Refuting A Bearish Argument: The Economy Is Accelerating

Record Highs In Tech, Small Caps, And Microcaps

I have been very bullish on stocks recently which has been the correct position to take as the S&P 500 has broken out of its recent tight range. It was up 0.07% on Tuesday. Tuesday was a microcosm of the recent action since the S&P 500 was barely up while the Nasdaq and the Russell 2000 were up 0.41% and 0.68% respectively. The Russell 2000 is now up 8.41% year to date. The Nasdaq is up 10.64% year to date. The S&P 500 is only up 2.81% year to date. The microcaps, the small caps, the Nasdaq, and tech are all at record highs. This means the breadth of the market is strong, indicating the S&P 500 should make a new record high itself. I will claim victory on my bullish call after it does.

Since tech is leading the market higher, let’s review the chart below which shows the correlation between the tech sector’s earnings growth and the overall market’s earnings growth. As you can see, generally when there’s a cyclical improvement, the tech sector’s EPS growth outperforms the overall market. This explains the sector’s current outperformance. It’s great news to see the market leaders, leading us to record highs.

(Click on image to enlarge)

Let’s Here The Bearish Case

I have been bullish on the economy partially because of the weekly ECRI index. As you can see, its bullishness in early 2018 correctly predicted the great Q2 GDP growth that the economy is on pace to achieve. The chart below shows after a few weeks of acceleration in early May, the leading index has decelerated again. Last week it fell from 3.5% growth to 3%.

Interestingly, even though I’ve used the ECRI data as justification for my bullishness, ECRI is actually bearish on the economy which I’d argue is the wrong position since GDP growth is expected to be 3.7% in Q2 and earnings guidance updates are better than average. ECRI hasn’t changed its bearishness since late 2017 when it went correctly bearish as Q1 saw a decline in GDP growth. I think the best time to review bearish opinions is when indexes are hitting record highs because it provides a counter to the bullish consensus.

I Refute Bearish ECRI Thesis

I asked the head of ECRI on Twitter why he thinks growth is slowing since consumer spending growth was strong in April. He stated this was only a one month improvement in year over year spending growth which doesn’t amount to a new cyclical upturn. To support his point, the consumer is saving less and spending more on gas. However, I’m still optimistic as it’s not as if that’s the only positive economic data point. The chart below shows ECRI’s claim that consumer spending and personal income are decelerating like the slowdown in 2015 and 2016. However, the latest reports, not included in this chart, show a re-acceleration.

The real disposable income growth was 1.93% in April which up from March’s 1.67% growth. Furthermore, real year over year consumption expenditures were up 2.67% in April which is an improvement from the 2.42% growth in March. Even though ECRI is claiming this was just one month of growth acceleration, their deceleration trend was only 4 months; it’s not like that was a long downtrend. Furthermore, they claimed the unemployment rate was stabilizing, prior to the last report, to support their thesis, but it’s dip to 3.8% in May, disproves that point. There isn’t much data from May which supports the idea of a slowdown. I’m not saying the soft data is absolutely correct, but it also supports the ‘growth accelerating’ theme.

The chart below shows the firm’s claim that corporate profit growth is mostly because of the tax cut. It shows before tax earnings were up, but below the growth peak in Q4 2016. I’m not buying this claim because S&P 500 Q2 guidance is better than normal and revenue growth was strong in Q1. This chart includes all firms. The small businesses show they also have strong profit growth in the NFIB surveys, so I don’t think it’s fair to say profits are weakening. Also, even the chart shows a stabilization rather than weakness.

NFIB May Employment Report

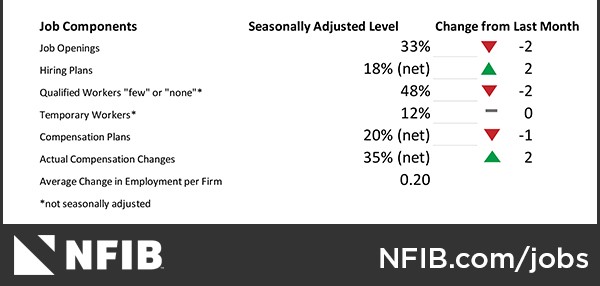

We’ve reviewed the BLS monthly jobs report. The NFIB jobs report is a private sector survey which gives us a more focused picture of the employment market for small businesses. The table below shows the changes in each indicator in the past month. As you can see, the changes from last month are mixed. However, all the reports are near all-time highs, so these aren’t bad numbers. It’s a plateau at very high levels. The reports of job opening were the strongest in the construction sector which supports the strong construction report I reviewed in a previous article. The strongest part of this report was the actual labor compensation changes index which was at 35% which is the highest level ever since the survey started in 1986.

Clearly, small businesses are having a tough time finding workers and are raising wages to fill jobs. The wage growth in the BLS report certainly isn’t at the highest point since 1986, so small businesses might be more susceptible to this issue. If you look at the average hourly earnings for production and non-supervisory workers, the growth hit above 4% in the past 3 cycles, but it’s only 2.8% now. This shows the difference between the NFIB survey and the BLS numbers.

Conclusion

Tech is leading the market higher. The NFIB small business survey shows business is so strong the index for labor compensation is at a record high. However, there are still bears claiming the economy is entering a cyclical slowdown. ECRI has a great track record of predicting economic growth, but I see little evidence of a slowdown. Q2 GDP growth might not hit the Atlanta Fed’s target of 4.8% growth, but there are few negatives in the recent economic reports. The recent decline in oil will give the consumers back some of their tax cuts after they were taken away earlier in the year by rising gas prices.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more