Pivotal Could Shift Lower When Lockup Expires

The 180-day lockup period for Pivotal Software Inc. (PVTL) ends on October 17, 2018. This date marks the point when the company’s pre-IPO shareholders and insiders can sell large blocks of currently-restricted stock for the first time. More than 37 million shares are currently restricted, and any significant sales could flood the secondary market for PVTL and cause a sharp, short-term downturn in share price.

Trading in Pivotal Software has been volatile during the last six months. The stock was priced at $15 and closed on the first day of trading at $15.73. PVTL has a return from IPO of 30%.

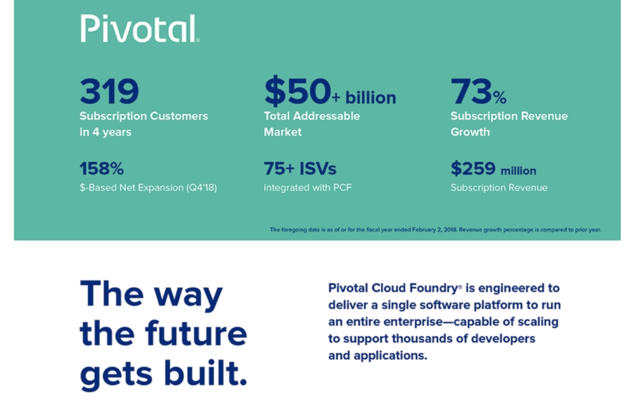

Business Overview: Provider Of Cloud-Native App Platform

Pivotal Software offers its integrated solution through a combination of its cloud-native application platform and various services within the U.S. The company calls their proprietary platform Pivotal Cloud Foundry (PCF), and the company markets it as having the capability to streamline and accelerate software development by cutting through the complex methods necessary to build and deploy applications. The company’s strategic services enable this accelerated process for clients.

(Source: S-1/A)

The Pivotal Cloud Foundry is currently in use in a wide array of industries including government, consumer, communications, technology and media, healthcare and insurance, financial services, industrial and business services, and automotive and transportation.

Pivotal Software markets its products and services through its own sales force and outside partners. In addition, Pivotal Software maintains go-to-market and commercial relationships with VMware (NYSE:VMW) and Dell Technologies (NYSE:DVMT). The company also works closely with Microsoft (Nasdaq: MSFT) and Google (Nasdaq: GOOG) (Nasdaq: GOOGL) to ensure adequate cloud infrastructure to meet the needs of its clients.

The company serves a variety of clients including Merrill Corporation, CoreLogic, Country Financial, Orange, Dish, Bloomberg, Comcast, The Home Depot, Humana, and the U.S. Internal Revenue Service, Sundance, Liberty Mutual, and Ford Motor.

Business overview was sourced from the firm's S-1/A.

Financial Highlights

Pivotal Software reported the following highlights for the end of the first quarter for fiscal 2019 ended May 4, 2018:

- Subscription revenue reached $90.1 million, an increase of 69% over the prior year. Total revenue reached $155.7 million, an increase of 28% over the prior year.

- GAAP operating loss was $33.5 million, representing 22% of total revenue, versus a loss of $48.4 million in the same period of last year. Non-GAAP operating loss was $21.0 million, representing 14% of total revenue, versus a loss of $39.5 million in the same period last year.

- GAAP net loss was $32.5 million, versus a loss of $51.5 million for the same period last year. GAAP net loss per share was $0.31, versus a loss of $0.76 in the same quarter of last year. Non-GAAP net loss was $23.3 million, versus a loss of $42.7 million for the same period last fiscal year. Non-GAAP net loss per share was $0.10, versus a loss of $0.20 in the same period of last year.

- Operating cash flow for the quarter was $4.5 million in contrast to a negative operating cash flow of $4.4 million in the first quarter of fiscal 2018.

- As of May 4, 2018, cash and cash equivalents were $645.5 million.

Financial highlights sourced from the company's website.

Management Team

CEO Robert Mee has served in his position since August 2015. He was part of the company’s founding team and began as the SVP of Products and Research and Development. His previous experience comes from positions at DellEMC.

President William Cook was also a member of the founding team. Prior to joining Pivotal Software, Mr. Cook held senior positions at the Greenplum Division of DellEMC. He previously held positions at companies including Sun Microsystems.

Management bios were sourced from the company's website.

Competition: Microsoft, IBM, and SAP

The industry for open-source projects and developing app software is intensely competitive. Pivotal Software faces such competition on a variety of levels: open-source offerings, legacy application infrastructure, and middleware. Companies offering these products and services include Microsoft Azure, Google Cloud Platform, Amazon (AMZN) Web Services, IBM (IBM), RedHat, and Oracle (ORCL).

Early Market Performance

The underwriters for Pivotal Software priced its IPO at $15 per share, within its expected price range of $14 to $16. Its six-month performance on the NYSE has been volatile. The stock closed on its first day of trading at $15.73, and it remained fairly steady until June. The price spiked beginning on June 4 and ended at a high of $28.91 on June 15. The price decreased to $22.57 on July 30 and rose again to $28.78 on September 12. Shares now trade around $19.

Conclusion

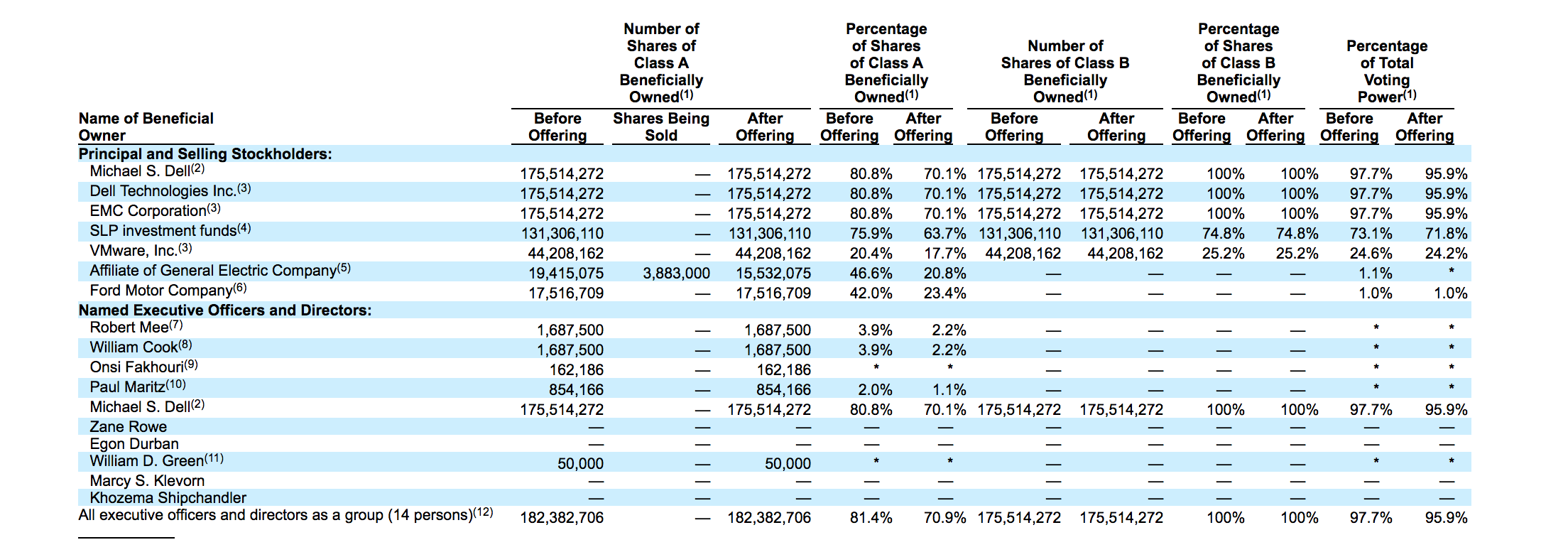

When PVTL's 180-day lockup period expires on October 17th, the company's pre-IPO shareholders and insiders will have the opportunity to sell large blocks of currently-restricted shares for the first time. This group of shareholders includes a host of individuals and corporate entities.

(Click on image to enlarge)

We believe that these individuals and corporate entities will be eager to sell at least some of their currently-restricted holdings and cash in on gains - PVTL has a 30% return from IPO. Significant sales of currently-restricted stock could flood the secondary marketplace and cause PVTL's share price to take a sharp, short-term downturn. Aggressive, risk-tolerant investors should consider shorting shares of PVTL ahead of the lock-up expiration on October 17th. Interested investors should cover short positions late in the trading session on October 17th or during the trading session on October 18th.

Disclosure: I am/we are short PVTL.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more