Protect Your Portfolio With These 2 Safe Growth Stocks

To me, it is really quite fascinating how obsessed the market and assorted pundits are with the first possible interest rate hike from the Federal Reserve since 2006. The consensus now has this occurring in December. This is especially true given we are some six and half years away from when the recession “officially” ended in June 2009 and we have basically had the Fed Funds rate at zero since the end of 2008.

However, this has not been a normal recovery by any stretch of the imagination. It is the weakest post-war recovery on record and the economy continues to muddle along with a measly two percent GDP growth rate. In contrast, the previous nine post-war recoveries averaged more than four percent annual GDP growth for the four years after their recessions ended.

Even the robust Jobs Reports that came out on November 7th and moved a rate hike in December from “doubtful” to “highly likely” is suspect. Yes, the economy created 271,000 jobs in October and we had the fastest year-over-year wage growth (2.5%) since the financial crisis. U6 unemployment (those workers who are part-time purely for economic reasons) actually dropped under 10% for the first time in recent memory.

However, there are many reasons to believe this was a “one-off” or outlier occurrence. First, labor participation came in at 62.4%, a level not seen since 1977. Second, the report contained no significant upward revisions to prior months’ numbers. In addition, the ADP job reading came in at an 182,000 level. The jobs number caused yields to rise significantly which buoyed financials like banks and insurance stocks. On the flip side, high-yield sectors like Utilities and Real Estate Investment Trusts (REITs) took substantial hits. Outside of Amazon (NASDAQ: AMZN), retail sales are punk. Inventory levels are high heading into Black Friday as the back to school shopping season was largely a bust.

Europe definitely looks like it could be a continuing story in 2016, and not a good one. Portugal just threw out their center-right government two weeks into their second term as a push back to continuing austerity. The love affair with former firebrand and now Prime Minister Alexis Tsipras seems to be over for the same reason. Greek unions called a 24 hour strike for the first time since Tsipras took leadership of the country, holding marches and accusing Tsipras of bowing to creditors and imposing measures that “perpetuate the dark ages for workers.” Then there is the largest migration across the continent since WWII which seems to be accelerating, as if the Eurozone did not have enough to focus on right now.

We continue to get feeble economic readings out of China and it appears Abenomics has lost traction in Japan after a promising start. Commodities are signaling that the slowest global growth since 2009 will continue as copper is hitting six-year lows and oil stubbornly refuses to move over $50 a barrel. This a key reason domestic manufacturing outside of vehicle production is hovering right above contractionary territory.

I continue to have the majority of my own portfolio in large-cap growth names that can churn out both earnings and revenue growth despite a tepid worldwide economic backdrop and that still sport reasonable or attractive valuations. Unfortunately, not a whole lot of names fall into this category these days.

Two that do are in the biotech/biopharma arena and delivered robust results this quarter. Very few large cap growth stocks delivered a better quarter for their shareholders than

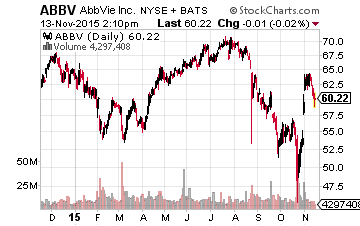

AbbVie (NYSE:ABBV)

. The company beat earnings estimates by a nickel a share on better than an 18% year-over-year increase in revenue to almost $6 billion in sales this quarter, despite an eight percent currency headwind in the quarter. The company laid out its plan to grow sales on average 10% annually through 2020 to $37 billion while raising gross margins from just over 36% currently to 50% in five years hence which would boost earnings substantially from current levels. The company threw in a 12% dividend hike to boot. At the middle of the company’s earnings guidance range for FY2016 the stock trades for just 12 times forward earnings, a deep discount to overall market multiple. The shares also yield a juicy 3.8% with the new dividend payout.

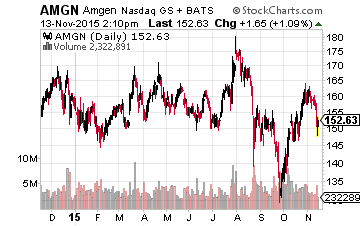

Amgen (NASDAQ: AMGN) also provided some early holiday cheer to its shareholders. The company posted earnings of $2.72 a share, more than a quarter a share above the consensus. Revenue came in $400 million above expectations to over $5.7 billion and was up nearly 14% year-over-year. The company also announced it was raising its dividend by over 25% and it also plans to buy back $2 billion to $3 billion of its stock in 2016. The company has a great pipeline and is going to be a major player in the emerging area of biosimilars. Amgen should have almost a half dozen of these compounds on the market by 2019 bringing in more than $3 billion in additional revenue. The stock goes for just 14 times forward earnings and yields 2.6%.

While not sanguine about the overall market right now, these core growth plays should navigate the challenging global economic backdrop just fine.

Disclosure: more