ParkerVision Is An Aggressive Buy For 2016

For investors looking for a relatively inexpensive and well-timed long play, ParkerVision (NASDAQ:PRKR) may be just such an opportunity. Some of the recent positives include the March 29 1-for-10 reverse stock split to stay in compliance with Nasdaq price requirements and possible settlements from a patent infringement case.

Business Overview

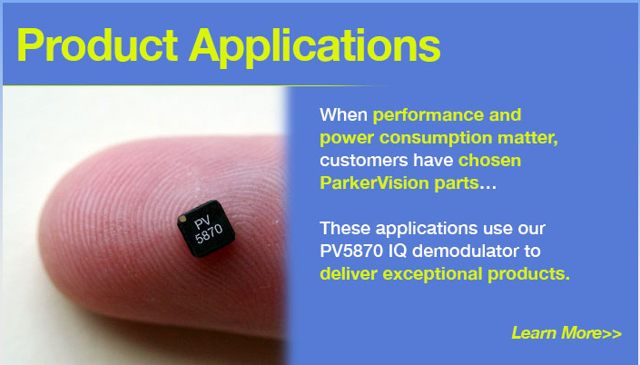

ParkerVision designs and develops proprietary radio frequency technology and other products. These are used in semiconductor circuits for wireless communication devices across the United States. In addition, PRKR is attempting to sell its technology for processing RF waveforms in wireless applications.

The proprietary technology covers the functions of transceivers, receivers and transmitters. The transmission functionality, Direct2Power, enables the conversion of baseband data signals into RF carrier waveform at the desired output level in a single operation. The receiver functionality, Direct2Data, enables the conversion of an RF carrier to a baseband data signal.

ParkerVision also offers design services and engineering consulting to its clients to help them develop prototypes or integrating ParkerVision technology with their own platforms. Its products can be integrated into a wide variety of products that utilize receivers, RF transmitters or transceivers. These include tablets, mobile handsets, machine-to-machine products, femtocells, RF identification and related infrastructure.

Its technology also is utilized in various RF components for industrial and military applications. The company was founded in 1989 and is headquartered in Jacksonville, Florida.

Edging Toward Larger Peers

ParkerVision competes with a range of larger firms (see below). However, given recent developments, the firm could begin to gradually grow market share.

|

Market Cap (mil) |

Net Income |

P/E |

5-yr CAGR |

|

|

ParkerVision |

$34 |

($17) |

n/a |

-30 |

|

Intel (NASDAQ:INTC) |

$151,168 |

$11,420 |

13.7 |

4.9 |

|

Taiwan Semiconductor |

$134,060, |

$304,141 |

14.3 |

20.9 |

|

Texas Instruments (TXC) |

$58,023 |

$2,986 |

20.5 |

-1.4 |

|

Nvidia (NASDAQ:NVDA) |

$19,403 |

$614 |

33.2 |

7.2 |

Recent Material Developments

On March 29, ParkerVision announced a 1-for-10 stock split to take the company's shares out of the price range that could lead to delisting on the Nasdaq. The stock has suffered significantly over the last year. On April 14, 2015, shares traded at $6.80. By December 3, they were trading at $1.60. The price recovered slightly by the end of January 2016 to the $2.70 range. Currently, shares are trading around $3.13.

(Click on image to enlarge)

Recently, the company filed a complaint asking the International Trade Commission ((NYSE:ITC)) to pursue an investigation pursuant to its Section 337. The complaint alleges that certain companies are violating ParkerVision patents.

These companies include:

- Apple Inc. (APPL)

- Qualcomm (QCOM)

- Samsung Semiconductor

- Samsung Telecommunications

- Samsung Electronics America

- Samsung Electronics of South Korea

- LG Electronics MobileComm

- LG Electronics USA

- LG Electronics of South Korea

ParkerVision expects a decision from the ITC this year, and the proposed remedy is that the ITC issue a limited exclusion order and permanent cease-and-desist order to all of the respondents. A positive response from the ITC could put ParkerVision well on its way to monetizing its intellectual property.

Potential Risk

One risk is the recent decision by the Supreme Court declining to review an infringement case that ParkerVision brought against Qualcomm (QCOM) beginning in 2011. PRKR had requested the review by writ of certiorari. The original decision in the lower courts had awarded PRKR $173 million in damages, which was subsequently overturned by the district court. This brings the Qualcomm case to a close.

Yet CEO Jeff Parker views the outcome simply as fodder for a new, more efficient way of future legal dealings. So too does analyst Jon Hickman of Ladenberg Thalman who has been following the stock for many years, has a Buy rating with a price target of $18.50.

Recent Financial Highlights: Narrowing Losses

- Net loss for the fourth quarter of 2015 was $3.3 million, an improvement over the net loss of $5.6 million for the same quarter last year.

- Net loss for the fiscal year ended December 31, 2015, was $17.1 million, an improvement over the net loss of $23.6 million for fiscal year 2014.

Conclusion: Rare Chance To Buy At Enormous Discount

With narrowing losses, expected patent settlement, a relatively inexpensive price and litigation risk, PRKR is very enticing at present. We have a long position and look forward to significant appreciation as 2016 unfolds.

Disclosure:

I am/we are long PRKR.

I wrote this article myself, and it expresses my own opinions. I am not receiving ...

more