MyoKardia IPO: Early Stage, Skittish IPO Market Leave Us Hesitant

MyoKardia Inc. (MYOK) expects to raise $73.6 million in its upcoming IPO. Based in South San Francisco, California, MyoKardia is a clinical-stage biopharmaceutical that is developing therapies for rare and serious cardiovascular diseases.

MyoKardia will offer 4.6 million shares at an expected price range of $15 to $17. If the underwriters price the IPO at the midpoint of that range, MYOK will have a market capitalization of $408 million.

MYOK filed for the IPO on September 28, 2015.

Lead Underwriters: Cowen & Co. and Credit Suisse Securities

Underwriters: BMO Capital Markets, Wedbush Securities and Wells Fargo Securities

Business Summary: Clinical-stage Biopharmaceutical Developing Therapies for Cardiovascular Diseases

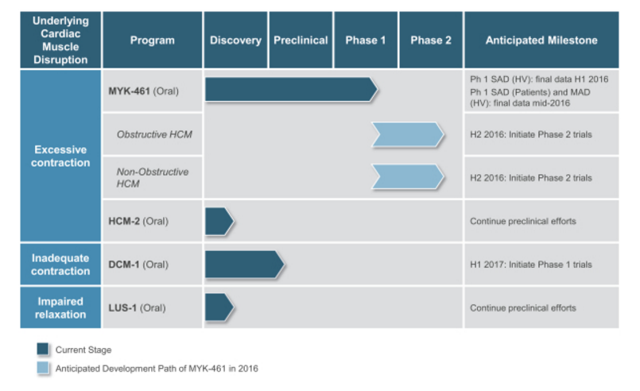

MyoKardia is a clinical-stage biopharmaceutical company in South San Francisco working on finding, developing and marketing treatments for rare, serious cardiovascular diseases. Its lead product candidate is MYK-461, which is in three separate Phase I clinical trials to test its efficacy at reducing severe cardiac muscle contractility that can produce hypertrophic cardiomyopathy (HCM).

In addition, the company is developing DCM-1, a product candidate designed to treat heritable dilated cardiomyopathy (DCM) by establishing normal contractility in a diseased DCM heart. Other product candidates include HCM-2, which is being developed to lower cardiac muscle contractility to normal ranges in HCM patients; and LUS-1, which is expected to counteract muscle disruption resulting in impaired relaxation of the heart.

(Source)

HCM is caused by genetic mutations, and MyoKardia estimates that up to 630,000 individuals in the United States suffer from HCM. DCM is caused by a biomechanical defect, possibly due to genetic mutations, and affects up to 400,000 people in the U.S. MyoKardia notes that no approved therapies exist for either condition, which are chronic and debilitating diseases.

MyoKardia intends to use the net proceeds to fund further clinical trials of MYK-461 and other pre-clinical, discovery and research programs. Any remaining proceeds will be used for development activities, working capital and general corporate purposes.

MyoKardia is in strategic collaboration with Sanofi S.A. (NYSE:SNY)

Executive Management Highlights

CEO Tassos Gianakakos joined MyoKardia in October 2013. He has over 17 years of senior leadership experience in the biopharmaceutical industry. His previous experience includes positions at MAP Pharmaceuticals, Codexis Pharmaceuticals, Maxygen and Merck. Mr. Gianakakos holds B.Sc. degrees in chemical engineering and economics from the Massachusetts Institute of Technology, an M.Sc. in biotechnology from Northwestern University and an M.B.A. from Harvard Business School.

Chief Medical Officer Jonathan Fox, M.D., Ph.D., joined MyoKardia in January 2013. Prior to MyoKardia, he held senior positions and led clinical research teams at AstraZeneca and SmithKline Beecham. Dr. Fox was a clinical professor at University of Pennsylvania School of Medicine for 20 years, and he currently serves as a consulting professor at Stanford University's Cardiovascular Institute. Dr. Fox holds B.A., Ph.D. and M.D. degrees from the University of Chicago, and completed postgraduate training in internal medicine and cardiology at Duke University.

Potential Competition: Bristol-Myers Squibb, Amgen, Novartis and Others

MyoKardia faces significant competition from several enterprise-level pharmaceutical companies, including Novartis (NYSE:NVS), Amgen (NASDAQ:AMGN), Bayer, Bristol-Myers Squibb (NYSE:BMY), C.H. Boehringer Sohn, Gilead Sciences (NASDAQ:GILD), Heart Metabolics, Array BioPharm (NASDAQ:ARRY), Kasiak Research and Zensun.

Financial Overview: Early Stage Losses

MyoKardia provided the following figures from its financial documents for the six months ended June 30:

|

2015 |

2014 |

|

|

Revenue |

$7,099,000 |

n/a |

|

Net Income |

($9,907,000) |

($10,576,000) |

As of June 30, 2015:

|

Assets |

$77,664,000 |

|

Total Liabilities |

$26,555,000 |

|

Stockholders' Equity |

($49,008,000) |

Conclusion: Consider Holding Off

We like MYOK's collaboration with Sanofi. In addition, being the only major IPO newly listed for this week, the deal does stand out.

The usual risks of an early-stage biopharma firm remain: limited operating history/history of losses, and heavy dependence on lead product candidate.

Overall, in a market where investors seem to be a bit skittish, even over high-profile deals like RACE, we are not sure an early-stage biopharma deal (often riskier than other deals, prior to commercialization) will be successful.

We suggest investors hold off at present.

Disclosure: None.