Royal Dutch Shell: 6.8% Dividend Yield With Room For Growth

Oil prices are gradually on the rise, after bottoming out in 2016. Oil prices sank below $30 per barrel in the U.S. last year, but recently reclaimed $50 per barrel. Brent crude, the international benchmark for oil prices, has climbed back to $54 per barrel.

In turn, this has lifted share prices across the oil and gas industry. But investors can still find Big Oil stocks trading at a discount, with high dividend yields as well. For example, Royal Dutch Shell (RDS-A) (RDS-B) offers a dividend yield of approximately 6.8%. Shell is one of 295 stocks with a 5%+ dividend yield.

You can see the full list of established 5%+ yielding stocks by clicking here.

And, Shell is the highest-yielding integrated oil and gas major. Its dividend yield is several percentage points above the U.S. integrated majors Exxon Mobil (XOM) and Chevron (CVX). Shell has taken several steps to secure its hefty dividend payout, including selling off unwanted assets and cutting costs. Now that oil prices are on the rise, it appears Shell’s nearly 7% dividend yield is secure, making the stock an attractive pick for income investors.

Business Overview

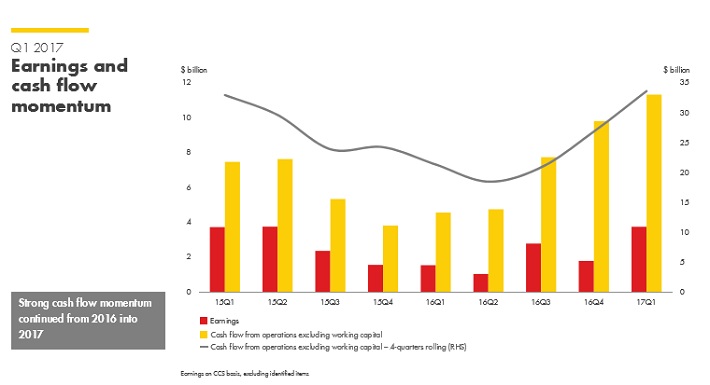

The huge decline in oil and gas prices took Shell’s exploration and production business down along with it. This is referred to as the upstream side of the integrated business model, which is highly reliant on supportive commodity prices. Due to falling commodity prices, Shell’s core earnings declined 8% in 2016, to $3.5 billion. The upstream segment posted a net loss of $2.7 billion for the year. Things have improved substantially in 2017. The company has seen a major rebound over the past several quarters. Cash flow is rising at a high rate, which is a credit to Shell’s renewed focus on efficiency.

Source: Q1 Earnings Presentation, page 7

The good news for integrated majors is that they also have downstream businesses, which include refining and marketing. Refining actually benefits from sharp downturns in oil prices, which lowers feedstock costs and boosts refining margins. For example, Shell’s downstream segment netted a $7.2 billion profit in 2016. Strong downstream results helped Shell generate $21 billion of operating cash flow in 2016, which allowed it to keep its dividend intact. Plus, now that commodity prices are rising, Shell’s upstream performance has notably improved in 2017. Net earnings more than doubled last quarter, to $3.8 billion. The upstream segment went from a $1.4 billion loss in the 2016 first quarter, to a $500 million profit last quarter. Overall, cash flow from operations soared to $9.5 billion in the first quarter, up from $700 million.

Growth Prospects

In addition to rising oil and gas prices, Shell’s future growth will be based on new projects. Shell has conducted an aggressive round of new projects since 2014, which are expected to add $10 billion of operating cash flow by 2018, by adding more than 1 million barrels per day of new production. The combination of reduced debt, lower capital spending, and higher production, should raise cash flow enough to comfortably support the dividend. Indeed, bringing together divestments along with new project completions, acts as a spring-board for cash flow generation. Shell is becoming leaner and more efficient.

Source: Q1 Earnings Presentation, page 13

At the same time, ramping up new oil and gas fields helps transform projects from a use of cash to a source of cash.In addition to new projects, Shell’s cash flow growth will be boosted by asset sales and efficiency gains. Shell has completed or announced $20 billion of divestments to date, with more to follow. The company intends as much as $30 billion of additional divestments through 2018. The assets being sold off are considered non-critical to the company’s future growth strategy. The divested assets have been located in the U.K. North Sea, and oil sands mining, which Shell viewed as generally less attractive.

Source: Q1 Earnings Presentation, page 11

Moreover, Shell is reducing costs to maintain cash flow levels. In the first quarter, capital spending was reduced by 32%, or $2.1 billion, from the previous quarter. Operating expenses were down 6.2% sequentially. Now that Shell has become free cash flow-positive, the company is covering its dividend with free cash flow each quarter. This is a major step in the right direction as far as Shell’s dividend is concerned.

Dividend Analysis

Shell currently pays a quarterly dividend of $0.94 per share, which works out to $3.76 per share annualized. Based on its May 22nd closing price, the stock has a current dividend yield of 6.8%. This is a highly attractive yield. The S&P 500 Index, on average, yields just 2%.

Many of the U.K.-based oil majors, such as Shell, provide dividends well above their U.S.-based peers. Exxon Mobil and Chevron currently have dividend yields of 3.7% and 4.1%, respectively. The trade-off is that Exxon Mobil and Chevron raise their dividends regularly. They are both Dividend Aristocrats, which are stocks in the S&P 500 with 25+ consecutive years of dividend growth.

To see the entire list of 51 Dividend Aristocrats, click here.

Integrated majors based in Europe tend to have higher yields than U.S. majors, but with less frequent dividend growth. Shell’s last dividend increase came in 2014. Another high-yielding international oil major is BP (BP), which has a 6.6% dividend yield.

Click here to see an in-depth analysis of BP’s dividend.

That said, Shell could have room for a dividend increase in 2018, depending on what direction oil prices take over the next several months. On the plus side, Shell has repositioned itself to not just capitalize when oil prices are rising, but to also maintain its dividend if oil prices decline again. Shell wants to become more resilient through all stages of the oil price cycle. This will be key for Shell to cover the dividend payment in good times, and bad. It has made notable progress.

Source: Q1 Earnings Presentation, page 10

In addition to cutting capital spending and operating expenses, Shell has also curtailed share buybacks for the time being, to help add even more protection to the dividend. These actions have had tangible results. For example, Shell has become free cash flow positive over the past year. Free cash flow was $5.2 billion last quarter, at an average Brent price of approximately $54 per barrel. Shell’s dividend cost $2.7 billion last quarter, which resulted in a free cash flow payout ratio of 52%. And, last quarter was the third in a row in which Shell’s free cash flow more than covered its cash dividend. With Brent crude hovering near $54 in the current quarter, it is likely the second quarter will be the fourth in a row.

Final Thoughts

Over the past year, chasing high-yield oil stocks has been a lot like walking through a minefield. Massive share price declines caused elevated dividend yields across the energy sector. But in many cases, tantalizingly-high dividend yields were nothing more than a mirage. Several companies, strapped for cash and fighting for survival, had to cut or eliminate their dividends entirely. Fortunately, the best-in-class operators, such as Royal Dutch Shell, maintained their hefty dividends through the downturn. As a result, as long as oil prices do not fall beneath their 2016 lows, it appears Shell’s dividend is secure.

For an even higher dividend yield in the energy sector (9%), click here.

more