My Top Short Pick For 2017: Recent IPO AquaVenture

AquaVenture (NYSE:WAAS) has advanced nearly 16% since the firm's IPO on October 5, 2016, but the water-as-a-service provider will likely face significant headwinds in the year ahead.

While we noted that the longer-term picture is positive for WAAS in both our IPO Preview coverage and our more recent quiet period piece, WAAS faces notable challenges in the short term with significant operating losses and the IPO lockup expiration on the horizon in April.

Water, Water Everywhere

WAAS came to market at a time when concerns about the future of potable drinking water were at the forefront of the news cycle. As concerns about pipelines out West and global warming appeared to make this an on-trend offering, it's important to remember that WAAS isn't the first firm to popularize the water-as-a-service theme - and not all of these offerings have managed to hold investors' attention.

In covering WAAS, I was acutely reminded of a raft of "water ETFs" that I covered back in 2010. At that time, several new water ETFs had made a splash in the marketplace: The equal-weighted First Trust ISE Water Index Fund (NYSEARCA:FIW) and the PowerShares Water Resources Portfolio (NASDAQ:PHO), alongside the Claymore S&P Global Water Index ETF (NYSEARCA:CGW) and the PowerShares Global Water Resources Portfolio (NASDAQ:PIO).

While all four of these ETFs are still in existence, average daily trading volume is anemic in all but FIW - and so anemic in PIO as to almost make the fund nearly untradeable. I mention these ETFs only to underscore that the theme of water investments is not a new one, and it has not been one that has particularly piqued the interest of investors in the ETF space.

The Company and the IPO

AquaVenture Holdings is a company that provides water-as-a-service to its customers around the world in order to help them ensure that their water is affordable and safe. It offers water treatment and purification services to businesses and governments and operates through its subsidiaries, Quench and Seven Seas. The company is based in Tampa, Florida and was founded in 2006. Currently, the company has over 500 employees.

In June 2014, Quench acquired Atlas, which enabled it to greatly expand its market in Boston, Massachusetts. Quench operates in the U.S., while Seven Seas builds, operates and designs water treatment facilities in Saudi Arabia, Chile, the Caribbean, as well as the U.S.

Before the IPO, the company raised $157.91 million in six rounds of funding, with its most recent round taking place on May 1, 2015. Notable investors include Element Partners, T. Rowe Price (NASDAQ:TROW), and TPG Growth. The offering was comprised of 6.5 million shares.

While AquaVenture priced at $18 - the low end of the stock's expected $18 to $20 range - early trading has been promising. The stock had a first day return of 21.9% (source), and since the IPO, has had an overall return of more than 16%.

Trouble in the Water

There are still serious concerns, however, about the company's profitability. A recent article in Barron's highlighted how WAAS's losses over the last decade add up to a $183 million deficit. For the 12 months ending September 2016, WAAS reported a $44 million loss on $111 million in revenue with accountants finding material weaknesses in its past two fiscal years' bookkeeping.

In our IPO coverage, we also mentioned a number of risks that the company itself has highlighted. In the company's SEC filings, the firm noted that AquaVenture had identified different risks for its subsidiaries Seven Seas and Quench holdings. For Quench, the company identifies possible risks as including customer attrition, competitors' activities, economic conditions, supply-chain disruptions and others. The company identifies its risks for Seven Seas as depending on a small customer base because of the complexity of its projects.

Competition is also a major factor for the firm. Future growth for Seven Seas depends on the company's ability to secure new contracts in a highly competitive environment. AquaVenture identifies its need to offer competitive compensation for its executive team in order to retain them.

AquaVenture isn't the only firm feeling the pressure. Competitor Consolidated Water (NASDAQ:CWCO) has seen its shares fall by two-thirds since 2007. A recent problem for CWCO is that the British Government recently cut the rate that it's offering to pay one of the company's plants located on the island of Tortola. With the plant's contract about to expire, commentators believe that the BVI government will renew the contract at a lower rate.

Lockup Expiration Could Push Shares Lower

With near-term concerns about profitability piquing investor interest and a still-strong IPO performance on the books, pre-IPO investors and insiders may look to cash in at the first possible opportunity: April 4, 2017.

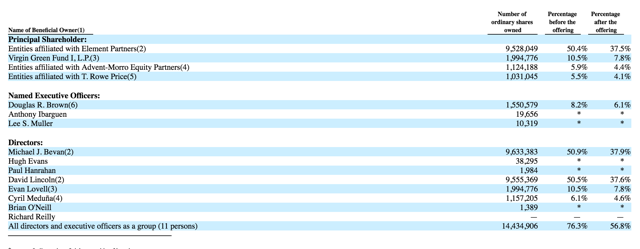

The 180-day lock-up period for WAAS is scheduled to expire on April 4, 2017, allowing pre-IPO insiders, institutional shareholders and executives to sell their approximately 18.9 million pre-IPO shares.

This is equivalent to nearly triple the total shares outstanding and could potentially flood the market, resulting in a sharp decrease in the share price. The top two "Principal Shareholder(s)," listed above, are Element Partners and Virgin Green Fund. These two shareholders are comprised of several individuals, including Directors Bevan, Lincoln and Lovell alongside Element II Managing Director Michael DeRosa. If any of these major shareholders decide to cash in a significant number of shares, WAAS could come under pressure when the lockup expires.

Our firm has found abnormal negative returns in the two weeks surrounding many lock-up expirations. We expect to see a decline in WAAS's share price around April 4, 2017, and therefore recommend investors sell their positions or consider shorting shares ahead of the expiration.

Conclusion:

Be wary of AquaVenture in the short term and consider a short position.

While the idea of investing in potable drinking water, or water-as-a-service, is certainly not a new one, it is an idea with a bright, longer-term potential. Environmental pressures will continue to make potable water a vitally important and increasingly scarce resource long into the future.

In the short term, however, WAAS shares face significant headwinds. First, the profitability of the company is certainly questionable in the short term considering ever-competitive markets for water-as-a-service firms. Second, anticipation over the upcoming IPO lockup expiration - and the lockup expiration itself - will likely put pressure on shares and move them lower in the short term.

We recommend that shorter-term investors consider selling existing positions in AquaVenture and also considering establishing a short position ahead of the IPO lockup expiration on April 4th. Since AquaVenture does have significant longer-term potential, we would recommend that interested investors cover any short positions after the IPO lockup expires in early April.

Disclosure: I am/we are short PTHN.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving ...

more