Nucor: A Steel Trade We Like

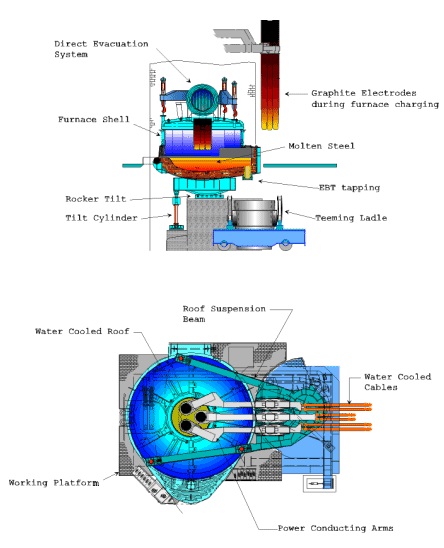

You may not be aware, but Nucor (NUE ) is the largest mini-mill steelmaker using electric arc furnaces to melt scrap steel to produce its products. So, when people are bringing their scrap metal to junkyards, Nucor is the type of company buying that metal in bulk from the yards to put it through the furnacing process:

Source: Steel.org

In fact, Nucor being the scrapper that it is, bought nearly 20 million tons of scrap last year. That is pretty hefty. This volume means that Nucor has a substantial percentage of the overall steel scrap market, perhaps as high as 30%. Last week BAD BEAT Investing issued a trade alert on the stock. In this column we look at production fundamentals. We think the stock has potential at current levels for the long-term.

Now, it is important to note that the company also does more than just scrapping. Nucor also makes what is known as a hot briquetted iron and direct reduced iron. Essentially these two items as well which function as steel scrap substitutes for arc furnace feedstock.

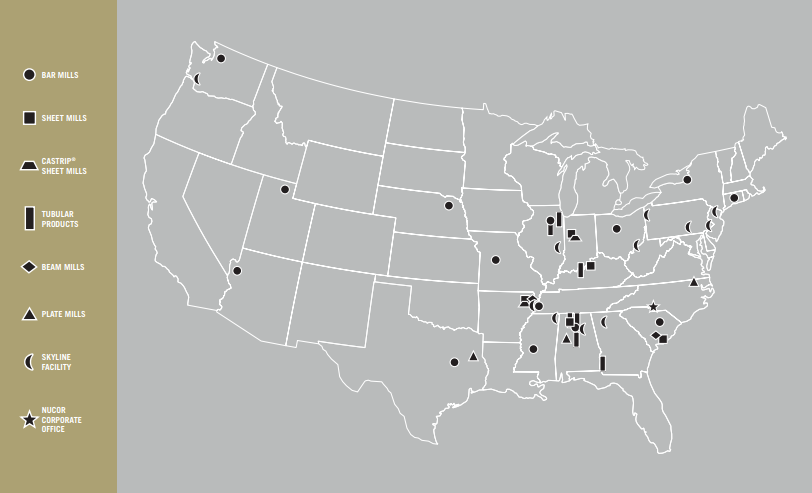

In total, the company operates several dozen production facilities, rebar facilities, and other processing plants. The vast majority of which are located in the United States:

Sources: Investor annual summaries, investor presentations

Steel pricing and demand

This trade highly depends on steel prices and demand going forward. We know that by looking steel prices over the past several months there is high volatility:

Source: Tradingeconomics.com

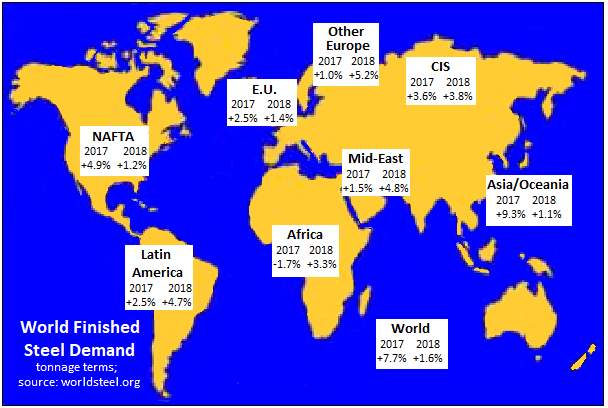

The World Steel Association predicted a small increase (0.5%) in global steel demand for 2017. That projection ended up being way too conservative. For 2018 they are projecting an 8% increase in the price of steel. The forecast is a reaction in large part to China’s 9.3-percent increase in demand, but also the AIA’s projection that the pace of construction will accelerate through 2019.

This demand for construction will follow growth in demand last year, which was not just limited to China and North America:

Source: Steel.org

That said, we need to be mindful that supply has started to catch up with this rising demand, and this could weigh a bit on prices.

Still, we think the demand picture offsets and supply concern as there is talk of accelerated investment in U.S. infrastructure continues. Of course, until there is action it is simply speculation, but infrastructure is a priority of both US Democrats and Republicans alike. We expect more clarity as summer approaches. Real action would have a material impact on demand in 2019, giving some wind to the sails for Nucor and the sector.

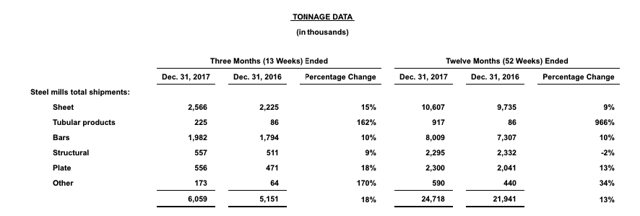

That said, based on where we are now, production has been solid, with rising tonnage.

Source: Quarter earnings

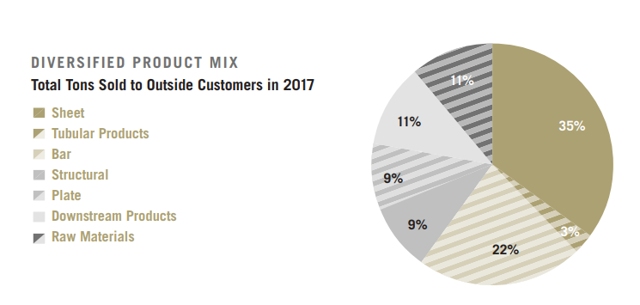

Here is a look at the total tonnage growth in 2017, as well as sales to outside customers, which we felt was more diversified than in the past:

Sources: Quarterly earnings, Nucor Annual report

As you can see, the production and sales have risen. This is in part due to higher demand, as well as a better price at which the company can sell its products.

Looking ahead

There are a number of positives for Nucor right now. Nucor expects the new tax package to be highly beneficial to it, allowing it to increase and accelerate investment. The new tariffs were also applauded by the Nucor CEO. We liked this particular comment:

“You also have to have a strong steel industry to have strong infrastructure. Strong infrastructure creates a strong economy; a strong economy ensures a strong national defense… We're in a very, very cyclical business," the CEO said. "We're at a good time in the cycle right now, but I would suggest that you go back and look at the tougher years in 2009-2010 and see how much of a struggle it's been for the entire industry during those down cycles”

Go back and look at the pain then, it is a good idea. As for our view, we think the stock will approach $70 which would be fair value. If you are bearish on steel or the US economy, avoid this trade. We are playing it because we see a stock that is cheap and pays a strong dividend yield of 2.5% to wait. As for our target of $70, we return to EBITDA. A fair price is 7.5X-8.5X a forward multiple. This puts the target range at $66 to $76, and we selected the mid-point of this range.

Disclosure: No positions in any stocks mentioned

Quad 7 Capital is a leading contributor with various financial outlets, and pioneer of the BAD BEAT Investing philosophy. If you like the material ...

more

#Steel has recently been in the headlines due to trade tensions and the U.S tariff on Chinese steel imports. Since then I have been passively monitoring the sector for any potential opportunities. $NUE seems like an interesting one although, I would like to see at least a little progress on infrastructure reform before I dive in.