Nearly 50% Of Unicorns Lose Their Unicorn Status When Their Valuation Is Recalculated

How much is are tech unicorn startups that recently went public really worth? Just like valuing a cryptocurrency, the “correct” price could be in the eye of the beholder. Two academics, Will Gornall at the University of British Columbia, and Ilya Strebulav at Stanford University think they have the answer.

Theresa O’Connor Flickr (CC BY-SA 2.0)

Unicorn Startups overvalued – some by as much as 200%

Looking at the valuations of a stock such as Amazon, which currently trades at a 250 price / earnings multiple, and comparing it to Google, which currently trades near 34 times earnings, can the valuation metrics be explained?

JHL Capital founder James LItnsky thinks that tech stocks trading at unheard of multiples are to be considered “collectibles,” rare works of art that at present only have intrinsic value.

But what about tech stocks that go public for over $1 billion with little in the way of earnings or even a measurable business plan?

Using an option-based financial model, Gornall and Strebulav determine that the average unicorn is overvalued by 48%, some of the fledgling companies have been overvalued by more than 200%.

Elon Musk’s Solar City, for example, was overvalued by 178% when it came out in March 2012 but his SpaceX venture was "only" overvalued by only 65% as of January 2015.

“SpaceX has since gone on to be a successful company, with its most recent round stratospheric price of $77.46 per share,” the report noted, arguing that the 2008 price increase “was due to the preferential treatment of the Series D investors and that the share price increase came about despite a fall in the company’s fair value.”

Payments transfer company Square was overvalued by 169% -- much of this due to recently issued preferred shares have better cash flow rights.

Snap, where investors have little shareholder voting rights and inclusion in benchmark indices is unlikely, was only overvalued by 5%. “Snap stands out as an outlier as its most recently issued preferred stock has the same value as its common stock,” the report noted, pointing to preferred stock with no liquidation preference that puts VC investors the same payout as common equity holders. “Industry sources confirm that Snap chose to issue common shares and was able to do so because of extremely strong investor appetite. Snap is the only company we found issuing common equity in this manner.”

Unicorn Startups - Contractual rights largely used to determine fair value

The model to determine “fair value” is based on numerous factors, many of them contractual in nature that tie back to investor rights and convertibility of the stock upon IPO launch. Factors include liquidation preference, the option pool offered to employees, security seniority, IPO ratchets and participation among other factors.

The researchers have two primary goals. The first is to attract more research to theobtuse research topic.

“Our paper is inevitably just a first step in building a unified theoretical valuation framework,” they write. “Our valuation estimates are substantially hampered by the lack of high-quality and consistent data on VC-backed companies and their financial structures. Both researchers and practitioners should devote more efforts to make such data available.”

The second goal is to wake up different constituents in the venture capital process, from founders, employees, investors, regulators, and consultants. If these people have a clearer understanding of how valuation metrics are interpreted, they can better gauge valuation.

One key factor is how the funds generated from the IPO are utilized. 80 out of 116 unicorns feature enforceable conversion exemptions, the report noted. In all such cases, restrictions include minimum IPO proceeds to the company on a net or gross basis before investors are paid.

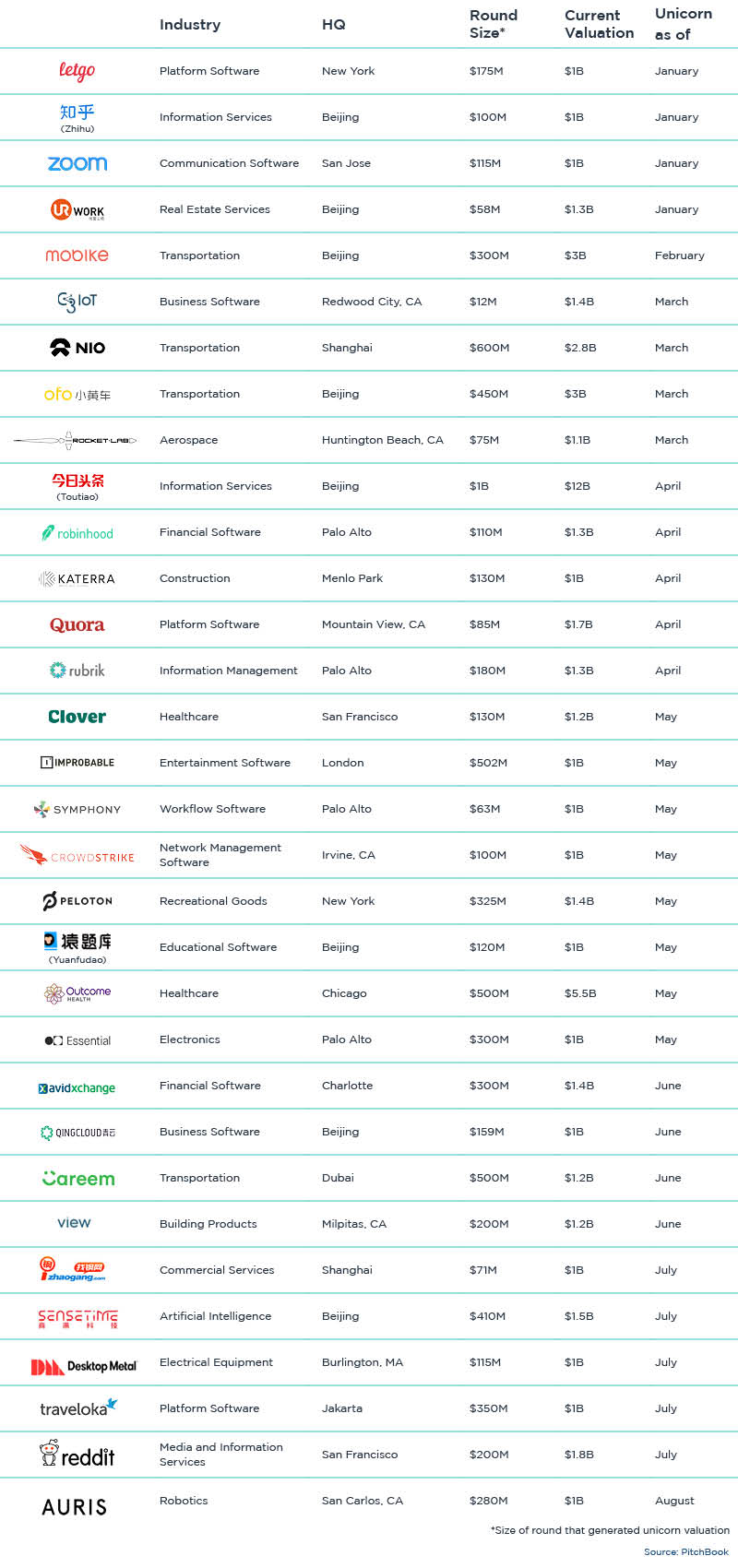

Here are a list of some of the most recent unicorns per PitchBook.

A larger list from CB Insights on the Unicorn startups.

The terms investors receive impact valuations, with different investor classes sometimes receiving different treatment depending on the type of exit.

In M&A exits, VCs are very well protected. Even if the company’s value falls to a tenth of the post-money valuation of the most recent round, the investor in that round get more than two thirds of their money back. In better M&A exits, the most recent series generally recover all of their investment.

In IPOs, the most recent investors’ payoffs depend on whether they have protection against down IPOs, such as an IPO ratchet or an automatic conversion exemption. If they do, they fare well; if they do not, they undergo unfavorable conversion. The most recent series of preferred recovers 45% of their investment, if an IPO valuation is at 10% of the share price they invested at. In less severe down-IPOs, the most recent round may be less able to obstruct the IPO, yet the average losses to the most recent preferred are still much less than the share price decline.

The lack of concrete information causes difficulty in valuation models. "There is essentially no reporting of the terms of venture capital deals, yet small variations in terms can correspond to large variations in value," the report noted.

Noting that “all Unicorn Startups are overvalued,” the report boldly goes where researchers have tended not to go: a study area where Unicorn Startups valuation might be considered as much art as science.

Disclaimer: This article is NOT an investment recommendation, please see our disclaimer - Get our 10 ...

more