Research Report: Brazil Resources

Brazil Resources, Inc. was founded by Amir Adnani and started trading on the TSX Venture Exchange in 2011.

Mr. Adnani is an entrepreneur and company builder in the resource sector. Mr. Adnani has a proven track record, having taken Uranium Energy Corp. from concept (2005) into initial production (2010) in 5 years, today UEC is a leading low-cost ISR uranium company, listed on the New York Stock Exchange, boasting the former US Secretary of Energy as its chairman and top shareholders such as BlackRock, JP Morgan and Hong Kong billionaire Li-Ka Shing.

His second company, Brazil Resources, Inc. is a gold company with the main focus on the acquisition and development of projects in emerging producing gold districts throughout the Americas while at the same time diversifying into safe jurisdictions like the US and Canada. Currently, Brazil Resources is advancing its Cachoeira and São Jorge Gold Projects in northeastern Brazil and its Whistler Gold-Copper Project in south-central Alaska.

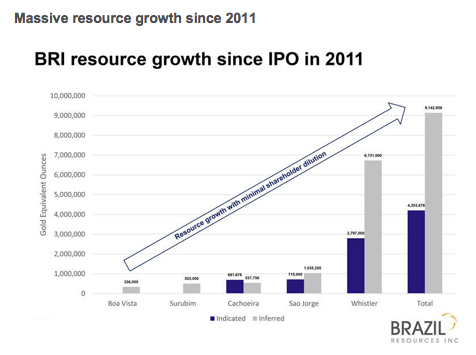

During gold´s bear market the company managed to create an impressive global gold resource beyond 10 million ounces through acquisitions and organic growth. Brazil Resources Inc. was able to acquire several potentially world-class gold projects at fire sale prices from struggling peer-group companies during the recent four-year mining recession. Presently, there are 3.2 million ounces indicated and 7.0 million ounces inferred. Most of the acquisitions have been realized near the bottom of the gold cycle.

With their founding shareholder and famous strategic partner Brasilinvest Group (one of the top 50 private groups in Brazil) the company should be able to profit form the ideal conditions in Brazil. The gold price in Reals is near all time highs and the uptrend is very likely to continue. Due to the current economic crisis the second largest emerging market in the world desperately seeks more international investments. Brazil already hosts a large number of public & private gold companies making it an excellent jurisdiction to consolidate. And at less than 1% Brazil charges a significantly lower royalty rate than other jurisdictions.

In summer of 2015, at the bottom of the cycle, Brazil Resources acquired the very large Whistler Project in Alaska which added nearly 2.8 million indicated gold ounces to the company.

On top of its outstanding gold projects the stock includes a Uranium optionality with its Rea Uranium Project (with joint venture partner AREVA) in the western Athabasca Basin in northeast Alberta, Canada.

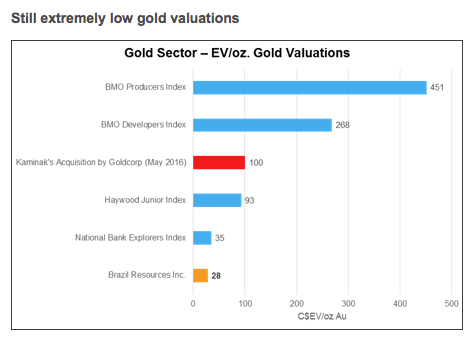

For investors, who want to control ounces in the ground (e.g. senior gold produces) BRI is still very undervalued compared to other development companies. In order to maximize their gains from a rising gold price senior gold producers are going to pay a much higher price in the future.

The value of mergers and acquisitions is starting to soar already. The average paid in 133 transactions in the three months to June was 64 USD an ounce of gold equivalent in the ground, up from 36 USD in the first quarter of 2016, as buyers factor in better long-term price expectations. Currently the market is paying up to 451 CAD per ounce for producing companies. For developers the recent Kaminak takeover by Goldcorp for example represented a 40% premium over the 20-day volume-weighted average share price and was settled at 100 CAD per ounce. This gives a good idea about the potential of Brazil Resource´s future valuation. Currently the market does not value ounces in the ground as the precious metals sector is just coming out of its nastiest bear-market in history. If gold breaks out above 1,500 USD this will change. In the latter stage of the new bull market ounces in the ground will be much more valuable and senior producing companies who need to increase their reserves will desperately bid up the price.

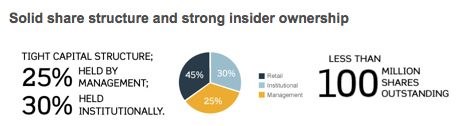

Brazil Resources Inc. stands out with a solid share structure due to strong management and exceptional insider ownership of over 30% as well as institutional ownership of 30%. KCR Fund is the largest shareholder, their investment in BRI is currently worth over 30 million CAD. Marin Katusa and Doug Casey are the largest shareholders in KCR Fund and are also personally shareholders of BRI. The 2nd-largest shareholder is the founder and chairman himself, Mr. Amir Adnani. As well, Rick Rule and Sprott Asset Management have been early stage investors and are strong supporters. Rick is a large shareholder of the company and believes that the stock price will go higher. He recently said that he likes the quality of the people running Brazil Resources and he is betting on Amir Adnani personally. He continued: "The prospect of a large-scale discovery on a property that's purchased cheaply and husbanded prudently . . . is the reason that people in bear markets back high-quality entrepreneurs to see these types of projects come to fruition. And that's what can really lead to significant share price escalations." During the four-year bear-market and despite its aggressive growth strategy the management was able to acquire world class assets with minimal shareholder dilution. With Rick Rule, of Sprott Asset Management, Doug Casey, chairman of Casey Research and Marin Katusa, of Katusa Research, through their fund, this promising gold stock has gained a lot of attention and is well positioned for further acquisitions and significant stock price gains.

Brazil Resources started with as little as 300,000 ounces and has now grown into an impressive and massive 13,5 million gold equivalent resource. As the graphic shows with each acquisition the management was able to add a substantial amount of indicated and inferred ounces to the company.

Pará is a state in the north of Brazil. The capital and largest city is Belém. Pará is the most populous state of the northern region with over 7.5 million people. It is the second largest state of Brazil. The mining sector represents 14% of the Gross Domestic Product (GDP) of the State, originated mainly from the extraction of iron, bauxite, manganese, limestone and tin, as well as gold. Within the "Gurupi Gold Belt" Brazil Resources Inc. owns four projects encompassing 3.9 million ounces of gold. So far they have been outlined approximately 1.5 million ounces of "indicated" (clearly-defined) gold and a further 2.42 million of "inferred" ounces (meaning that additional drilling is needed to more clearly define this resource estimate). In this area a few significant gold deposits have been discovered over the last few decades so it would be of no surprise if Brazil Resources is able to add more ounces in the future. Some of the main advantages are easy access by paved highway, grid power and water. As well there is workforce available in the city of Novo Progresso. The ore is sitting close to the surface and therefore open pitable. The corporate tax rate in Pará State is only 15.25% compared to 34% in other states.

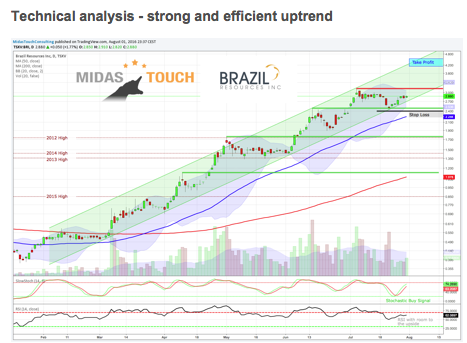

Trend-following works, so buy what´s going up and sell what´s going down. Pretty simple, yet very hard to do for many traders and investors. Most of them are emotionally and psychologically hardwired to do the exact opposite. Yet we all know what´s simple will work. So let the market tell you what to do. If the market is mostly going up, then one should be mostly long. If the market is mostly going down, one should be mostly short. If the market is mixed, one should have a strong hedged position reflective of the overall market. BRI has undoubtedly been one of the top performers since mid January in the mining sector. The stock is in a strong and efficient uptrend and has recently reached a short-term top at 3.16 CAD. Since then the stock reacted back down to the last breakout level and former resistance at 2.44 CAD. It looks like the stock is currently within a sideways consolidation similar to the one in May. The 50-MA (2.24 CAD) is rising and should be a massive support zone in case the stock unexpectedly moves into a larger correction. Yet the next support zone already sits around the early June highs at 2.49 CAD. The uptrend channel is well defined and currently at 2.73 CAD. On top the lower Bollinger band is rising and supports the stock at 2.53 CAD.

If the stock manages to break out above 3.15 CAD it should quickly advance towards around 4.00 - 4.50 CAD. That gives us an upside potential of 30 - 50%. To protect our capital we have to put in a stop loss below the recent low at 2.40 CAD (end of the day stop). Expect some breakout attempts around 3.00 - 3.15 CAD for the next couple of days before we should witness the decisive breakout above 3.16 CAD.

- Big drop in gold price (very unlikely that gold will move below $1,200 again)

- Increased capital requirements for further project development

- Political risk in Brazil (e.g. impeachment.. this could be a positive factor too as the recent events in Brazil have caused the currency to drop and hence making it very attractive to buy and develop gold projects.. also impeachment of president has no barring on mining code and mining projects)

- Moderate financing risk (in the past Amir Adnani was always able to raise capital if needed. BRI has 9 million CAD on hand and a current annual burn rate of less than 3 million CAD)

- Stock already performed well (which is logic due to the trend change in the gold market; if your gold-stock did not perform in the last six months something is wrong..)

Take advantage of the ongoing consolidation during the next couple of days and weeks to initiate a first position.

Buy Brazil Resources Inc. (currently 2.88 CAD)

Stop Loss: 2.40 CAD (you´re risking 16.6% of your position)

Profit Target: 4.50 CAD

Timeframe: 1 - 8 months

Risk (0.48 CAD) / Reward (1.62 CAD) = 1 : 3,37 (pretty good ratio)

Official Corporate Presentation

Kitco News: Interview with Amir Adnani

Commodity-TV Extended Interview with Amir Adnani

Future Money Trends Interview with Amir Adnani

If you would like to get regular updates on our gold model, gold and ...

more