Sell Kansas City Southern

U.S. GDP grew at 2.9%, twice the pace set in Q2. The results deprived presidential candidate, Donald Trump, of a chance to gloat that the economy was in recession. However, recessionary signs are everywhere. One could look at declining rail traffic as evidence. For the first 40 weeks of 2016 total carloads for the U.S. and Canada were down Y/Y by 6.9% and 5.7%, respectively. Less materials being shipped cross country means less revenue for railroads like Kansas City Southern (KSU). That said, it will likely get worse for Kansas City Southern.

Revenue In Decline

Railroads are experiencing revenue declines across the board, particularly those exposed to Coal. Kansas City Southern is not exposed to Coal so its revenue decline has not been as pronounced as that of Norfolk Southern (NSC) or CSX (CSX).

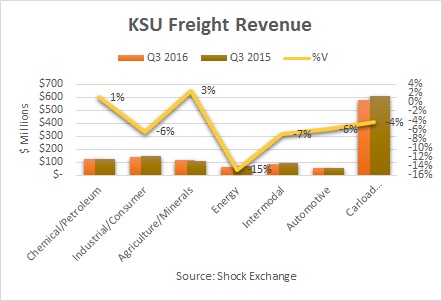

Q3 freight revenue fell 4% Y/Y, a slight erosion vis-a-vis the 3% decline the company experienced in Q2. Of the six product segments, only two -- Chemical/Petroleum and Agriculture/Minerals -- experienced an uptick in revenue. The largest decliners were Energy (down 15%) and Automotive (down 6%) and Industrial/Consumer (down 6%). Energy was hurt by lower demand for oil and frac sand; I expect this segment to rebound in Q4 due to the rise in the rig count and overall drilling activity. Total carloads and revenue per carload also declined Y/Y by 4% and 1%, respectively.

Going forward the push/pull between Chemical/Petroleum and Industrial/Consumer could be the narrative. Chemical/Petroleum (21% of revenue) grew 1% on the strength of robust plastics volume and lower prices for commodities. Meanwhile, Industrial/Consumer (24% of total revenue) fell 6% Y/Y as paper volume fell due to a competitive trucking market and softness in the global economy; metals and scrap volume fell due to a customer's plant shut down. Revenue from this segment also fell 6% in Q2 and will likely be a major headwind going forward.

EBITDA Margins Could Come Under Pressure

Kansas City Southern has best-in-class EBITDA margins at 46%. Margins were flat compared to the year-earlier period, despite the decline in revenue. Compensation expense ticked up 3%, but the company also received a reimbursement for Mexican fuel excise tax (3% of revenue) that did not exist in Q3 2015. EBITDA fell 5% Y/Y and to stem the erosion Kansas City Southern will likely have to cut costs going forward. Again, companies like CSX and NSC who have major Coal exposure have begun cost containment efforts; Kansas City Southern has been rather spoiled. Compensation, purchased services and materials expense represent a combined 42% of revenue. I expect management to cut into these expenses by the first half of 2017 if revenue continues to fall.

Conclusion

It is difficult to defend KSU when its top line continues to fall. With an enterprise value of $11.7 billion, it trades at 10.2x run-rate EBITDA which is outside my 8.0x range. KSU is a sell.