Recession Warning: Sell These 3 Popular Stocks Most At Risk

The billionaire and contrarian investor, Sam Zell, has been getting increasingly negative on the United States’ economy and recently said a recession is all but guaranteed — noting that the United States is in the “ninth inning” of its current economic cycle. According to Zell, this isn’t pessimistic, but realistic.

Zell has made bold calls in the past, but he’s never been quite so vocal.

These days, Zell is running the public real estate investment trust Equity Commonwealth (NYSE: EQC), of which he became the chairman in 2014.

What’s interesting is that Zell isn’t just talking the recession talk, he’s actually walking the walk by positioning Equity Commonwealth to take advantage of a downturn in the economy.

Zell and his Equity Residential recently sold $5 billion in suburban residential real estate assets, plus another $3.5 billion in other assets sold over the last year-and-a-half.

This is a similar play that Zell pulled in 2007 before the last major downturn.

Recall that Zell sold off his office real estate trust, Equity Office, to Blackstone Group (NYSE: BX) for $39 billion in 2007. At the time, Equity Office was the largest office owner in the United States. Just a couple years after the sale, almost all the properties sold were worth less than their mortgages.

Zell might be ringing the top again with his recent warnings and real estate sales. He recently noted, “If someone needs a bell to hear that the real estate market is much more frothy nowadays, I’m in the business of selling hearing aids.”

Plus, his recent buildup of cash will give Zell some fire power to buy up distressed real estate after the recession hits, noting that, “This pool of capital that we are creating will be an enormous competitive advantage over the next 12 to 18 months.”

Known as a contrarian investor, Zell’s recent thoughts on a looming recession is more mainstream than you might realize.

Owen Thomas, CEO of Boston Properties (NYSE: BSX), says that we’re approaching a correction point. Another notable real estate CEO, James Conner or Duke Realty, has said that they’ve been deleveraging for when the recession hits.

While the real estate market will certainly feel the pressure of a recession, there’s a number of other opportunities out there.

So while there are issues within the real estate industry, Zell notes that the issues are wide-ranging for the United States economy. This includes the decline in import demand for emerging markets, deflation, low oil prices, the strong dollar, and the possibility of negative interest rates.

Notably, there are stocks that you might own but should take a second look at. This comes down to thinking about the industries that will be most impacted by a recession. With that in mind, here’s the top 3 stocks to sell before the recession hits:

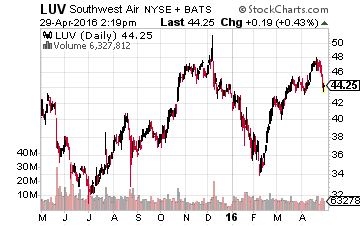

Stock To Sell Before The Recession No. 1: Airlines

To start, the airlines will likely feel some of the worst pain. The benefit of low oil prices has already been reflected in their stock prices and there’s no additional catalyst on the horizon to keep this stocks evaluated should a recession hit.

Now, I’ve talked about the major headwinds facing the airlines, and with a recession all those will be exacerbated. With that in mind, it’s the more expensive airline, Southwest Airlines (NYSE: LUV), that looks to be the name to avoid. This airline is trading at 14 times earnings and 32 times cash flow.

The other thing working against Southwest is that it’s spreading itself too thin. It started out as the low-cost leader, but has since added more international routes. Essentially, it’s lost its advantage and is now trying to compete with the major airlines on price.

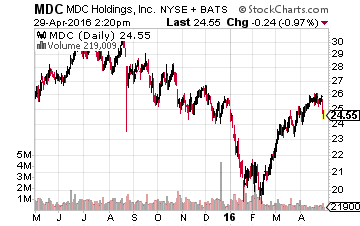

Stock To Sell Before The Recession No. 2: Homes

Housing, just like during the last recession, will play a key role in the upcoming one. It’s a market riddled with uncertainty right now as millennials continue to opt for rentals versus home buying. Mortgage rates have been at near record lows for years, thus, again we’re faced with the question of what’s the catalyst?

This is an especially troubling trend as the number of incremental buyers for homes continues to shrink. This particular generation is opting to defer marriage and kids, which is delaying their move to homes and the suburbs. When the recession hits, that move will be deferred even further.

Right now, the most expensive homebuilder looks to be MDC Holdings (NYSE: MDC), trading at nearly 20 times earnings. Now, it’s one of the smaller homebuilders and will be the most volatile when the recession hits. The other issue is that it focuses on speculative homes, building homes without buyers. A risky bet for homebuilders heading into a recession.

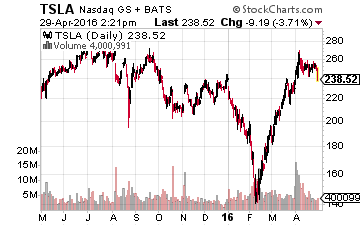

Stock To Sell Before The Recession No. 3: Cars

So, when we do find ourselves in a recession, the first thing that people will cut back on is the big purchases — this includes traveling, buying new cars and homes, and scaling back on consumer discretionary goods. Overall, it is tough to avoid all the stocks that are in the consumer discretionary space, but that’s the industry that will be hit the hardest by a recession.

Cars in general are a tough bunch to own with the strong dollar trend potentially coming to an end. But, the big name to avoid in the car market is Tesla (NASDAQ: TSLA). First, Tesla trades at over 8 times sales, compared to General Motors (NYSE: GM) at 0.3 times. Now Tesla, previously, was targeting the wealthier income class with cars priced at $100,000. However, it’s now trying to compete with other car makers, pricing cars at $30,000.

In the end, nobody knows what’s going to happen for sure or when the next recession will hit. However, it’d be foolish for your portfolio not to pay attention to what some of the world’s best investors are buying and selling. Sam Zell got his nickname, grave dancer, for a reason. He’s known for buying assets at distressed prices, so don’t let it be your dead portfolio that Zell is dancing on in twelve months.

Disclosure: You could collect an average of $3,268 in extra monthly cash with ...

more