OpGen: Helping Solve A Rapidly Expanding Health Crisis

With a leading analyst predicting that "Superbugs" will become a bigger killer than cancer by 2050, OpGen (OPGN) is suddenly in the middle of a promising area of demand. The small stock remains relatively unknown despite a potential large market opportunity and a peer with a much larger market value.

With over 2 million multi-drug resistant organism (MDROs) related illnesses each year, the financial impact to the economy already provides a significant market need even prior to a large death related issue. The question is whether OpGen is positioned to participate in this large and expanding market opportunity.

Rapidly Expanding Market

OpGen is leading the precision medicine informatics sector with a focus on MDRO market. Back in 2013, the Centers for Disease Control and Prevention (CDC) quantified the market as causing 2 million illnesses per year with 23,000 deaths resulting from these "SuperBugs".

The cost to the system now is the healthcare impact of these illnesses. Patients spend a considerable amount of time in the hospital and it can cost around $50,000 per MDRO incident for an incredible total annual cost of $20 billion to the system just because people have become resistant to antibotics.

The deaths are a growing problem, but Jim O'Neill from Goldman Sachs fame wrote a review on the issue back in 2014 for the U.K. government that predicated a massive health crisis from the antibiotic resistance issue. Mr. O'Neill predicts that by 2050 antimicrobial resistant infections will cause 10 million deaths per year and surpass the deaths caused by both cancer and diabetes.

Mr. O'Neill made this statement to CNBC about the report:

No new classes of antibiotics have been created for decades and our current drugs are becoming less effective as resistance increases.

The R&D president at GlaxoSmithKline (GSK) confirmed that antibiotic resistance is a very complex issue that could have a devastating impact if not resolved.

Enter OpGen

Of course, these death totals ultimately depend highly on the ability of doctors and research professionals to find cures to these common diseases and infections. OpGen is working on completing rapid tests and a cloud platform that will help predict antibiotic susceptibility based on resistance gene tests.

The company is initially working on the Acuitas Rapid Test for urinary tract infections that will identify antibiotic resistant pathogens in less than three hours. Once linked with the Acuitas Lighthouse Knowledge base, the cloud-based information store provides constant updates on new resistance genes providing patients with the proper treatments. The database uses genotype/phenotype predictive algorithms based on past testing of clinical isolates.

OpGen has plenty of opportunities in a global market that already exceeds $2 billion. According to data from hospitals, the testing revenues for acquired infections has a wide area of diseases with the urinary tract infection topping the list and plenty of other opportunities in surgical site infections, pneumonia and bloodstream infections.

Just last week, OpGen was awarded a small, but important contract from the CDC to develop a smartphone-based clinical decision support solution for antimicrobial stewardship and infection control in lower income countries. The mobile platform will identify infected patients along with tracking and monitoring of infection control precautions to prevent the spread of infections. Having the CDC identify the importance of this work and then granting funds to OpGen is a positive sign that the government agency values the related work of this company.

The company plans to launch the Acuitas Rapid Test for urinary tract infections in the first half of 2018 for research use.

Financials

OpGen already generates several million in annual revenues though not enough to turn cash flow positive considering the research and development expenses for building the testing systems and databases. The company was burning several million per quarter before implementing a recent cost reduction that will reduce the annual cash burn by at least $4 million.

The company started Q3 with nearly $9 million after raising funds via a secondary offering that raised $8.7 million after fees. OpGen has the cash to fund operations into 2018 while the exercising of warrants will provide additional cash needed to fund research.

A similar company in T2 Biosystems (TTOO) is worth a considerably larger amount at $144 million. The company didn't even generate $1 million in sales last quarter making OpGen an attractive valuation at a market value of only $16 million. Last month, T2 Biosystems successfully raised $17.5 million in a secondary offering roughly at the current market cap showing the investor appetite for the sector and the ability of OpGen to raise more funds as needed and grow the market cap.

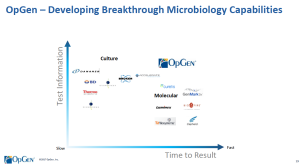

As an example of the value of the systems developed by OpGen, the company is leading a competitive sector with both time to result and quality of the test information. The ultimate winner in the sector will have the best combination of both.

Takeaway

The key investor takeaway is that OpGen provides a compelling investment in rapidly expanding market. The global antibiotic resistance crisis is only going to grow in the next decade. The company is making progress to improve the results for patients that will reward shareholders.

Due to the small size of the stock, investments are only recommended for diversified portfolios willing to accept capital losses.

Disclosure: