Pluralsight Could Falter When Lockup Expires

The 180-day lockup period for Pluralsight LLC (PS) ends on November 13, 2018. This date marks the point when the company's pre-IPO shareholders and insiders may sell large blocks of currently restricted shares in the secondary market. With more than 36 million shares of PS subject to lockup restrictions - and just 20 million shares trading pursuant to the IPO - any significant sales of restricted stock could flood the market and cause a sharp, short-term downturn in share price.

Trading in Pluralsight has been volatile during this six-month period. PS had a first-day return of 33.3%, and the stock currently has a return from IPO of more than 35%.

Business Overview: Provider of Online IT and Software Development Training

Pluralsight LLC offers online software development and IT training options for software developers worldwide. The company provides its online courses for IT administrators, professional developers, and creative artists. The courses are available for businesses and individuals in addition to the government and academic sectors.

(Source: S-1/A)

The company uses its cloud-based platform for technology training with a wide array of tools, including business analytics, learning paths, a library of courses, and skill assessments. This platform is powered by Iris, which is Pluralsight's proprietary technology using machine learning that enables students to identify and develop desired skills.

The company states in their SEC filing that it has significant opportunity for growth. According to Training Industry, Inc., worldwide spending on corporate training initiatives was approximately $359 billion in 2016. In addition, Evans Data Corporation estimates that technical teams worldwide have approximately 102 million members. Using this data, Pluralsight sees its current potential market at $24 billion.

Pluralsight has seen growth in its users and authors on the Iris platform in recent years. As of December 2017, Iris had over 695,000 users across 150 countries. The content offered over the platform comes from a network of more than 1,400 authors. Currently, Pluralsight has more than 6,700 online and on-demand courses, and they add approximately 80 new courses every month.

The company has 890 employees and is headquartered in Farmington, Utah.

Company information sourced from the firm's S-1/A.

Financial Highlights

Pluralsight LLC reported the following highlights for the end of the third quarter for fiscal 2018 ended September 30, 2018:

- Billings - Third quarter billings were $72.2 million for an increase of 44% versus the period LY. Third quarter billings from business clients were $61.1 million for an increase of 53% versus the same period LY.

- Revenue - Third quarter revenue was $61.6 million for an increase of 42% versus the same period LY.

- Gross margin - Third quarter gross margin was 75%, versus 71% in the third quarter of 2017. Non-GAAP gross margin was 77%, versus to 75% in the third quarter of 2017.

- Net loss per share - GAAP net loss per share for the third quarter was $0.23.

- Cash flows - Cash from operations was $1.9 million for the third quarter, versus cash used in operations of $6.9 million last year.

Financial highlights sourced from the Pluralsight website.

Management Team

Co-founder, CEO, and Chairman Mr. Aaron Skonnard has extensive experience in technology training. He has developed software development course materials and taught professional developers around the world. He has been a presenter at developer conferences such as VSLive, TechEd, and PDC. He authored many of the Pluralsight courses in the areas of XML, Web Services, Azure, WCF, and BizTalk Server. Mr. Skonnard earned a B.S. in computer science from Brigham Young University.

CFO James Budge has served in his position since April 2017. His previous experience includes senior financial positions at Anaplan, Genesys, and Rovi Corporation. Mr. Budge earned a B.S. in accounting from Brigham Young University.

Management information sourced from the Pluralsight website.

Competition: YouTube, LinkedIn Learning, Udemy, and Others

The marketplace for professional skill development is intensely competitive, with many free options for consumers such as YouTube. Pluralsight faces competition from instructor-led training vendors, legacy e-learning services, and individual-focused e-learning services. These include YouTube (NASDAQ:GOOG) (NASDAQ:GOOGL), Udacity, Udemy, LinkedIn Learning, Cornerstone OnDemand (CSOD), Skillsoft, New Horizons, General Assembly, and Global Knowledge.

Early Market Performance

The underwriters for Pluralsight priced its IPO at $15 per share. The original expected price range was $10 to $12, but the underwriters increased that range to $12 to $14. Its six-month performance on NASDAQ Global Select has been volatile. The stock had a first-day return of 33.3%. The stock currently has a return from IPO of more than 35%.

Conclusion

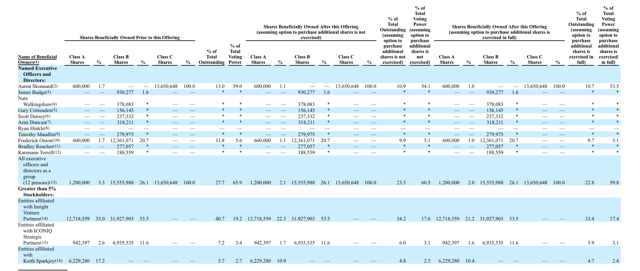

When the IPO lockup for PS expires on November 13th, pre-IPO shareholders and company insiders will be able to sell a large quantity - more than 36 million shares - of previously restricted PS stock for the first time. This group of pre-IPO shareholders and company insiders includes numerous individuals and several corporate entities.

(Click on image to enlarge)

Significant sales of this previously restricted stock could flood the secondary market for PS and cause a sharp, short-term downturn in share price. Aggressive, risk-tolerant investors should consider shorting shares of PS ahead of the IPO lockup expiration. Interested investors should cover these short positions either late in the trading day on November 13th or during the trading day on November 14th.

Disclosure: I am/we are short PS.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more