Sell Gold And Invest In These U.S. Industries

Low oil prices are stealing all the headlines right now, and the media has decided to focus only on the negatives. However, in America there are strong headwinds building that will only propel the American economy higher. Investors would be wise to invest in these sectors and avoid gold.

It’s no secret that gold is a long bet on fear.

And the fear trade works, until it doesn’t — what that means is that none of the major market selloffs have led to an all out stock market collapse. Eventually cooler heads prevail and the market moves higher.

Ever since 2004, gold has been transformed into a speculative asset. Ten years ago the World Gold Council (formed by mining companies) pushed for the creation of a gold ETF, the SPDR Gold Trust (NYSEARCA:GLD).

The GLD allowed anyone and everyone to buy and sell gold. And after the GLD was created, gold traded above $500 an ounce for the first time in more than 20 years.

There’s hundreds of miners out there trying to find new gold sources, while another few hundred companies are working feverishly to extract as much gold as possible out of the mines they do have.

However, gold isn’t consumed, it merely changes hands. Yet, we continue to mine more and more of it. When you think about other commodities, they are valuable because they need to replenish — think: coffee, oil, beef, corn, wheat, etcetera.

Gold is only valuable because other people think it is valuable. Or think it will be more valuable in the future. However, after a tremendous run in the price of gold, the market finally came to its senses in 2012. Gold peaked at over $1,900 and at a time when the GLD was the largest equity holding in 401ks, behind only Apple (NASDAQ: AAPL).

As a long-term investment, it’s hard to see how gold has a place in any portfolio. Throughout the '80s and '90s, gold did nothing. It provided investors with no income or return and was literally just dead weight.

Warren Buffett has long questioned the usefulness of gold. One of his most famous quotes goes something like this,

“Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

However, many investors still like gold as a fear play. So what’s an investor to do during times of fear?

Put their money in a mattress and invest in a decent home security system? Chances are, if you’re thinking like that, you’re already heavily invested in gold and nothing I say will change your mind.

On the other hand, bonds have long been low volatility, steady performers during times of economic uncertainty. Yet, you sacrifice returns for not being invested in the stock market.

Owning low-beta stocks (meaning low correlation to the stock market) is an underrated alternative to owning bonds.

Two places that offer low-beta returns are unexciting consumer staples and utilities. Think: Hershey Co (NYSE: HSY) and General Mills (NYSE: GIS) on the consumer goods side, and Southern Co (NYSE: SO) and NextEra Energy (NYSE: NEE) when it comes to utilities.

Since gold bottomed out around $250 an ounce in 1999 it’s had an impressive run. But including dividends, all four companies above have outperformed gold over the last fifteen years.

That’s just a couple things to think about if you find yourself tempted by gold. But we shall worry about utilities and low volatility names when things look more dire because, right now, there’s better things to own.

If I owned any gold I’d be selling it and buying the U.S. stock market. The U.S. economy is looking really good and that’s bad news for gold bulls.

Last week, the University of Michigan consumer sentiment survey revealed that consumer confidence is at the highest level since December 2006. The indicator jumped to 93.8, rising the most since 2011, and crushing expectations of 89.5. It’s quite likely that low oil prices is fueling this exuberance.

The shale revolution, helped by the U.S.’s push for energy independence and the easy money Fed policy, has done its job. Oil prices have plunged. But it has the media and investors up-in-arms.

Why? I’m not sure. Low oil is great for the consumer and the American economy. Low oil prices will fuel consumption and increase economic growth.

Here’s what’s going to happen: First, the American economy will continue to strengthen on the back of low oil. Meanwhile, certain overseas countries will continue to struggle. That means international investors will flock to the U.S.

Countries like Japan and Europe will use easing to try and jumpstart their economies, which depreciates their currency, strengthening the dollar even more.

Then, next year, the Fed will likely raise rates, driving even more investment in the U.S. markets. The dollar continues higher.

All this time, the strengthening dollar pushes gold lower.

So what’s the play for investors?

Although gold won’t be worth owning over the next couple years, that doesn’t mean I’m out shorting the GLD. Nor is buying an inverse ETF like the ProShares UltraShort Gold (NYSEARCA:GLL) the answer.

The lesson is; it’s risky to own gold or any precious metal here and you’d be doing your portfolio a disservice not investing in companies that will benefit from a strong dollar, low oil prices, rising interest rates and a strengthening U.S. consumer.

Domestic airlines and regional banks look to be two areas of particular interest. They both benefit from the strong dollar as they do most of their business in the U.S., not to mention being helped by low oil and higher interest rates.

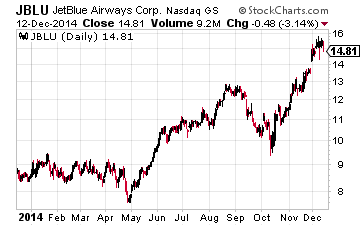

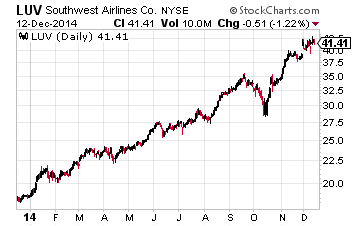

On the airline side, two of the best regional operators are JetBlue Airways (NASDAQ: JBLU) and Southwest Airlines (NYSE: LUV). Both have a small portion of their jet fuel hedged, meaning they will enjoy the lower oil prices.

JetBlue trades at a forward P/E (price-to-earnings ratio based on next year’s earnings estimates) of just 13. Yet, it’s expected to grow earnings an impressive average annual rate of 28% for the next half decade. Southwest is just as impressive, trading at a forward P/E of 16 and expected to grow earnings at an annualized 34%.

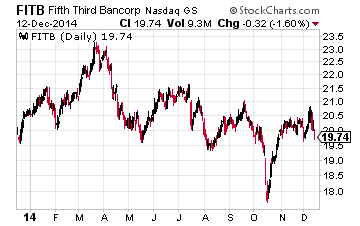

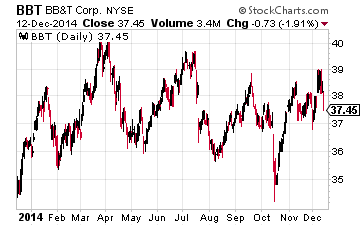

Then on the bank side, a couple top picks are Fifth Third Bancrop (NASDAQ: FITB) and BB&T Corporation (NYSE: BBT). Both trade at reasonable price-to-book ratios of around 1.3, while their returns on equity are 12.5% and 9.5%, respectively.

On the interest rate side, regional banks get the majority of their revenues from loans — not from advising or trading — so these guys will benefit more than your larger investment banks.

Assuming the apocalypse doesn’t come, the best trade today is to cash in your gold bars and enjoy the strengthening U.S. economy by owning strong American companies.

Marshall Hargrave is the managing partner of Bridgewater Investments LLC