Rev Group Driving Downward Ahead Of IPO Lockup Expiration

Event Overview

The 180-day lockup period for Rev Group (NYSE: REVG) is scheduled to expire on July 26, 2017.

The company's pre-IPO insiders will then have the opportunity to sell 49.32M shares that are currently restricted from sale. This represents 77.4% of the total shares outstanding. With such a large percentage of the shares becoming available for sale, the event could lead to heavy selling activity and potentially push share price down.

(Click on image to enlarge)

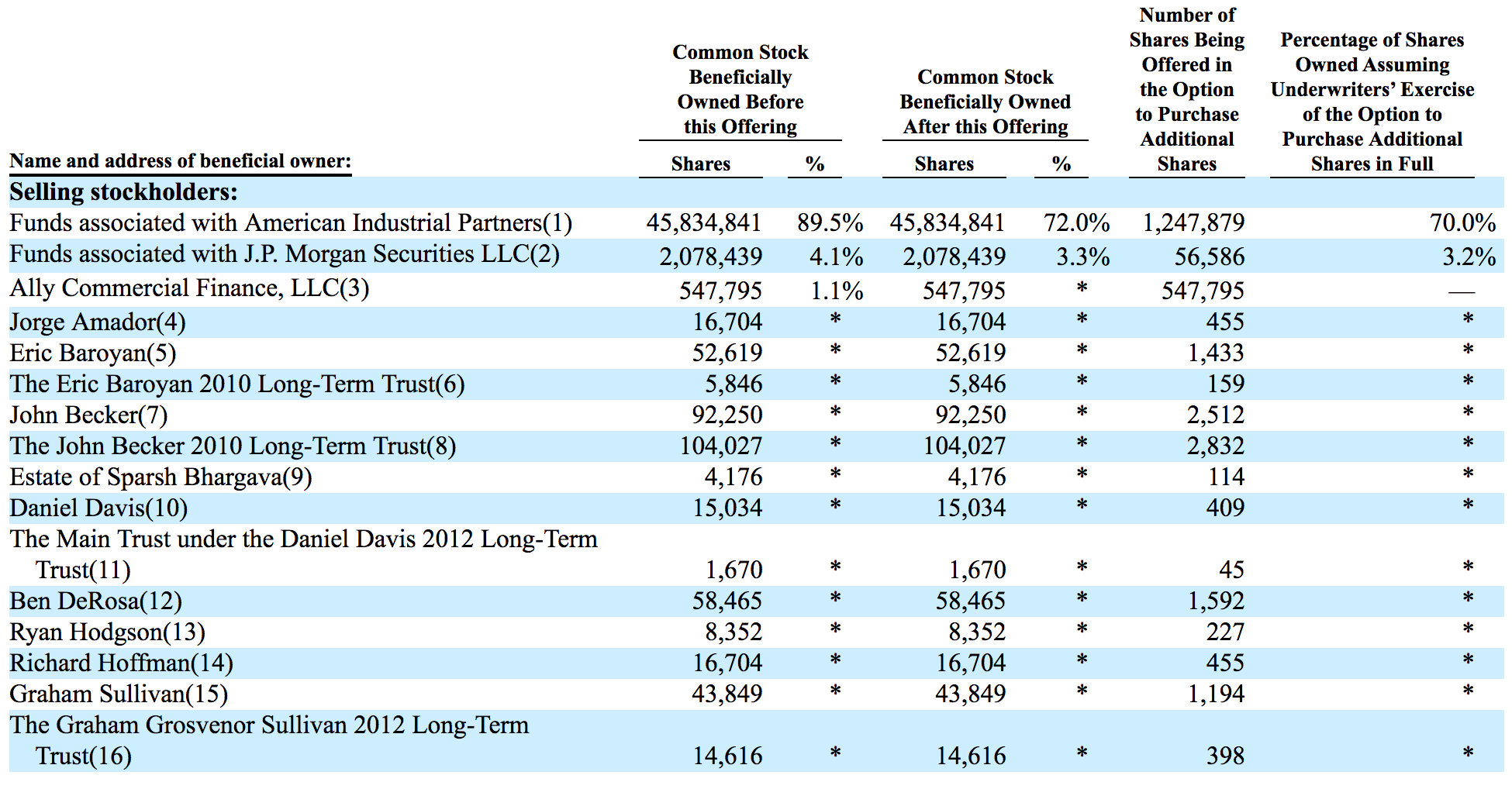

The company's largest shareholder is American Industrial Partners (AIP), an operations and engineering-focused PE firm based in New York, NY. AIP owns 70% of the total shares outstanding. We expect this PE firm will be eager to cash in on gains so that they can move on to other projects. This presents a sell or short opportunity to savvy investors who take a position ahead of the lock-up expiration.

(Click on image to enlarge)

(S-1/A)

Business Summary

Rev Group manufacturers, distributes and designs specialty vehicles and after-market parts and services throughout the US. The company manufactures vehicles for essential needs such as ambulances, school buses, mobility buses, municipal buses and fire trucks. It also manufactures luxury vehicles such as RVs and industrial vehicles. Customers include: municipalities, government agencies, private contractors, consumers and industrial and commercial end users. In 2016, the company sold 17,300 units and had an installed base of vehicles in operation of 240,000.

Management Highlights

Tim Sullivan serves as chief executive officer and a director of Rev Group, positions he has held since Aug. 2014. He previously served as the CEO and chairman of Gardner Denver Inc. from 2013 to 2014 and the CEO and chairman of Bucyrus International Inc. from 2000 to 2011. Sullivan graduated with his Bachelor of Science in business administration from Carroll University and his MBA from Arizona State University.

Dean Nolden is the chief financial officer of Rev Group and has served in that position since Jan. 2016. Previously, he worked at The Manitowoc Company Inc. from 1998 to 2016, holding numerous positions in the company's finance department. Prior to that, Nolden worked for eight years in public accounting at PriceWaterhouseCoopers LLP. He graduated from the University of Wisconsin-Madison with a Bachelor of Business Administration in accounting and from Marquette University with an MBA.

IPO History and Financials

Rev Group made its market debut on January 26, raising $275M through the offer of 12.5M shares. Shares were priced above its marketed range of $19 to $21 at $22 per share and then increased 20% on the first day of trading. Shares have stayed relatively flat since then and are currently shares are trading at $26.14 (at close of market session 7.13).

The company reported strong earnings on June 6. Highlights included:

- Quarterly revenue of $545.3M, a 14% increase in compared to same period the prior year.

- Net income of $6.8M, a decline of 15% which was largely due to the costs associated with early extinguishment of debt

- Adjusted Net Income of $19M, 33% higher than second quarter 2016

Additionally, the company completed two acquisitions which strengthened its product portfolio and upwardly revised guidance for the FY 2017. Rev Group expects consolidated net sales in the range of $2.3 to $2.4 billion and net income in the range of $36 to $39.

Conclusion: Short Opportunity Ahead of Event

Rev Group has performed well since its IPO and is up more than 10% from its upwardly revised market place. We believe PE firm, AIP, and other insiders are likely eager to sell shares, capitalize on gains, and move on to other investments.

With the opportunity to sell fast approaching, we recommend investors consider selling and/or shorting shares before the lock-up expiration date.

Our firm's detailed research on the event is here, including optimal holding times.

Disclosure: I am/we are short REVG.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more