OHA Investment Corporation Announces Third Quarter 2016 Results

NEW YORK, Nov. 14, 2016 (GLOBE NEWSWIRE) -- OHA Investment Corporation (Nasdaq:OHAI) (the “Company”) today announced its financial results for the quarter ended September 30, 2016.Management will discuss the Company's results summarized below on a conference call on Monday, November 14, 2016, at 2:00 p.m. Eastern Time.

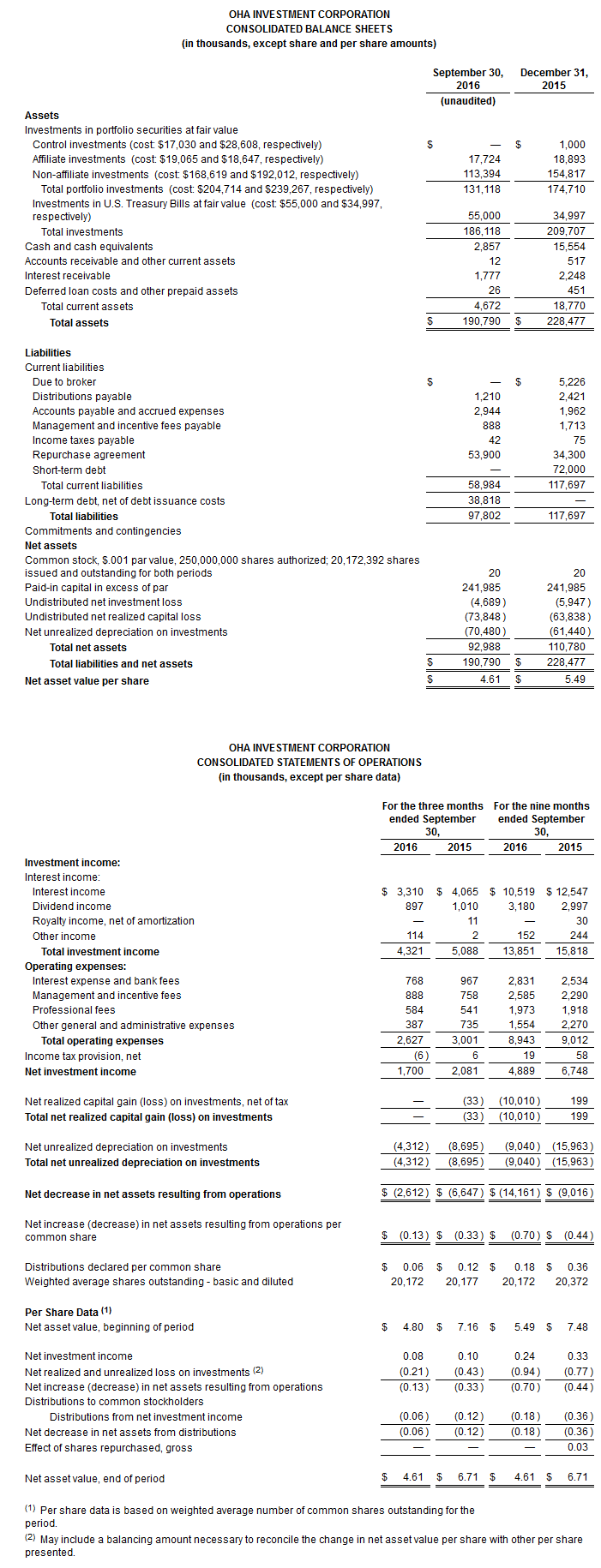

Summary results for the quarter ended September 30, 2016:

Total investment income:$4.3 million, or $0.21 per share

Net investment income:$1.7 million, or $0.08 per share

Net realized and unrealized losses: $4.3 million, or $0.21 per share

Net asset value:$93.0 million, or $4.61 per share

Investment realizations: $14.1 million

Fair value of portfolio investments:$131.1 million

Portfolio Activity

The fair value of our investment portfolio was $131.1 million at September 30, 2016, decreasing 11.5% compared to June 30, 2016. During the third quarter of 2016, the Company had realizations totaling $14.1 million and made no new investments.The concentration of our investment portfolio in the energy sector at September 30, 2016 was 40%.The current weighted average yield of our portfolio based on the cost and fair value of our yielding investments was 7.5% and 11.7%, respectively, as of September 30, 2016.

In July 2016, WP Mustang (Electronic Funds Services, LLC), or EFS, repaid its second lien term loan in the amount of $10.0 million plus a 1% prepayment fee. We recorded previously unamortized discount of $0.1 million as additional interest income as a result of this repayment. This investment was initiated in December 2014 and generated a Gross IRR of 11.0% and a return on investment of 1.17x.

In August 2016, Appriss Holdings, Inc., or Appriss, repaid part of its second lien term loan in the amount of $3.8 million. We recorded previously unamortized discount of $0.05 million as additional interest income as a result of this repayment.

Operating Results

Investment income totaled $4.3 million for the third quarter of 2016, decreasing 15.1% compared to $5.1 million in the corresponding quarter of 2015. The decrease was primarily attributable to a decrease in average portfolio investment balance on a cost basis and a decrease in the weighted average yield on our investment portfolio from September 30, 2015 to September 30, 2016.

Operating expenses for the third quarter of 2016 were $2.6 million, a decrease of $0.4 million, or 12.5%, compared to operating expenses for the third quarter of 2015. The decrease in operating expenses is related to lower interest expense and bank fees and other general and administrative expenses, partially offset by an increase in management and incentive fees and professional fees.

The resulting net investment income was $1.7 million or $0.08 per share, for the third quarter of 2016, compared to $2.1 million, or $0.10 per share, for the third quarter of 2015.

We recorded net realized and unrealized losses on investments totaling $4.3 million, or $0.21 per share, during the third quarter of 2016, compared to $8.7 million, or $0.43 per share, during the third quarter of 2015. Total losses recorded in the third quarter of 2016 totaled $8.5 million, which was driven by our legacy energy portfolio investments.

Overall, we experienced a net decrease in net assets resulting from operations of $2.6 million, or $0.13 per share, for the third quarter of 2016. After declaring a quarterly dividend during the period of $0.06 per share, our net asset value decreased 4%, from $4.80 per share as of June 30, 2016 to $4.61 per share as of September 30, 2016.

Liquidity and Capital Resources

At September 30, 2016, we had cash and cash equivalents totaling $2.9 million.The amount outstanding under our credit facility at September 30, 2016 was $40.5 million.

On September 9, 2016, we entered into a new secured term loan credit facility (the "Credit Facility") with MidCap Financial, which replaced our existing Third Amended and Restated Revolving Credit Agreement (the "Investment Facility"), dated May 23, 2013, as amended.As of September 9, 2016, the size of the Credit Facility was $56.5 million with a maturity date of March 9, 2018, which can be extended for a six-month period at our option.Initial proceeds of $40.5 million from the Credit Facility were used to pay off the $38.5 million outstanding balance on our previous Investment Facility, pay transaction expenses and provide balance sheet cash.The remaining $16.0 million consists of a delayed draw term loan, which is committed for one year, and is available to us to grow our investment portfolio and operate our business.

Additional Disclosure

Investments are considered to be fully realized when the original investment at the security level has been fully exited.Internal rate of return, or IRR, is a measure of our discounted cash flows (inflows and outflows). Specifically, IRR is the discount rate at which the net present value of all cash flows is equal to zero. That is, IRR is the discount rate at which the present value of total capital invested in our investments is equal to the present value of all realized returns from the investments. Our IRR calculations are unaudited.Capital invested, with respect to an investment, represents the aggregate cost of the investment, net of any upfront fees paid at closing. Realized returns, with respect to an investment, represents the total cash received with respect to an investment, including all amortization payments, interest, dividends, prepayment fees, administrative fees, amendment fees, accrued interest, and other fees and proceeds. Gross IRR, with respect to an investment, is calculated based on the dates that we invested capital and dates we received distributions. Gross IRR reflects historical results relating to our past performance and is not necessarily indicative of our future results. In addition, gross IRR does not reflect the effect of management fees, expenses, incentive fees or taxes borne, or to be borne, by us or our stockholders, and would be lower if it did.

Webcast / Conference Call at 2:00 p.m. Eastern Time on November 14, 2016

We invite all interested persons to participate in our conference call on Monday, November 14, 2016, at 2:00 p.m. Eastern Time. The dial-in number for the call is (877) 303-7617. International callers can access the conference by dialing (760) 666-3609. Callers are encouraged to dial in at least 5-10 minutes prior to the call. The presentation materials for the call will be accessible on the Investor Relations page of the Company’s website at www.ohainvestmentcorporation.com.

About OHA Investment Corporation

OHA Investment Corporation (NASDAQ:OHAI) is a specialty finance company designed to provide its investors with current income and capital appreciation. OHAI focuses primarily on providing creative direct lending solutions to middle market private companies across industry sectors. OHAI is externally managed by Oak Hill Advisors, L.P., a leading independent investment firm (www.oakhilladvisors.com). Oak Hill Advisors has deep experience in direct lending, having invested approximately $3.7 billion in over 120 direct lending investments over the past 13 years.

Forward-Looking Statements

This press release may contain forward-looking statements. We may use words such as "anticipates," "believes," "intends," "plans," "expects," "projects," "estimates," "will," "should," "may" and similar expressions to identify forward-looking statements. These forward-looking statements are subject to various risks and uncertainties. Certain factors could cause actual results and conditions to differ materially from those projected, including the uncertainties associated with the timing or likelihood of transaction closings, changes in interest rates, availability of transactions, the future operating results of our portfolio companies, regulatory factors, changes in regional or national economic conditions and their impact on the industries in which we invest, other changes in the conditions of the industries in which we invest and other factors enumerated in our filings with the Securities and Exchange Commission (the "SEC"). You should not place undue reliance on such forward-looking statements, which speak only as of the date they are made. We undertake no obligation to update our forward-looking statements made herein, unless required by law.

CONTACTS: Steven T. Wayne – President and Chief Executive Officer Cory E. Gilbert – Chief Financial Officer Lisa R. Price - Chief Compliance Officer OHAICInvestorRelations@oakhilladvisors.com For media inquiries, contact Kekst and Company, (212) 521-4800 Jeremy Fielding – Jeremy-Fielding@kekst.com James David – James-David@kekst.com

Disclosure: None.