Quarterly Update For Golden Capital Portfolio: Tesla Remains In Focus After Quick Profits

Golden Capital Portfolio continues to outperform the benchmark S&P 500 Return On Invested Capital year-to-date. In my most recent update I offered to investors and readers alike my 5-year plus dedication to investing in VIX-leveraged ETPs as the core strategy behind Golden Capital Portfolios strong ROIC. My VIX-leveraged ETF of choice is, and sorry to sound repetitive, ProShares Ultra VIX Short-Term Futures ETF (UVXY). In my most recent article titled VIX-Leveraged ETPs And The 5% Contango Rule, I outlined my strategy for allocating capital during elevating levels of contango. Additionally, I gave investors and readers a peak into Golden Capital Portfolio’s YTD performance as displayed below:

It’s for this reason that the portfolio is now expressing a 67.5% ROIC year-to-date. The screen shot below of Golden Capital Portfolio performance YTD identifies the portfolio’s mirroring of UVXY’s backwardation, portfolio manager’s layering of additional short positions during backwardation and subsequent drop in UVXY share price.

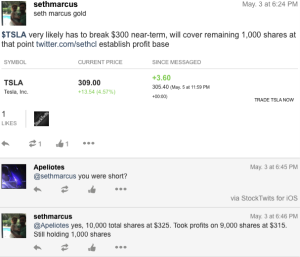

While admittedly a 67.5% ROIC no more than a quarter into 2017 is a robust performance, it comes with some well positioned investments that have included Intel (INTC), Microsoft (MSFT), Facebook (FB), Costco (COST), Fireye (FEYE), Fitbit (FIT) and more recently the addition of Starbucks (SBUX). Since my latest article, most of these invested corporates have reported quarterly results and it is with some well-timed positioning that Golden Capital Portfolio has entered the 70% ROIC range. But I can’t offer a great amount of appreciation to the aforementioned corporates shy of COST, which has soared to above $180 a share. Nope, most recently I added an under the radar position in shares of Tesla (TSLA), short of course. At $325 it was about time the stock found investors taking some profits and more importantly filling a gap back below $300 a share. So with 10,000 shares short at $325, I was found to have benefited my clients in quick order as shares dipped below $300 in a matter of a couple trading sessions. I offered my newly initiated positions publicly on Twitter and StockTwits.

Initially taking a short position in shares of TSLA at $325 the stock quickly dropped $10 for which I collected a sizable profit on 9,000 shares. I left the remaining 1,000 shares in play, believing the stock would eventually drop below $300. When it did, I covered the remaining 1,000 shares at $299. This short-term trade greatly added to Golden Capital Portfolio’s recent gains.

Tesla is a bit of a conundrum stock with a cult following. My personal take on the company is that it is little more than a ponzi scheme with extremely limited potential to ever bear out a profit. Tesla would have investors believe that it can eventually achieve scale, manufacturing and selling millions of units. However, what they continuously fail to objectively address is the total addressable market (TAM) for its premium priced vehicles, regardless of the foundation of its electric powered engine. TAM is the undisputed defining variable in any business models’ potential. Much like Father Time, TAM has never been defeated. If we take the premium price point as an average selling price before including the GM% model for an included electric powered vehicle, Tesla could potentially achieve the scale of the likes of BMW. Having said that we of course are saddled with the fact that these Tesla vehicles ARE electric battery powered and for each unit sold, there are no profits to be had with fewer than 100,000 units sold annually. Even BMW was found to need and benefit from coming downstream with its price point and product offering to sustain its business model long-term. BMW now sells vehicles in the $30,000 price range and has for many years since the financial crisis. Tesla is the perfect example of smoking mirrors for which the government can’t deny potential for the sake of possibility. There is no law in place that denies the possibility of profits even at the risk of deleveraging the probability. Even as Tesla is continuously forced to go to the capital markets to raise more and more capital every single year, nobody steps in to remedy the fact that the cash burn is increasing at an alarming rate and the company has yet to come remotely close to achieving scale. Even as Tesla is set to introduce a more mainstream price point available to a larger TAM, such a feat of actually achieving that TAM alongside a profit would require…that’s right, additional capital and exact execution without failing demand or delivery on that demand. In other words, everything has to align just right for TSLA to ever achieve a profit.

Now that Golden Capital Portfolio has established a profit base in shares of TSLA, I aim to revisit this short opportunity in the future, and with any luck, at a higher price from whence I covered the Portfolios short positions.

With Fireye reporting better than expected results the share price soared last week. I’ve held on to this position for the last 9 months. As shares of FEYE rose to $14.50 I disposed of the shares in the Portfolio and reaped a 26.3% ROIC over the 9-month period. While shares could potentially go higher and as analysts have increased their price targets on the name, I’m gladly moving on from this investment and looking to place the capital in…but of course, UVXY on any spike and as contango has steadily risen over the last two weeks. But I’ll come back to that in a moment and after I update my thoughts on Fitbit (ugggghhhhh).

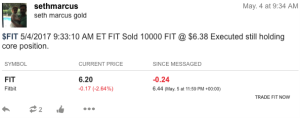

Fitbit is an investment in Golden Capital Portfolio for which the Portfolio is currently finding itself underwater by roughly 20 percent. The company reported a dismal Q1 2017 performance, but shares rose roughly 13% and off a baseline valuation near book value. While the share price boost was warranted on valuation alone, the company’s channel inventory reduction was the most beneficial part of the Q1 2017 results. During the Q1 2017 period, Fitbit reduced channel inventory by roughly 30%, putting the company in a much better position going into the back half of 2017. I’m not expecting the recent share price appreciation to be sustained near-term, which is why I vacated some shares at $6.38 as offered on StockTwits and as displayed below:

I will continue to hold a core position in the name for the portfolio, but also believe I will be able to reacquire these shares sold at a cheaper price.

Since authoring VIX-Leveraged ETPs And The 5% Contango Rule, shares of UVXY have continued to decay in price even as the VIX has slightly found itself elevating. From $14.18 a share at the time of the last publication, shares have declined another 7% or so to end last week at $13.15 and with contango finishing the week at nearly 7.5 percent. To reiterate from the 5% Contango Rule principles, contango is presently in what I call the “chop zone”. The chop zone represents an area whereby traders can day trade UVXY and like ETPs for daily 30-50 cent moves if they so choose. I’ve been employing this strategy profitably all last week and of course over the last several years without fail. The last position I added to the portfolio was last week Friday at $13.15 as offered to my Twitter followers. My original limit order did not execute at $13.30 a share and as such I modified the order lower to achieve an execution.

So what now or what’s next for Golden Capital Portfolio? Firstly I expensed some protection on shares of COST. Given the outperformance and Special Dividend forthcoming, I thought it prudent to establish a baseline for ROIC on this investment and secure the profit potential with options. Moreover, I’m looking to initiate a new short position in shares of…may your drums all roll…Snap (SNAP). The valuation is a bit crazy and I dipped my toe in the name, short, last week with a quick profit. As the company will report earnings this coming week, I’ll be monitoring the stock for an opportunity. I’m sure my followers will see my thoughts and possible positioning, when established, on Twitter and StockTwits. Beyond that offering, Golden Capital Portfolio remains on a path to continued outperformance. I hope readers/investors/traders have benefited from my dedicated analysis and Portfolio updates. Moreover, be on the lookout for my upcoming quarterly analysis on your favorite retail names like Target (TGT), J.C. Penney (JCP) and Macy’s (M), as they will all be reporting quarterly results over the next couple of weeks. If you have any questions, speak up, I carry no stick and offer a congenial dialogue to the masses.

Disclosure: I am long FIT

Where is Golden Capital website? How do you invest?

You are more than welcome to email me privately.

Excellent as ever. Awaiting ur moves on snap.

All the best.

Thank you sir. I'm hoping SNAP achieves all-time trading high before shorting.