Pay Down The Mortgage Or Invest: Part II – Rising Interest Rates

Now that the year of 2016 is wrapping up and we are only around 4-5 weeks away until we ring in the New Year, I have been deeply thinking about my extra-mortgage payment paydown strategy. Mortgage interest rates have been skyrocketing since the election, another element to showcase the roller coaster ride that we are truly on. This has caused me to potentially make a tweak or two to my strategy that I have had in play for the last few years. Let’s see what I mean.

Paying down Mortgage Part II Intro

This article and thought, was even further prompted by Financial Samurai’s Mortgage Paydown Strategy, where he has laid out the strategies and his objectives. That article then fired me up to set a conclusion on what I want to do with my extra mortgage payments. I’ve been paying an extra $500 every quarter for the last 2 years. My mortgage amount for principal and interest is $447. Therefore, the extra $2K per year was actually 4.47 extra payments per year. I’ve made a couple one-time extra payments in the earlier years of my mortgage history (began in September 2011), so I’ve made around 11-12 full extra payments.

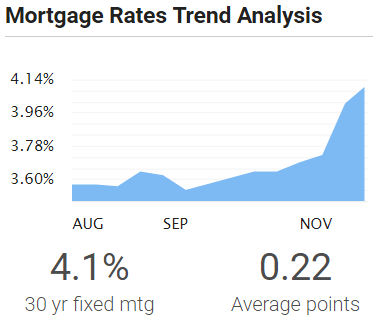

All of these paydowns, however, have occurred at a time where interest rates were tremendously declining (tremendously is used heavily here), from my mortgage rate of 4.375% down to the mid-to-low 3 percent range. Instead of re-financing during that time, I simply made extra payments on the mortgage to reduce the payment life. To me, at a time when the stock market was crushing it, it made sense to try to apply extra cash every quarter at the mortgage, to have a double-attack occurring. However, as you can see from the snipped picture below on mortgage rates, they have started to jump back up post-election and it isn’t showing any sign of slowing down.

As you can see, since only August – the rates have increased more than 54 bps. That is a 15% increase in interest rates in just a short period of time. This has a tremendous impact on the strength of your mortgage rate that you currently have, which assuming you’ve purchased your house in the last few years, and/or refinanced recently – are in a fairly strong position. Again, my rate is 4.375%, so still higher than what the average 30 year is showing (credit to bankrate.com). Therefore, mine is still higher, but the trend is pointing that it’ll break through my rate in no time.

The other item I have been considering, which I don’t want to predict what will happen, is the Federal Reserve. They have hinted numerous times, and it is expected, that another 25bp increase will occur. What will happen to mortgage interest rates? More than likely, they will rise. What does that mean? Well – from a pure math/number stand point, if the average rates outstanding in the market are showing a higher rate than yours, then I should reduce my paydown faster strategy, simply because there would be other opportunities out there that would be more advantageous with my money. However, as FS also stated, a lot has to do with personal preference and what value it brings to your life in how you want to paydown and get rid of debt. The battle ALWAYS continues with asking the question – should you pay down the mortgage or invest?

Here is the kicker, though. I hate debt. I want my cash flow opened up, hands down. I hate it just as much as the next person and dammit – if I could just write a check for the remaining amount of the mortgage I would, however, I love investing more than hating my debt. However, I’ll always make some form of extra payment, I concluded, as it just feels better ultimately and it’s reassuring knowing that in my lower 40’s I’ll have this mortgage out the door. I am sure during those later years, I’ll have tuition payments to make for children, potentially, and/or will allow cash to be heavily fueled into other investment, further speeding up the financial freedom clock. This falls in line with Bert’s recent Student Loan attack mode strategy, where he and his wife are determined to just get over that. I am sure they would still want to do the same with a mortgage in their name. We all know that every dollar counts in this game.

My Adjusted Extra Mortgage Payment plan

With rates starting to jump back up and pending a federal reserve increase, for 2017 I plan on reducing my extra payment amounts from $500 to $250 per quarter. This starts January 2017 and can be adjusted if suddenly mortgage rates stay where they are or decline.

With me reducing down to $250 per quarter, this equates to a total of $1,000 per year. This still is approximately 2.25 extra payments per year, which keeps me on track to pay down the mortgage and balance out the finances a little bit more. My expected mortgage payoff date was August 2030 and reducing down from $500/quarter to $250/quarter, extends this out to October 2033. The increase in interest is approximately $6,300 over the life starting January 2017 through the new maturity date or an extra few hundred dollars per year.

What do YOU the readers think of this? Are you changing your extra payment strategy? What would you do in this situation? Obviously, I'm very lucky that I have extra funds by saving my money to make these extra payments. Please feel free to chime in, as I can’t wait to read and see different perspectives. Your perspectives may even help sway what I do.

Disclaimer: I DO NOT RECOMMEND ANY DECISION TO THE READER or ANY USER, PLEASE CONSULT YOUR OWN RESEARCH. THANK YOU FOR YOUR ...

more