Netflix: Limited Upside, Substantial Headwinds

There's no question that Netflix (NFLX) has rewarded its shareholders handsomely over the past several years. Since the beginning of 2012, Netflix stock has risen an astonishing 1,100%. That, however, is in the past. Netflix is hugely expensive by almost any metric but, thanks to aggressive international expansion efforts, continues to crank out impressive subscriber growth. The question now is how much of that growth already is priced into the stock and how much room does it have to grow further.

In my view, Netflix's valuation is based on only one factor - number of subscribers. The actual financials of this company will matter at some point. Netflix is free cash flow negative to the tune of $1.1 billion over the past 12 months as it grows internationally and it added roughly $1.5 billion in long-term debt to the balance in the beginning of 2015. Those are long-term concerns but the market doesn't seem terribly concerned with those numbers today. It's all about subscribers.

It's fair to say that I think Netflix is overvalued but to determine how overvalued it is we need to first calculate what the stock should be worth. In the case of Netflix, I think we can determine fair value by looking at subscriber numbers, margins, revenues and apply a P/E multiple. It's a simple method but one I think can still get us a pretty accurate estimate.

Since Netflix is still ramping up its international expansion, I'm going to look out at what I think we will see in 2020. By then, the most ambitious phase of its growth plans should be complete and we should have a good idea of where Netflix stands in most of the markets it has entered. By then, we also should hopefully have the answer to the question of whether or not they can set up a viable operation in China. I should mention for the record that there will be a wide range of opinions as to what any of the numbers I'm forecasting will look like in three years, so I'll state my case for why I chose the number I did.

Total Subscribers

I think we can safely assume here that the DVD business has peaked. There are only about 4.2 million subscribers left which is down more than a third from just three years ago. In the third quarter, DVD provided just 5% of total revenue.

The real subscriber number comes from streaming. In the last quarter, Netflix reported just north of 86 million total subscribers, about 55% of which are domestic. At the current growth rate, the number of international subscribers could top the domestic number by the end of 2017.

What that 86 million number grows to in 2020 is the big question and estimates are all over the place. Last year, Ampere Analysis projected total subscription of 130 million. Piper Jaffray put its 2020 estimates at 142 million. ARK Investment Management forecasted 175 million, while market researcher Ovum thought the number could push 200 million. Truthfully, the number depends on a number of factors which can't be accurately forecast yet.

Since domestic subscription is approaching saturation, it all depends on overseas. Reed Hastings has talked about targeting one-third penetration in each of the markets Netflix is competing in. That could be ambitious in some markets. I think competition from other streaming services could be substantial by that point making the one-third mark a tough target to hit. Even if they get to that number, Netflix could face a triple whammy of higher acquisition, retention and content costs. Netflix already is burning significant cash in order to ramp up and it might not be close to being over.

My estimate falls somewhere in the middle. I think Netflix gets to 160 million subscribers in 2020. By then, I think the company's customer base will be somewhere along the lines of two-thirds international and one-third domestic. Netflix has averaged about one million domestic adds per quarter over the past two years. The company has about 47.5 million domestic subscribers as of Q3 2016 so getting to 53 million by 2020 seems well within reach.

International subscription would need to hit 107 million, which would translate to about 4 million per quarter. Netflix has hit 4 million net new international subscribers in past quarters but it should become more likely given that the company has only been in major markets such as Portugal, Spain, Italy, Hong Kong and South Korea for only about a year. China would be a major get for Netflix but it looks like it won't happen anytime soon. Hastings pretty much admitted recently that attempts to enter China had failed.

So I'm going to stick with an estimate of 160 million subscribers by 2020. It's possible the number could end up higher but I think several things need to go Netflix's way for that to happen.

Average Monthly Subscription Fee

This one requires a little less speculation. Netflix has its basic $8 per month standard definition single stream plan, its $10 per month high definition dual stream plan and its $12 per month premium UHD and HD quadruple streaming plan. By 2020, I think most users will be off the $8 plan. The question is how the remaining customers will be split between the standard $10 plan and the premium $12 plan. The premium plan should require a little time to ramp up but I think we're going to be looking at a roughly 50-50 split.

Hastings in the latest earnings conference call said that the company has no plans for any further rate hikes. While I think he could be considering another rate increase in four years, I'm going to assume that the current plan prices will remain. A 50-50 split between the standard and premium plans yields an average subscription fee of $11 per month.

Net Margin

Projecting net margins for a company that's burning through an incredible amount of cash and is still in its growth phase is difficult.

Netflix is only producing net margins in the low single digits right now. That's understandable given the current global expansion but what will margins look like as the company is maturing? In its best year, Netflix has only produced a net margin in the 7-8% range. This one is a real wild card. Margins should improve as expenses from the expansion begin winding down. On the other hand, I can see customer retention and content costs rising as competition grows.

I'm going to forecast a net margin of 10% over the long term. Netflix should benefit from scale as annual revenues continue growing at a 20%+ clip. But I think content and production costs will be a real headwind. Amazon (AMZN) already is a threat. If Google (GOOG) (GOOGL) or Apple (AAPL) ever enter the streaming content arena, which seems unlikely at this point, the space will grow more competitive yet.

I think a 10% margin is a reasonable assumption at this point but I wouldn't be surprised either if it ends up trending lower.

Price/Earnings Multiple

Netflix trading at 133 times next year's earnings is obviously unsustainable over the long term but the question is when will it begin trading at anything remotely close to a reasonable valuation? By 2020, price/earnings multiples in the hundreds should be a thing of the past but I expect Netflix to still trade at a multiple far above traditional media companies such as Comcast (CMCSA), Time Warner (TWX) and even Disney (DIS). Those companies trade at forward multiples in the 17-20 range.

I'm assigning a 2020 forward multiple of 30 to Netflix for a few reasons. First, in favor of a higher multiple there's an established premium valuation here that has survived many ups and downs. Even in times where it looked like growth was slowing, the stock has typically dropped sharply on the news only to rebound back toward highs. See the drops in mid-2015 and the beginning of 2016 for evidence. Second, international growth expectations could be conservative. If the company continues adding 4 million net new subscribers, it could continue getting a growth multiple around 50.

But I'm seeing more pressures to the downside. First, I think competition will remain a factor. Amazon hasn't been a huge factor thus far but I think that will change going forward as it becomes more of a priority. Second, I think expenses will remain high as content costs rise and the company spends more on customer retention in the face of increasing competition. Third, I think international growth will likely be more subdued than expected. Fourth, I think Netflix is going to issue additional debt soon. It raised around $1.5 billion at the beginning of 2015 and, looking at the balance sheet, much of that cash is gone.

I have yet to get a handle on Netflix's valuation so it wouldn't surprise me if it was still way above average several years from now. A 30 multiple is where I think the company should be in 2020. It still gives the stock a premium valuation but reflects its status as a maturing company instead of a growth story.

Price Target

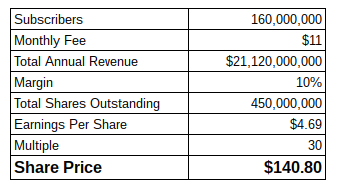

Given the inputs discussed, here's the calculation I used to develop my Netflix price target.

I've got a 160 million subscriber estimate multiplied by an average $11 monthly fee resulting in just over $21 billion in annual revenue. I've estimated 450 million outstanding shares (Netflix currently has around 430 million shares outstanding but that number has been increasing slowly every year). Multiply annual revenue by the 10% margin estimate and you get an EPS figure of $4.69 per share. Factor in a 30 multiple and you've got my 2020 price target for Netflix of $141. That represents a CAGR of around 3% per year over the next four years from current levels.

My outlook for Netflix is likely more bearish than many, but I have concerns over cash flow, competition, debt, international growth and valuation. I'd rate Netflix stock a hold at current levels. There is some upside if the company's subscriber growth estimates pan out and the market continues to give it a premium valuation. However, I view downside risk as more substantial at this point.

No positions.