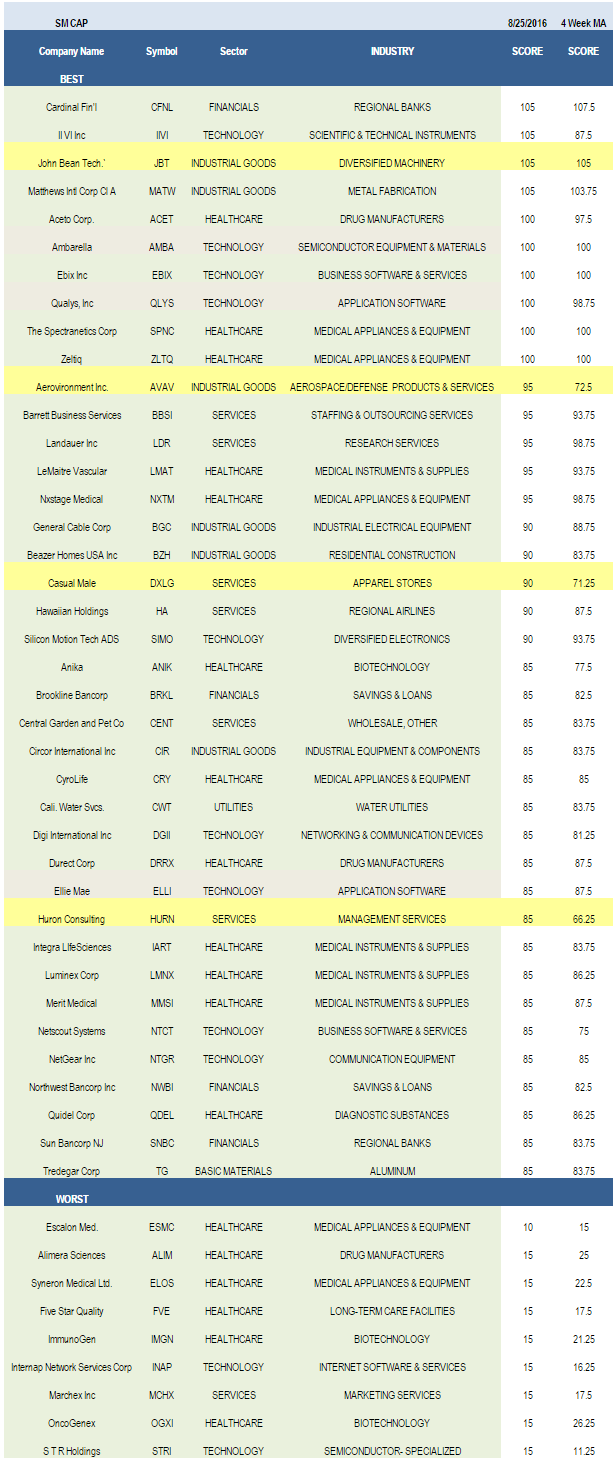

- The strongest small cap sector is industrial goods.

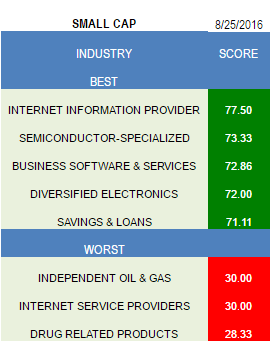

- The best small cap industry is Internet information.

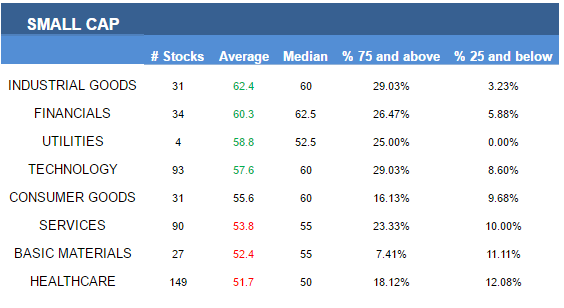

The average small cap score this week is 54.97. For comparison, the average score over the past four weeks is 55.57. The average small cap stock in our coverage is trading -24.41% below its 52 week high, 7.82% above its 200 dma, and has 8.24 days to cover held short.

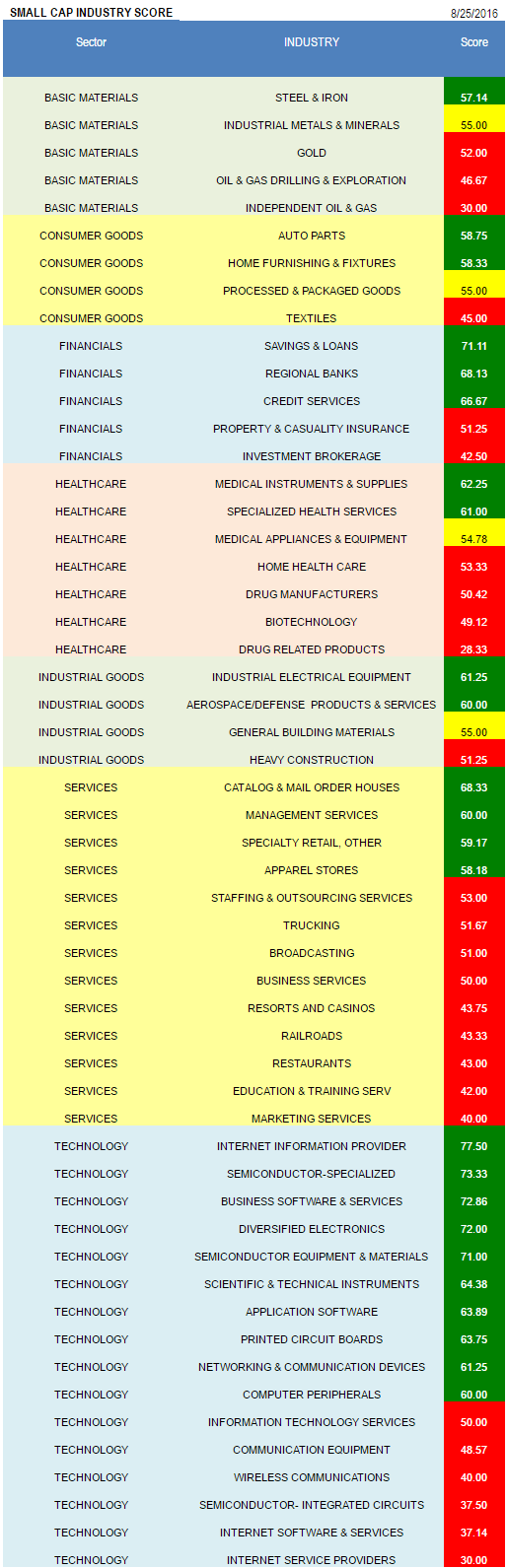

Industrial goods, financials, utilities, and technology score high in small cap. Consumer goods score in line with the average universe score. Services, basics, and healthcare score below average. In healthcare, trade up in market cap where possible.

The top small cap industry is Internet information providers (XOXO, BCOR). Specialized semi (QLGC, MPWR), business software (EBIX, NTCT, TSYS), diversified electronics (SIMO, MEI, KOPN), and S&Ls (NWBI, BRKL, PROV, FBC) can also be bought.

Only steel & iron (SCHN, HAYN, AKS) scores above average in basics. Auto parts (SRI) and home furnishings (ETH) score strong in consumer. S&Ls, regional banks (CFNL, SNBC, MBWM), and credit services (WRLD) are attractive in financials. Medical instruments (LMAT, MMSI, LMNX, IART, VASC, ICUI, ANGO) and specialized health (USPH, BEAT) offer upside in healthcare. The top industrial goods groups are industrial electrical (BGC, HOLI) and aerospace/defense (AVAV, TASR). Concentrate on catalogs (NSIT, FLWS), management services (HURN, NCI), and specialty retail (MED, HZO) in services. Focus on Internet information, specialized semiconductor, and business software in technology.

Disclosure: None.