Qualcomm Is Racing Ahead. Its Stock Is Dead In The Water. What Gives?

Apple (AAPL), Microsoft (MSFT), Alphabet (Google’s parent – GOOG), Facebook (FB), and Amazon (AMZN) are all consumer as well as investor favorites. As consumers, we might respect a product or service and get excited about the company’s stock.

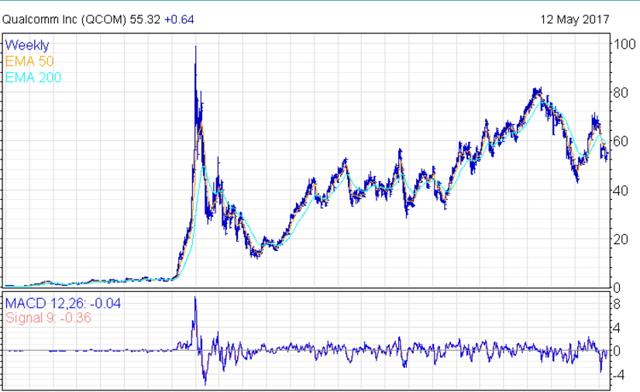

When a company supplies the backbone for what other companies do, however, we can’t simply use the Peter Lynch sniff test and say, “Gee, everybody’s using Facebook. I’ll look into it.” Maybe that partially explains why Qualcomm is languishing right now. Take a look at QCOM’s stock chart since its IPO in 1992:

Notice the company’s stock was a Steady Eddie until January of 1999. That’s when Pets.com’s sock puppet and anything that aided, was sold on, or even appeared on the Internet sold at hope times greed times infinity. Qualcomm met the description. Even though it wasn’t nearly as exciting as sock puppets, institutional buyers realized what the company really did and bid its price from 3 up to 99 in less than a year. (All prices are post-splits. There have been four of them – three 2-for-1s and one 4-for-1.)

Parabolic rises seldom simply plateau, of course. A year and a half later, QCOM was selling under 14. Since then, however, even through a tough Oct 2007 to March 2009 bloodbath, Qualcomm’s stock has advanced steadily. It was 82 in 2014, fell on problems with China not paying licensing fees for Qualcomm technology, rose again to 71 as recently as October 28 of last year, and now sells around 55. At this price, this tech leader sells for 18 times earnings, 2.6 times book and 3.5 times sales.

What is it exactly that Qualcomm does and what are the risk factors in buying at this price?

If you visit the company’s website, you might find a clue as to why the average investor doesn’t cotton to Qualcomm right out of the box. Here’s the kind of thing you’ll see as you scroll down their homepage:

Designing 5G NR.

To meet the expanding global connectivity needs—in the next decade and beyond—we are designing a new OFDM-based 5G unified air interface. We are delivering OFDM-based waveforms and multiple access optimized for different use cases. The 5G NR flexible framework is also designed to efficiently multiplex 5G services and features with built-in forward compatibility.

Or how about this one:

Accelerating the path to 5G.

Qualcomm is leading the technology innovations designed to make 5G a reality. We’ve spent years working on new 5G designs, building on our long-standing expertise in 3G, 4G and Wi-Fi. We’re also collaborating with industry leaders across the mobile ecosystem to drive 3GPP 5G New Radio (NR) standardization along with impactful trials that will lead to timely commercial network launches.

Pretty exciting stuff, huh?!! For those who have already dozed off, I’m certain this stuff fires the imagination of the PhDs that Qualcomm wants to recruit from elite universities and the B2B corporate clients they want to attract. But to fire the imagination of those who might invest in the company’s future? Not so much.

Hence my attempt to place in context some of their products and how those products might change our lives.

Among QCOM’s key product areas are:

Mobile processors like the brain that allows your smartphone to do what your smartphone does. There is more computing power in this one little processor chip than there was a few years back in a huge bank of mainframe computers. The latest iteration is the “Snapdragon 835” processor which features a CPU with up to 2.45 GHz and the latest LTE modem.

Cellular modems that allow you to take calls, make calls, watch movies, send and receive texts and otherwise communicate with your friends and colleagues around the world.

Bluetooth technologies and products which enable listening to music, dictation, hands-free communication while driving and so on. A step beyond Bluetooth is Qualcomm Halo™. Halo technology eliminates the need for plug-in cords for more accessible recharging in electric and hybrid vehicles.

Wi-fi products. Qualcomm has created and continues to create products that make wi-fi connectivity smoother and faster than ever before. And with Qualcomm Powerline solutions, you don’t even need booster products for large area coverage. Electrical outlets become broadband connection points, creating high-performance networks by simply plugging in. The company’s WiPower™ wireless charging technology supports wireless power transfer, eliminating the need for multiple chargers and wires. (Who wouldn’t want to leave the endless array of separate chargers and wires at home when traveling?!) Wi-Fi Certified Passpoint™ automatically discovers nearby Wi-Fi hotspots with your smartphone wherever you go without requiring new passwords or account numbers.

All fascinating stuff with great applicability to our daily lives. How so?

In consumer electronics like cameras, wearables, drones, printers, robots, Bluetooth speakers, headphones, soundbars, home theater and remote controllers for all manner of connected “things” Qualcomm’s products are saving us time and changing the way we interact with our environment and entertainment.

As one who first loved music on vinyl, then cassettes, then CDs, the idea of streaming anything I want at any time I want it without worrying about breaking or losing my personal collection is worth the frustration of having done all that work to create it and now tossing the old media into the dustbin of history.

Smarter cars. I admit it – I’m a throwback. I have raced cars, rallied in cars, and wrecked cars (on purpose! -- as part of a specialized military application for anti-hostage training.) I own 2 cars today, both of which are manual shift and one of which is 58 years old. (I’ve restored lots of classics in my lifetime and love to DRIVE.)

But I also realize that many people (most?) just want a car versus public transportation for the privacy it affords and the fact that it gets you from specific destination A to specific destination B. For those folks, Qualcomm has more than 40 applications already that provide connectivity, entertainment, navigation, safety and wireless (yes, wireless) electric vehicle charging solutions.

Networking. With the exponential increase of connected devices, Qualcomm’s huge portfolio of network technologies provides better reliability and better speed, whether it be for our home networks, enterprises or the broadband carriers themselves.

Health Care. For years the experts have been telling us our medical records will be encrypted in bulletproof form and available, with our agreement, to any doctor we decide to go to. Riiiiight. Every time I tear something break something and have to find a replacement for the doc I had that just retired, or the doc I need to use 1000 miles from home, I am faced with the same daunting, duplicative, repetitive, stupidly-designed forms asking me the same questions that every other doctor’s office demands I fill out. When are they finally going to deliver on this promise?

Thanks to Qualcomm, it may actually happen in our lifetime. They claim to have an 11-layer authentication process that will absolutely safeguard patient information and allow medical information to be shared in seconds between doctors. (Anything that can be built can sooner or later be hacked but anything that puts more control in the hands of the patient is also an improvement.)

This will allow for more reliable at-home health monitoring systems and save you the time of getting into your self-driving car just to wait an hour in the doctor’s office for the doctor to say, “No new symptoms? Still feeling good? Great! Bye now.” Do you want to see America’s health-care costs plummet and those who truly need in-office visits get them more easily? Video medicine provides one solution.

So why are the shares of a company that provides key parts of the backbone of the Internet and hundreds of other technological solutions to today’s very real problems just poking along at 18 times earnings?

Most likely because Qualcomm is like the old Bell Labs or Xerox’s PARC. They design, integrate and manufacture but they also license a great deal of what they own via patents. This has created numerous problems in the past where, for instance, Chinese partners “might have” reneged on their obligations and when QCOM objected, the full force of China’s government came down on them, charging all manner of what many believe, in retrospect, were spurious allegations.

It is just a cost of doing business. Qualcomm will always strive to protect its intellectual property and others will claim, truthfully or not, that they invented something just like it or they have an adjunct to it and shouldn’t pay for the original product or innovation. The most recent brouhaha came when both Apple and the FTC announced a lawsuit against Qualcomm, claiming the business is monopolistic and unlawful. IBM, Microsoft, Apple, Xerox and many others have faced similar allegations. If you are the only company that produces x and x is light years ahead of the competition, of course, you will be labeled monopolistic!

Since QCOM lost some $20bn in market capitalization the week after the announcement, clearly some analysts believe the current lawsuits have some merit. It may be different this time, but in the past whenever Qualcomm has been distracted by such events, as soon as it is over the stock has returned to a more normal valuation.

If I were on the legal team at Apple, I would come out of the box strong as well. But is Apple’s approach grounded in a belief that Qualcomm is doing something illegal or is it merely a negotiating tactic to get more favorable treatment from a sometimes-competitor, sometimes vendor?

There is also some concern that Qualcomm’s takeover of NXP might not be consummated. In this I am reminded of the lyrics to an old song: “…got along without you before and I can get along without you now.”

Finally, Qualcomm has informed the analyst community that the company expects only 2% revenue growth and 3% earnings growth this year, so the hot money abandoned it in droves. But for those of us who think longer term (and are willing to use trailing stops if the entire market tanks, then buy QCOM again even cheaper) this stock is bargain-priced right now.

I could even make the case that Qualcomm’s shares are a buy based solely on this steady dividend-payer’s price translates to a 4% yield. QCOM is one of the most dependable “increasers” of dividends in the entire tech universe. I have no doubt, with it’s a-1 balance sheet, that it will continue to add shareholder value by increasing these dividends year after year. After all the company has some $20 billion in cash and great continuing free cash flow from its products and solutions.

I believe the current price decline to near its 52-week lows has made Qualcomm more attractive. A relative momentum trader would not touch the company here, not until it resumes its uptrend. For patient value investors, getting this kind of value with this kind of aggressive growth is simply a gift. I plan to graciously accept that gift.

Disclaimer: You are welcome to contact me at joe@stanfordwealth.com with any questions.

(1) Do your due diligence! What's right for me may not be right for you.

(2) Past ...

more