Okta Headed For Another Stock Boost From Quiet Period Expiration

Event Overview

The quiet period will expire for Okta (Nasdaq:OKTA), on May 2, 2015.

On that date, restrictions preventing underwriters from recommending or reporting on the deal will be lifted. Underwriters tend to release reports as soon as restrictions are lifted and these reports most often are positive. Our firm has studied price movement around IPO quiet period expirations and have found an uptick in the stock price in a short window of time surrounding these days. This is particularly true for companies with a large team of underwriters and which have performed well since the IPO.

Okta Inc. fits both of these criteria. We predict an increase in share price in the five days prior to and two days after the conclusion of the quiet period, which is in line with what we have seen in our research.

Underwriters for the deal include: Allen & Co., Goldman Sachs, J.P. Morgan, Cannacord Genuity, JMP Securities, and Pacific Crest Securities.

We first previewed Okta ahead of its IPO and recommended investing. High revenue growth, increasing gross margins, and leading position in a growing market were all factors that motivated us to invest. We view the upcoming quiet period expiration as a second buying opportunity for investors and recommend buying in ahead of the May 2 date.

Company Background

Okta Inc. provides cloud-based security services to businesses through its Okta Identity Cloud platform. The objective of the platform is to control and protect employee access to various applications in a secure and easy to use way. The platform streamlines the identity process by eliminating duplicate authentication policies, so employers can get faster access.

The company's service portfolio includes adaptive multi-factor authentication, single sign-on, lifecycle management, mobility management, and universal directory products for its IT clients; and user management, complete authentication, API access management, flexible administration, and developer tools for developers.

As of its IPO, Okta had over 3,100 clients and over two million people using its services daily. Prior to its IPO, Okta had completed seven rounds of financing and raised $230M from VC investors.

Early Market Performance

Okta had a strong start in its first month as a public company. The company went IPO on April 6, 2017 offering 11 million shares at $17 per share, the higher end of its upwardly revised price range of $15-$17. The stock then jumped 38% on its first trading day, closing at $23.51. The stock has stayed around that range and currently trades at $23.89 (pre-market session 4.24).

Financial Overview

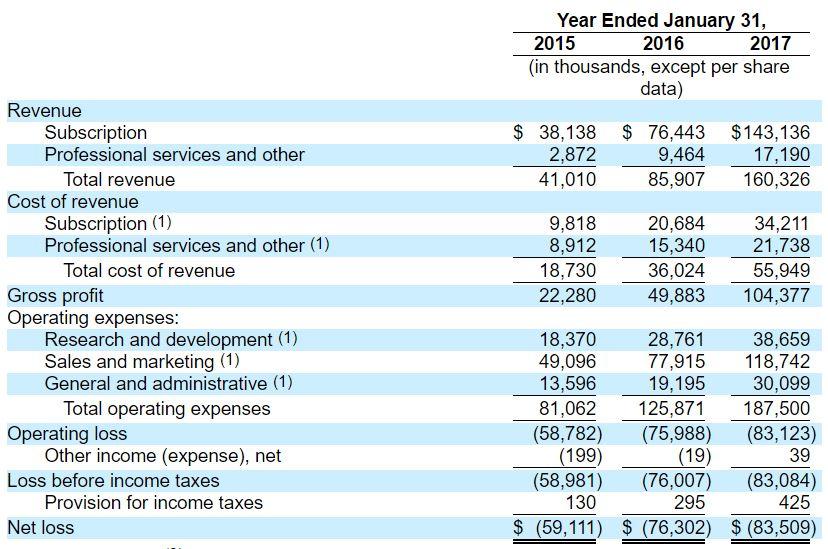

Okta generates revenue through subscription fees from its Okta Cloud Platform. The fees include: Use of the service, technical support, and management of the platform. The company has grown revenue at a fast pace. The table below shows highlights. Year-over-year revenue growth was 109.5% for 2015 to 2016 and 86.6% for 2016 to 2017. Gross profits have also been steadily climbing, reaching 65% in 2017. The company has not yet generated profits and generated a net loss of $83.5M in 2017.

Conclusion: Buying Opportunity

We recommended Okta prior to its IPO and expect to see another pop in the stock price around the upcoming quiet period expiration. Okta is a leader in a quickly growing market and has a strong competitive position.

We expect underwriters will be eager to publish very positive detailed reports and recommendations once restrictions are lifted on May 2. We recommend investors consider buying in now, prior to the expiration to benefit from the likely bump.

Disclosure: I am/we are long OKTA.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more