ShotSpotter Could Get Shot Down By Lockup Expiration

December 4, 2017 concludes the 180-day lockup period on ShotSpotter, Incorporated (SSTI).

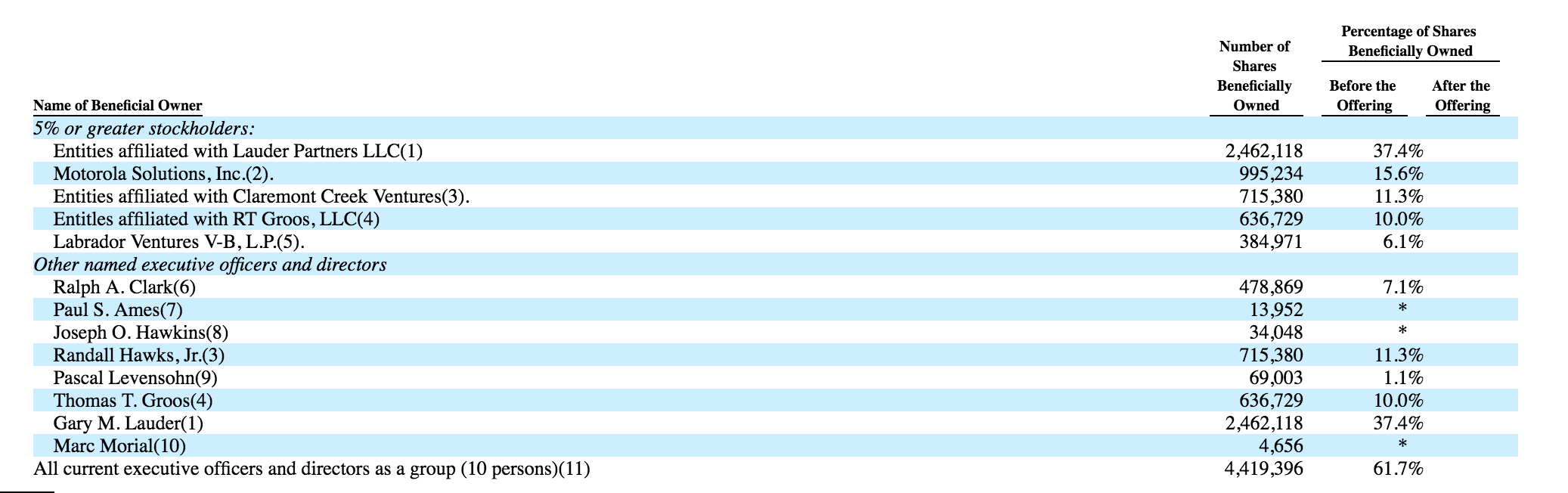

When the lockup period ends for SSTI, its pre-IPO shareholders, directors, and executives will have the chance to sell their approximately 4.4 million shares of previously restricted shares.

(Click on image to enlarge)

The potential for a sudden increase in stock available in the open market may cause a significant decrease in the price of ShotSpotter shares. Just 2.8 million shares of SSTI are currently trading.

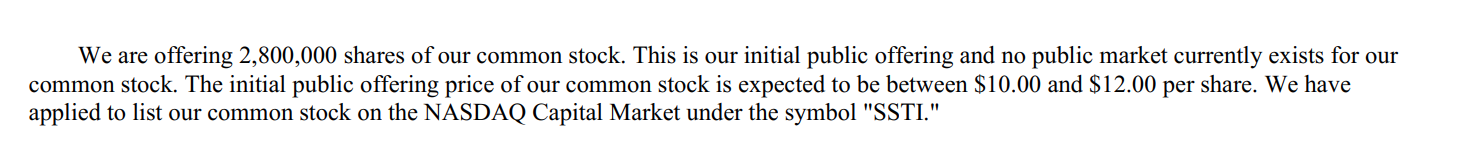

(Click on image to enlarge)

Currently SSTI trades in the $17 to $18 range, above its IPO price of $11 and higher than its first day closing price of $14.38 on June 7, 2017.

Business Overview: Provider of Gunshot Detection Solutions

SpotShotter is a leader in providing gunshot detection solutions that assist law enforcement in deterring gun violence. The software solution is offered on a SaaS-based subscription model. Currently, the company has clients in the United States, Puerto Rico, the U.S. Virgin Islands, and South Africa. Their product, ShotSpotter Flex works within urban, high-crime areas by detecting and locating gunshots and sending real-time alerts to law enforcement. The company also offers SST SecureCampus and ShotSpotter SiteSecure, which are designed to help security on universities, corporate campuses, and critical infrastructure and transportation centers. Their solutions transmit validated sensor data along with a recorded digital file of the triggering sound to the company’s Incident Review Center (IRC). There trained acoustic experts analyze the data and send it along to law enforcement typically in less than a minute. SpotShotter derives its revenue through annual subscriptions based upon deployment of their solutions on a per-square-mile basis. Through March 31, 2017, SpotShotter had 74 public safety clients covering approximately 450 square miles in 89 cities across the United States, including four of the ten largest cities.

Financial Highlights

SpotShotter reported the following financial highlights for the third quarter ended September 30:

-

Quarterly revenues of $6.8 million, up 72% from $4.0 million in same period in 2016 and up 17% from $5.8 million in the second quarter of 2017.

-

Gross margin was 50%, up from 40% in same quarter in 2016.

-

Added 50 square miles of new “go-live” coverage during the quarter; on a net basis, added 17 square miles of “go-live” coverage (compared to 11 in the same period in 2016).

-

33 discontinued square miles were directly related to the recent hurricanes in Puerto Rico and the U.S. Virgin Islands.

-

Raising full-year 2017 revenue guidance to $23.0 million.

-

Setting revenue guidance for full-year 2018 to a range of $30.0 million to $32.0 million.

-

All outstanding indebtedness has been repaid. ShotSpotter is now debt-free.

Management Team

President and CEO Ralph Clark has served SpotShotter since 2010. His previous experience comes from senior positions at GuardianEdge Technologies, Adaptec, IBM, Goldman Sachs, and Merrill Lynch. Mr. Clark holds a B.S. in economics from the University of the Pacific and an MBA from Harvard Business School.

CFO Alan Stewart has served in his position since February 2017. He previously served as Managing Director at RA Capital Advisors. His other experience comes from positions at Epsilon Systems Solutions and FIT Advisors. Mr. Stewart was selected as San Diego Business Journal's CFO of the Year in 2007 and again in 2013. Both awards were in the large private business category. Mr. Stewart served over ten years as a submarine nuclear engineer in the United States Navy. He received his B.S. in Oceanography, with distinction, from the U.S. Naval Academy and his M.B.A. from Harvard Business School.

Competition: Thales Group, Rafael Advanced Defense, and Raytheon

ShotSpotter notes in its SEC filing that its primary competitors are Thales Group, Safety Dynamics, Raytheon (RTN), and Rafael Advanced Defense Systems. Morningstar lists SpotShotters peers as SAP (SAP), Adobe (ADBE), and Salesforce.com (NYSE:CRM).

|

Market Cap (mil) |

Net Income (mil) |

P/B |

P/E |

|

|

SpotShotter |

$167.0 |

($8.0) |

10.9 |

n/a |

|

SAP |

$134,318 |

$3,700 |

4.8 |

31.5 |

|

Adobe |

$89,380.0 |

$1,592.0 |

10.9 |

57.0 |

|

Salesforce.com |

$76,347.0 |

($80.0) |

9.0 |

n/a |

|

Industry Average |

$2,888.0 |

$298.0 |

7.3 |

128.2 |

Early Market Performance

SpotShotter Incorporated’s IPO priced at $11 per share, at the midpoint of its expected price range of $11 to $13. The stock closed on the first day of trading at $14.38. Since then, the stock reached a low of $10.01 on August 2. But it has climbed steadily since then reaching a high of $19.65 on November 9. The stock currently trades in the $17 to $18 range.

Conclusion

We believe that SSTI's previously restricted shareholders will be eager to cash in on some of their gains - SSTI has a return from IPO of nearly 59% - when SSTI's IPO lockup expires on December 4, 2017. This group of previously restricted shareholders includes five corporate entities and ten individuals. If even a portion of these shareholders elects to sell some of their previously restricted shares, the marketplace could be flooded and SSTI's share price could experience a sharp, short-term dip.

We recommend that risk-tolerant investors establish a short position in SSTI ahead of the company IPO lockup expiration on December 4, 2017. Interested investors should cover these positions late in the trading session on December 4th or during the trading session on December 5th.

Disclosure: I am/we are short SSTI.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more