Should You Sell NVDA Now?

If you are a Nvidia (NVDA – Research Report) investor, you probably know that the stock has been going through a bit of a rough patch lately. Shares plummeted last week, as a disappointing earnings report cost NVDA over $23 billion in market capitalization. Demand for chips to use in crypto mining has dramatically dropped as the prices of digital currencies have plunged.

So the key question becomes, should you cash out of Nvidia- and should you do so now? Or alternatively, if you are not currently invested, should you be tempted to buy on the dip?

Well there is never one clear answer. But there is a place we can turn to for advice. And most crucially, advice from experts with a proven track record of making smart investing decisions. Because if you are going to listen to someone, it may as well be from someone who actually knows what they are talking about.

Time for a Downgrade

That takes us to Craig Ellis of B Riley FBR.He is one of the top-ranked analysts on TipRanks.

How do we know this? We can see from his TipRanks profile that Ellis is ranked #30 out of over 5,000 Wall Street analysts.

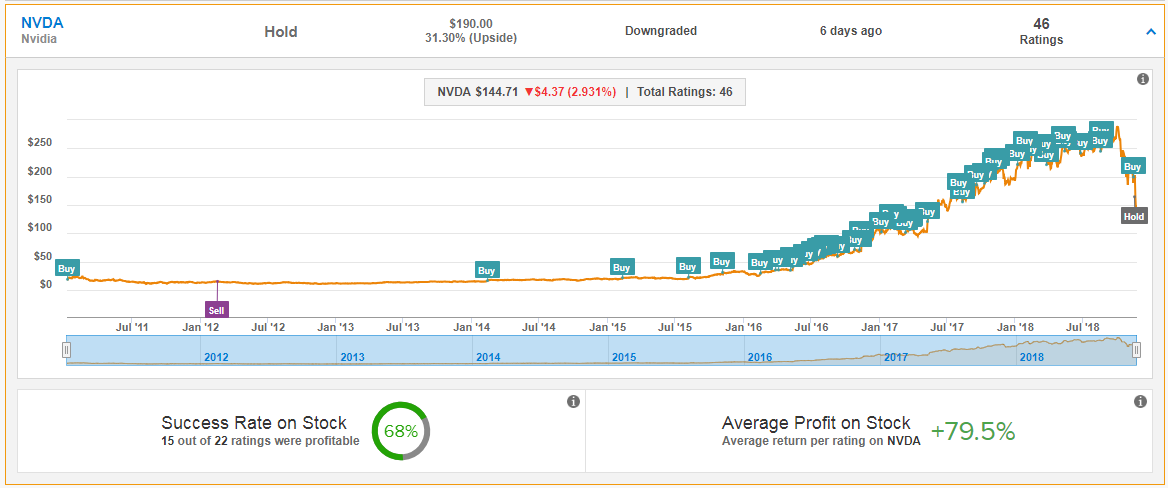

This is down to his very impressive success rate and average return- currently he is tracking a 21.4% average return per rating. Plus the ranking takes into account the statistical significance of his ratings i.e. the number of ratings an analyst makes. And as you can see below, Ellis’ track record on Nvidia specifically is even stronger.

For a long time Ellis has been a big fan of Nvidia. He upgraded Nvidia from Sell to Buy back in 2014, and has been bullish ever since. That is, until now. On November 16, Ellis downgraded the graphics-chip specialist from Buy to Hold.

(Click on image to enlarge)

True, that’s not a Sell rating but for an analyst, a downgrade is a very bearish signal nonetheless. Plus he slashed his price target from $240 to $190. Given the stock’s 27% fall in the last five days, even his reduced price target suggests 30% upside from current levels.

Why the bearish move?

Ellis explains “Against a broader SOX expectation for choppy multi-quarter trading with potential for a downward bias well into NVDA’s seasonally-soft F1Q, we move to the sidelines, looking for more attractive entry points or unmodeled upside catalysts to get more positive.”

He cited the following issues 1) the inventory problems affecting sales; 2) a slowing in data center growth; and 3) possible headwinds with multi-quarter volatility in the SOX chip index due to tariffs and the US-China trade war.

“In sum, we are very disappointed with the severity of the P1060’s inventory issues” Ellis told investors. The Pascal-based 1060 graphic cards are Nvidia’s mid-range previous generation offerings.

Top Needham analyst Rajvindra Gill (Track Record & Ratings) also noted the inventory issue: “The crypto hangover lasted longer than expected and led to an excess supply of mid-range Pascal GPUs” he wrote on Friday. “We estimate there was $600 million of excess … inventory in the channel or 12 weeks that needs to be purged.”

Overall Consensus

Right now Nvidia’s overall top analyst consensus is a cautiously optimistic Moderate Buy. This is with 17 bullish analysts vs 8 analysts on the sidelines (based on the last three months of ratings). Meanwhile the average analyst price target is at $231- 60% upside potential from the current share price. Again, when considering the upside potential, bear in mind that the stock is down 45% in the last three months.

(Click on image to enlarge)

View NVDA Price Target & Analyst Ratings Detail

Moreover, if we dig into the ratings a bit deeper, we can see that bearish sentiment is clearly on the rise. Over half the analysts who cover the stock slashed their price targets following the earnings report.

However, on a longer-term basis the picture is more bullish. And that’s where your investing strategy comes into play. Longer-term investors should note the following comment from Susquehanna’s Christopher Rolland (Track Record & Ratings): “While disappointing, the crypto-bubble is temporary, but secular growth opportunities like ray tracing and A.I. are not,” Rolland said.

He is sticking to his Buy rating but cut his price target to $210 from $230, and describes the inventory problem as “unimaginably bad.”

But, to put it bluntly, don’t expect a quick turnaround. “The stock will likely not bounce back right away, given the severity of the miss” said Morgan Stanley analyst Joseph Moore (Track Record & Ratings). Even though Moore has a Buy rating on NVDA, he cut his price target to $220 from $260 as “gaming road bumps” ended up turning into “mountains.”

Disclaimer: TipRanks is an independent cloud based service that measures and ranks digitally published financial advice. TipRanks' natural language processing (NLP) algorithms aggregate and ...

more