Picture This Blockchain: Eastman “Cryptocurrency” Kodak

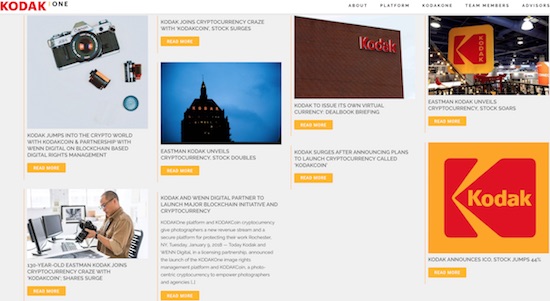

Kodak (KODK) proudly displays the news of its entry into the world of blockchains and cryptocurrencies.

Source: KODAKOne

“The KODAKOne image rights management platform will create an encrypted, digital ledger of rights ownership for photographers to register both new and archive work that they can then license within the platform. KODAKCoin allows participating photographers to take part in a new economy for photography, receive payment for licensing their work immediately upon sale, and sell their work confidently on a secure blockchain platform.” – Source: Eastman Kodak

And thus Eastman Kodak (KODK) entered the world of blockchains and cryptocurrencies.

When I last wrote about KODK almost 5 months ago, I offered it up as a stock to watch. I was hopeful it could become a value play, but I did not dare touch it because the technicals were so bad. The stock still trades below that point, but a 119% rally on this blockchain/crypto news brought new and sudden life to the stock…to the tune of a 119% gain.

Eastman Kodak (KODK) surges on blockchain and crypto news. The buying enthusiasm stopped perfectly at 200-day moving average (DMA) resistance.

Source: FreeStockCharts.com

If nothing else, this news should bring more interest in Kodak as a company. Of course, Kodak is a company of a previous generation. Kodak severely lagged the transition to digital photography, and its belated catch-up attempt failed to stave off bankruptcy. The newly incarnated company seemed to have promise, but the new hope only lasted 4 months before the persistent decline resumed. KODK peaked close to $38/share in January, 2014. Now, KODAKOne, through blockchain and cryptocurrency technologies, might provide one of the last hopes of the company to revive itself in earnest.

There are many interesting angles on this story. For example, Kodak’s ICO will be issued under SEC guidelines as a security token under Regulation 506 (c) as an exempt offering and thus has a good chance of being highly subscribed. Kodak also plans to mine its own cryptocurrency; Kodak already licenses bitcoin mining technology.

I find the role of AppCoin Innovations to be the most intriguing angle of all so far. AppCoin Innovations trades on the pink sheets as ICOX and provides services for blockchain initial coin offerings (ICOs). On December 29, 2017, AppCoin entered into a business services agreement with WENN Digital. Kodak is partnering with WENN Digital to create its blockchain and cryptocurrency solution to help photographers protect their copyrights and monetize their intellectual property. Per the press release titled “KODAK and WENN Digital Partner to Launch Major Blockchain Initiative and Cryptocurrency“:

“‘For many in the tech industry, ‘blockchain’ and ‘cryptocurrency’ are hot buzzwords, but for photographers who’ve long struggled to assert control over their work and how it’s used, these buzzwords are the keys to solving what felt like an unsolvable problem…Kodak has always sought to democratize photography and make licensing fair to artists. These technologies give the photography community an innovative and easy way to do just that…

Engaging with a new platform, it is critical photographers know their work and their income is handled securely and with trust, which is exactly what we did with KODAKCoin…Subject to the highest standards of compliance, KODAKCoin is all about paying photographers fairly and giving them an opportunity to get in on the ground floor of a new economy tailored for them, with secure asset rights management built right in.'”

AppCoin’s deal with WENN Digital triggered an 8-K filing that provides a lot of fascinating details about AppCoin. Here are bullet points for what I found of greatest interest:

- AppCoin has no employees. It consists of two executives who were installed in their CEO and CFO positions in August, 2017. The CFO is also the secretary and treasurer. He is also fresh off the unfortunate failures of two companies in 2017.

- In July, 2017 the company changed its business model to provide services for blockchain initial coin offerings (ICOs).

- The company has no technical expertise in crypto or blockchain and is focused on consulting which apparently includes connecting clients with the necessary technical resources for blockchain and cryptocurrency implementations.

- The Chairman and Director of AppCoin, Cameron Chell, was formerly the CEO and President of the company and is now the CEO of Business Instincts Group (BIG) which is “a venture creation accelerator and services firm whose focus is building high-tech startups.” He also owns a 10% stake in BIG. In October, 2017, AppCoin hired BIG “to provide certain services, including creating, designing and project managing the launching of initial coin offerings for [its] clients.”

- Over the next 12 months the company expects to need an additional $1.5M to fund its operations.

- The company has not earned any revenue since at least 2015. Its cash balance came from selling an extended series of unsecured convertible notes. The company has an accumulated deficit of $348,973.

- The deal with WENN Digital involves the launch of an ICO. Kodak presumably is piggybacking on WENN Digital’s deal with AppCoin (Kodak is not mentioned in the filing).

- The Chairman and Director of AppCoin owns a 2.7% stake in WENN Digital and AppCoin itself owns a 7.5% stake in WENN. He is also listed as the lead Strategic Advisor for KODAKOne.

In other words, the KODAKOne project must have been cobbled together very quickly and assembles a number of people who are brand new to the world of crypto and blockchain. The dealmakers and stakeholders also have very intertwined interests. So, it is no wonder that in a Barron’s interview, Kodak CEO Jeff Clarke said the KODAKOne roll-out “…does not mean a doubling in the stock price…This doesn’t change the fundamentals in a way that means the stock should double.”

As we learned with the truly bizarre crypto case of LongFin (LFIN), the protestations of a company executive that appeals to cooler heads matter little in the short-term. What matters now is the rush to try to get in on the ground floor of something that COULD become really important some number of years from now. The fact that the stock stopped perfectly at 200DMA resistance tells me that speculators with screens full of flashing technicals were the main traders and investors pushing the stock. Yet, If KODK actually manages to push over its 200DMA, then look out above!

For now, I decided to get in on the “fun” with a VERY small position to see what happens (almost like a call option). I can excuse myself as someone who followed the company pre-crypto and has a genuine interest in seeing the company succeed. I will not be surprised to see much of Tuesday’s gain reversed, but I THINK I want to be a more interested buyer if the stock does indeed pullback significantly.

I was just asking about this #KodakCoin talk. I had actually thought it was a joke.

It's VERY real! As a follow-up for readers, I sold my KODK shares soon after the open. The stock was up another 75% or so and under these conditions the better risk/reward move was to lock in profits.

We welcome #KodakOne - a marketplace for digital images!