RealPage - Chart Of The Day

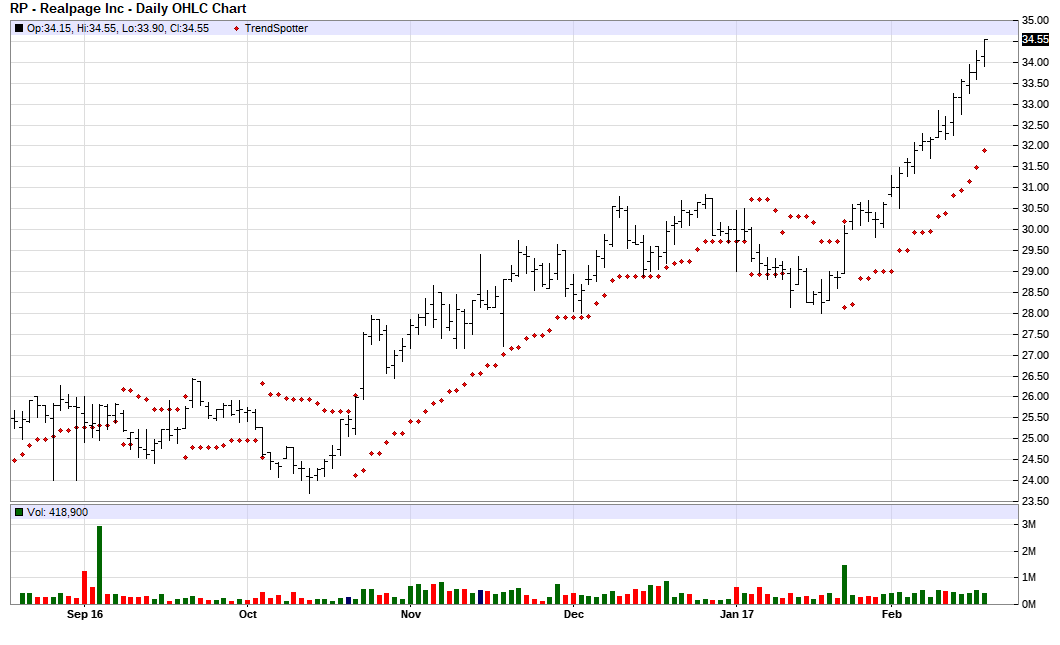

The Chart of the Day belongs to RealPage (Nasdaq: RP). I found the property management software stock by using Barchart to sort today's All Time High list first for the most frequent number of new highs in the last month, then again by technical buy signals of 80% or more. Since the Trend Spotter signaled a buy on 1/25 the stock gained 13.28%.

RealPage, Inc. provides on-demand property management solutions that enable owners and managers of single-family and a wide variety of multi-family rental property types to manage their marketing, pricing, screening, leasing, accounting, purchasing and other property operations. The Company's products include OneSite Solutions, to increase occupancy and reduce operating expenses through streamlined operations; CrossFire, a sales and marketing system to capture more leads, manage and retain more residents, and provide residents with the means to sign up for utilities and other services; YieldStar, to optimize asset values through revenue management, portfolio management, and market intelligence; LeasingDesk, a risk mitigation system; Velocity, to generate comprehensive utility and convergent bills for properties and deliver superior submetering services; OpsTechnology, a spend management system. RealPage, Inc. is headquartered in Carrollton, Texas.

The status of Barchart's Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 5 and 100 day moving averages

- 19 new highs and up 22.30% in the last month

- Relative Strength Index 84.60%

- Technical support level at 34.12

- Recently traded at 34.55 with a 50 day moving average of 30.43

Fundamental factors:

- Market Cap $2.78 billion

- P/E 83.05

- Revenue expected to grow 21.30% this year and another 14.70% next year

- Earnings estimated to increase 34.50% this year, an additional 21.60% next year and continue to compound at an annual rate of 20.00% for the next 5 years

- Wall Street analysts issued 3 buy and 1 hold recommendation on the stock

Disclosure: None.