NCS Multistage Holdings Could Head Lower On Lockup Expiration

October 25, 2017 concludes the 180-day lockup period on NCS Multistage Holdings (NCSM).

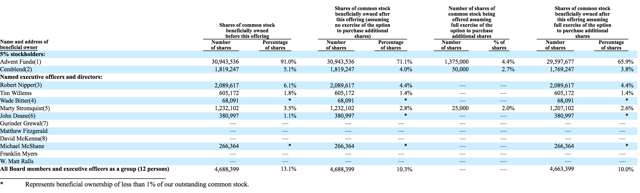

When the lockup period ends for NCSM, its pre-IPO shareholders, directors, and executives will have the chance to sell their 38.5 million outstanding shares. With just 9.5 million shares currently trading, any significant sales could flood the market and cause a sharp, temporary, decrease in share value.

![]()

NCSM's insiders and pre-IPO shareholders include 12 individuals and two venture capital firms.

(Click on image to enlarge)

Currently, NCSM trades in the $21 to $22 range, above its IPO price of $17 and higher than its first day closing price of $20.01 on April 28, 2017.

Business Overview: Provider Of Products And Services For Oil And Natural Gas Well Completions

NCS Multistage Holdings provides engineered products and support services for oil and natural gas well completions and field development strategies in the United States and globally, including Russia, China, and Argentina. They have over 140 clients as of 2016, including major oil companies and large independent oil and natural gas companies.

The company’s products include ballshift sliding sleeves, spotfrac systems, sand jet perforating products, liner hanger systems, airlock casing buoyancy systems, downhole frac isolation assemblies, and casing-installed sliding sleeves. In addition, NCSM offers advisory services to clients on completion designs and field development strategies.

NCSM began providing products and services in 2006, and since then their technology has been used in over 7,600 well completions representing more than 155,000 individual frac stages. The company’s market penetration in Canada is 26%, and it derived approximately 23% of its revenue in 2016 from the United States.

The company offers its products and services portfolio through its technically trained direct sales force and through operating partners. The company was formerly known as Pioneer Super Holdings, Inc. and changed its name to NCS Multistage Holdings, Inc. in December 2016. NCS Multistage Holdings, Inc. was founded in 2006 and is headquartered in Houston, Texas.

Financial Highlights

NCS Multistage Holdings reported the following financial highlights for the second quarter of fiscal 2017 ended June 30:

-

Total revenue of $36.9 million, an amazing 227% increase year over year.

-

Net loss attributable to NCS of $(4.5) million, a $4.1 million improvement from the previous year.

-

Net loss attributable to NCS of $(0.11) per diluted share; ($0.09) adjusted net loss per diluted share.

-

Adjusted EBITDA of $4.8 million, a $7.3 million improvement from the prior year, and an adjusted EBITDA margin of 13%.

Management Team

CEO and Director Robert Nipper co-founded NCS Multistage in 2008. Mr. Nipper has over 30 years of experience in the industry and holds several patented technologies relating to downhole oil and natural gas and geothermal service equipment. Prior to founding NCS, Mr. Nipper held positions at Tri-State Oil Tools and Baker Hughes.

Chief Operating Officer Tim Willems has served in his position since May 2015. He has over 30 years of experience in the oil and gas Industry, specializing in wellbore construction, completion and remediation. He has been with NCS Multistage Holdings since 2010. He received a BS in Petroleum Engineering from Montana College of Mineral Science and Technology.

Competition: Schlumberger, Halliburton, Baker Hughes, and Others

NCS Multistage lists its primary competitors as Superior Energy Services (SPN), Nine Energy Service, Packers Plus Energy Services, Weatherford International (WFT), Baker Hughes (BHGE), Halliburton (HAL), and Schlumberger (SLB). Morningstar includes National Oilwell Varco (NYSE:NOV) and TechnipFMC (NYSE:FTI) as peers in addition to the companies listed above.

|

Market Cap (mil) |

Net Income (mil) |

P/B |

P/E |

|

|

NCS Multistage |

$958.0 |

0.0 |

2.8 |

1130.5 |

|

Schlumberger |

$94,604.0 |

$177.0 |

2.4 |

401.9 |

|

Baker Hughes |

$40,054.0 |

($904.0) |

2.6 |

n/a |

|

Halliburton |

$39,247.0 |

($147.0) |

4.4 |

n/a |

|

Industry Average |

$2,136.0 |

($38.0) |

2.1 |

n/a |

Early Market Performance

NCS Multistage Holdings’ IPO priced at $17 per share, towards the high end of its expected price range of $15 to $18. The stock closed on the first day of trading at $20.01. Since then, the stock reached a high of $27.04 on May 26 before declining to a low of $19.05 on August 30. Currently, NCSM trades between $21 and $22. NCSM has a return from IPO of more than 25%.

Conclusion: Sell Or Short Shares Before October 25, 2017

A significant number of NCSM's total outstanding shares - 38.5 million - are currently subject to lockup restrictions. With just 9.5 million shares currently trading, any significant sales of restricted shares by pre-IPO shareholders and insiders could cause a sudden, sharp decrease in share price when the IPO lockup expires on October 25, 2017. We recommend that risk-tolerant investors short shares of NCSM ahead of this trading event and cover positions on October 26th and October 27th

Disclosure: I am/we are short NCSM.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more